6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

Because 2020 was such a strange year in so many ways, we’re all hoping that 2021 will be better. But 2021 could be a dangerous year for many investors. While 2020 has turned out to be not as bad as many had feared, particularly given the major stock market crash early in the year, it hasn’t exactly been a great year for most investors, except maybe for those who invested in gold and silver.

Many investors are looking nervously at 2021, wondering whether we’re going to see more of the same, a stagnating economy beset by lockdowns, or whether we’re finally going to see the V-shaped recovery we’ve been promised. A lot is riding on what transpires in 2021, and the fate of many a retirement could depend on next year’s economic and market performance.

Will we see an actual recovery and a return to normal, especially once the coronavirus vaccine sees more widespread adoption, or will we see even further economic stagnation, the possibility of stagflation, or even hyperinflation? Here are four things investors should keep an eye on in 2021.

Official inflation figures show that consumer price inflation (CPI) remains subdued. The Federal Reserve has long targeted a 2% annual CPI increase, but has struggled to get CPI to rise even that much. Now it has pledged to try to stimulate inflation to rise above that 2% target, which means that inflation could rise significantly in the coming months.

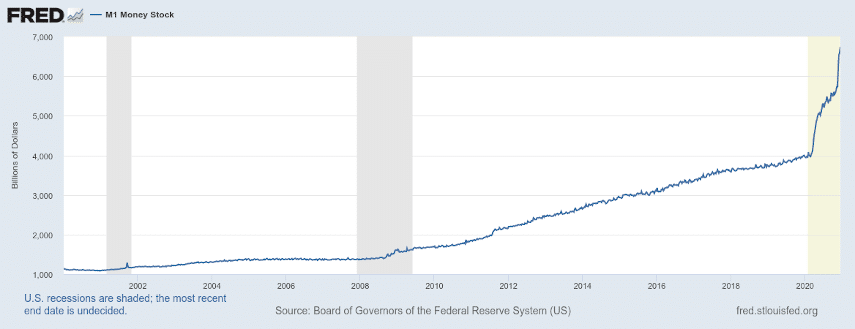

In fact, if you look at the figures for money supply, they are growing exponentially, at unprecedented rates. The M1 money stock has risen over 70% this year, far more than the 20% it grew during the 2008 financial crisis. M2 and MZM have seen smaller percentage increases, but their trend is also to grow straight up.

That’s a worrying sign for the economy, as it could be a sign that the Fed either doesn’t want to or can’t keep inflation under control. And if it lets inflation get out of control, that could be very bad news for investors.

Yes, you read that right. A gold website is telling you to watch copper prices. That’s because the price of copper tends to rise along with price inflation, and often falls during severe economic crises. The copper price isn’t necessarily a bellwether of any sort, but it could be a useful indicator for investors.

A rising copper price could be another indicator of rising inflation and a sign that the Fed’s monetary policy will drive up prices throughout the economy. But if the copper price begins to fall, it could be an indicator that the economic crisis many have been waiting for could finally be underway.

There are some analysts out there who are predicting economic growth of 4-5% next year. While that would be a higher annual growth rate than in past years, that might not be enough to get the US economy back on trend.

Remember that the economy was already slowing in the first quarter of 2020, then dropped 35% in the second quarter, and even the major third quarter rebound put economic production at a bit over 90% of normal. We haven’t seen figures for the fourth quarter yet, but it’s hard to imagine them getting fully back to normal. So a 4-5% growth figure for next year wouldn’t necessarily be unusual.

What will be important to watch for is not necessarily the percentage growth, either year-on-year or quarter-on-quarter. Although, if that growth fails to meet expectations, it could be an indicator that the economy will face significant headwinds. More important will be whether economic growth is able to exceed 2019 levels. If the economy in 2021 can’t top 2019’s numbers, it’s a sign that the economy remains weak and likely won’t be able to support more growth in the coming years.

The Federal Reserve has announced its desire to see inflation rise above 2% for some time, and it’s decided that employment numbers are the barometer it will use to determine when the economy has fully recovered. With millions of Americans still out of work as the result of lockdowns, and with recent extensions to unemployment benefits likely to keep many of those unemployed at least somewhat financially stable and not in need of immediate employment, how long it will take the labor market to recover is anyone’s guess.

For investors, looking at figures like the unemployment rate, the underemployment rate, the number of unemployed, etc. will give an indication of what the Fed might decide to do in terms of its monetary policy. Without significant gains in employment next year, the Fed will very likely keep the monetary spigot wide open, creating trillions more dollars and resulting very likely in higher inflation.

Unfortunately, many of us are at the mercy of monetary authorities. We can try to save and invest the best we can, but ultimately the mantra of “don’t fight the Fed” makes a lot of sense. Saving up funds in a bank account is just going to result in you losing money to inflation. Putting it into stock and bond markets isn’t too much better, not just because of the risk of loss, but because dramatically higher inflation will eat into those returns as well. The key to defending yourself against inflation and out of control monetary policy is to invest in assets that protect the value of your investments against inflation. And two of the key assets that can do that are gold and silver.

Gold has a reputation for protecting investor wealth against inflation over time, as its purchasing power keeps up with inflation, as opposed to the dollar which consistently loses purchasing power over time. The gold price is up nearly 24% this year, its best year in a decade, while silver is up 47%. As both gold and silver tend to increase in value when the economy weakens, both may still have plenty of room to grow. And 2021 could be an incredibly important year for them.

If you have retirement savings that you want to protect against inflation, shouldn’t you start thinking about protecting them if you haven’t already? If 2021 turns out to be a rough year, particularly for stock markets, many investors sitting on big 401(k) balances could see their investments decimated. You don’t want to be one of them. Call Goldco today to find out more about how gold and silver can protect your investment portfolio from the threat of inflation and financial turmoil.