6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

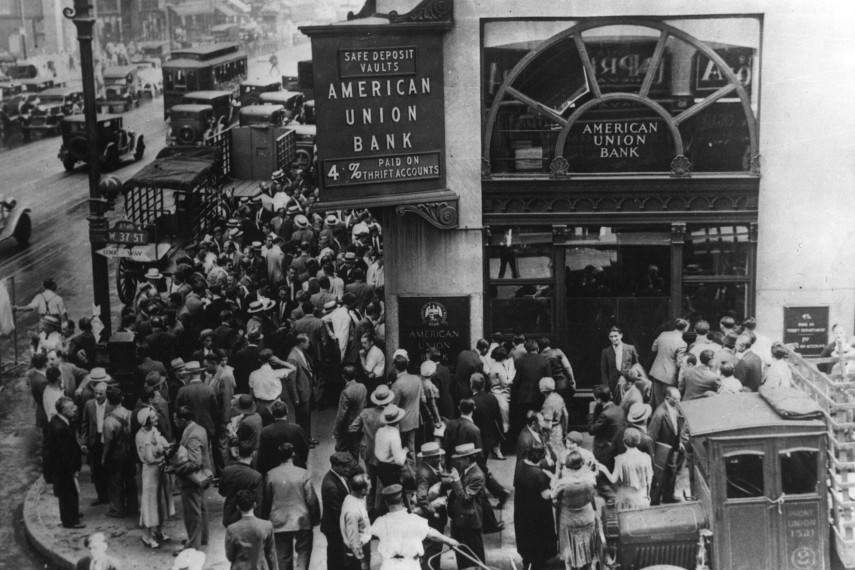

In the history of depressions and financial crises, the Great Depression ranks right up there as the worst crisis to hit the modern world. Although some who lived at that time quipped that the Depression wasn’t that bad as long as you had a job, the problem was that many people didn’t have jobs. Unemployment rates reached nearly 25%, and government policies to combat the Depression only exacerbated the Depression, even leading to a “depression within a depression” that began in 1937.

With the onset of World War II and the mobilization effort for the war, the depression more or less formally came to an end. But it wasn’t until well after the war was over, in 1954, that stock markets finally recovered their pre-Depression highs.

Imagine being in your 30s or 40s in 1929 and losing up to 90% of your stock market investments. You wouldn’t have even been able to think about recouping your money until you were near or at retirement.

Even worse, imagine that you were in your 50s or 60s in 1929. You not only would have lost a boatload of money, but you also would have likely been out of a job for years, if not for a decade. And by the time 1954 rolled around, you would have been well into retirement, if you were alive at all. What kind of financial situation would you have been in for the past 25 years? Probably not a good one.

There’s one characteristic of the Great Depression that ended up putting a lot of people in the poorhouse. And it’s something that is rearing its head once again.

One reason so many people fared so poorly after stock markets crashed in 1929 wasn’t so much the fact that markets plummeted, it was the fact that they were borrowing money to invest in stocks. It’s one thing to lose money that you actually own. It’s another altogether to lose money that you don’t own.

Even big names like economist Irving Fisher, who famously said that stocks were at a new permanently high plateau, got caught up in borrowing money to invest in stocks and lost big. Stock markets were so hot during the 1920s that they were seen as a guaranteed way to get rich. The dangers of borrowing money to buy stocks were completely unappreciated. After all, you should be able to borrow money to invest, see your investments gain in value, then sell to someone else and book a profit. No one ever planned for losses, to their detriment.

Borrowing on margin has always been risky, but it took the losses experienced during the Great Depression to bring that reality home to many people. Still, lessons learned once gradually are forgotten by successive generations.

While many of us remember how margin calls were so calamitous for financial institutions during the 2008 crisis, borrowing to invest in stocks just hasn’t been on the radar screens of most Americans. Until now.

Traditionally, most Americans invest in stocks in one of two ways: either by using payroll contributions to invest in workplace-sponsored 401(k) or IRA retirement accounts; or by using post-tax dollars to invest through brokerage accounts, IRAs, Roth IRAs, or other types of investment accounts. In the majority of instances, investors are using money they have earned to make their investments. But since 2000, the amount of borrowing being done to invest in stocks has doubled. And that’s a risky venture, particularly for those who may not be knowledgeable about investing or margin calls.

With the advent of new technologies and the development of smartphone apps, investing in stocks is easier than ever. And with trillions of dollars of easy money flooding the economy over the past decade, so is borrowing on margin. Combine the two and you have a recipe for disaster.

You’ve probably read the stories of young millennials using margin accounts to invest through stock trading apps. They think it’s so easy as they see their accounts going up and up and up. But then things go sideways, stock prices start to fall, and soon enough they’re facing a margin call and have lost everything they invested and more.

The really sad thing is that it’s probably not just millennials doing this. Imagine how many older Americans have gotten involved in borrowing money to invest. Perhaps they’ve decided that now is the time to make up for the losses they suffered in 2008, so they’re using margin to multiply their gains. But the potential for disaster looms, and it could cost them their dreams of retirement.

Saving for retirement isn’t about getting rich quickly, it’s about accumulating wealth slowly and steadily to ensure that you have enough money saved up for what could be 20-30 years of retirement. That’s why you’ll often hear financial writers talking about adjusting the risk profile of your investments as you near retirement.

There’s nothing wrong with being bold and taking risks in your 20s, when you have decades ahead of you to make up for your investment losses. But when you’re in your 50s and 60s and nearing retirement, taking a big gamble can result in big losses, something that could be catastrophic to your ability to retire.

While hearing stories of those who have struck it rich borrowing money to invest in stocks can tempt us to throw caution to the wind, for most of us sticking to tried and true methods is probably still our best bet. And one of those tried and true methods that is gaining in popularity is investing in precious metals.

Precious metals such as gold and silver have been trusted by investors for years to protect their wealth through tough economic times. When stock markets falter, gold and silver often begin to gain strength. During the 1970s, for instance, gold and silver averaged annualized gains of over 30%, while stock markets stagnated. And in the aftermath of the 2008 financial crisis, gold nearly tripled and silver more than quintupled, while stock markets struggled to reach their pre-2008 peaks.

With an increasing number of Americans engaging in the same risky behavior that marked the run up to the Great Depression, there’s a very real risk that the next crash and its effects could rival the Great Depression in size and severity. Now is the time to ensure that your retirement savings are protected against that eventuality.

Don’t let your hard-earned wealth remain at risk one more day. Call the experts at Goldco today to learn more about how gold and silver can help protect your retirement savings, even if the economy falls into another depression.