6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

For many people today, stagflation is something that we know only from history books or economics classes. That combination of economic stagnation and problematic inflation seemed to characterize the 1970s.

But while the topic of stagflation has popped up off and on over the past few years, the threat of stagflation doesn’t seem to have been taken seriously. Even when inflation pushed to 40-year highs a few years ago, everyone seemed to take for granted that the US economy would remain strong and resilient.

While economic growth has largely remained positive post-COVID, recent events surrounding President Trump’s tariffs have thrown that into doubt. No one knows what the long-term effects of those tariffs will be, let alone the short-term effects.

But with markets reacting wildly to the tariffs and fears of recession growing, could the threat of stagflation be rearing its head once again?

Stagflation is a portmanteau of the words stagnation and inflation, describing an economy that is simultaneously suffering economic stagnancy and troublesome inflation.

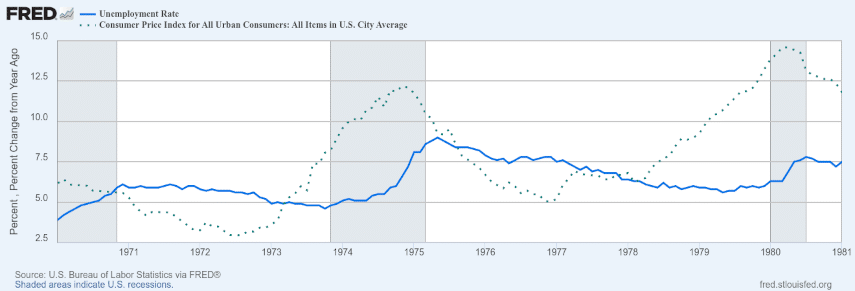

In the 1970s this was thought to be impossible by mainstream economists of the time, as the concept of the Phillips curve predominated. According to Phillips curve theory, there was an inverse relationship between inflation and unemployment.

That meant that as inflation rose, unemployment fell, and as inflation fell, unemployment rose. Thus it was believed that fiscal and monetary intervention could target employment levels by using inflation targeting.

The experience of the 1970s, however, threw all of that into disarray, as the US economy faced both high inflation and high unemployment. Inflation rose to over 12% by the end of 1974 and over 13% by the end of 1979.

Meanwhile the unemployment rate rose to 9% by mid-1975 and nearly 8% by mid-1980.

With the Phillips curve relationship breaking down, the Federal Reserve was thrown for a loop, and its inflationary monetary policy ended up boosting inflation without any corresponding drop in unemployment.

The Fed Chairmen in the 1970s, Arthur Burns and G. William Miller, are almost universally regarded as the worst Fed Chairmen in history. And it took shock treatment from Miller’s successor, Paul Volcker, to bring inflation down and restore a sense of normalcy.

That shock treatment, however, resulted in a sharp recession from 1980 to 1982. Will current Fed Chairman Jerome Powell go down in history as the next Arthur Burns or the next Paul Volcker?

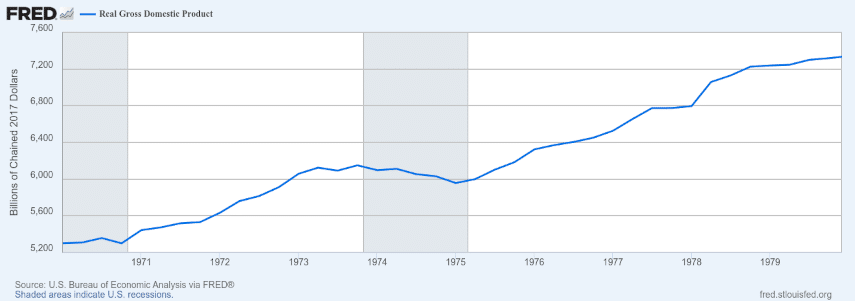

The 1970s stagflation was characterized by high inflation, high unemployment, and recession. Two recessions occurred during the decade, with the first recession beginning in December 1969 and ending in November 1970, and the second recession lasting from November 1973 to March 1975.

But if you look at data for real GDP, i.e. GDP adjusted for inflation, economic contraction was rather mild. And indeed, real GDP actually grew by 38% over the course of the decade.

Indeed, if you compare that 1970-1975 real GDP growth, it works out to 12.4%, versus 12.2% for the most recent five years today.

So if we’re already experiencing similar economic growth to the 1970s, could we already be on the path toward stagflation?

If economic growth is already lackluster, the two remaining elements that would be required to come to some sort of consensus of stagflation are unemployment and inflation.

Inflation right now is still running above the Federal Reserve’s 2% target, although it has been coming down in recent months. But the impact of Trump’s tariffs could send prices on imported goods upward, which could end up getting reflected in the various inflation measures.

The unemployment rate also isn’t terribly high, at 4.2% in March. While it’s slightly higher than it was a few years ago, there haven’t been any significant upticks.

But if the unemployment rate were to start rising, and if inflation were to start to pick up again, then there could be a possibility that the economy could enter a period of stagflation again.

Right now all eyes are on President Trump and his tariffs. If Trump is able to successfully negotiate trade deals and minimize the impact of tariffs, all may end up well with the economy.

But if negotiations falter, or if the impact of tariffs on Chinese imports becomes too burdensome, then things could become more difficult. Markets are worried about the potential impact of these tariffs, which helps explain why there has been so much volatility so far.

While the US economy isn’t in stagflation right now, six months or a year from now could be a different matter altogether. We’ll just have to wait and see how things shake out.

Many Americans have already taken steps to try to help safeguard themselves against stagflation by pursuing alternative assets such as precious metals. Gold in particular has seen pretty steady safe haven buying this year from people looking to stay ahead of a potentially deteriorating economic climate.

Gold has served as a safe haven asset for centuries, through both good times and bad. And this year it has rocketed to record high prices probably in part due to all that safe haven buying.

If you’re thinking about trying to safeguard your wealth with gold but you don’t want the hassle of having to hold gold coins at home, that’s no problem. With a gold IRA you can own physical gold coins or gold bars that are safely stored for you at a bullion depository.

Your gold IRA offers all the same advantages as any other IRA, including tax-free gains. You only pay taxes when you take a distribution or, if your gold IRA is a Roth IRA you would pay no taxes on qualified distributions.

Gold IRAs can be funded with tax-free rollovers from existing 401(k), 403(b), TSP, IRA, and similar retirement accounts, enabling you to move part of your existing retirement savings into physical gold and benefit from any potential future gains in the gold price.

With so much uncertainty surrounding markets today, is now the time for you to start thinking about gold? Call Goldco today to learn more about how you can make gold part of your portfolio.