War’s Effects on Gold, Oil, and Markets

If you had told someone at the beginning of 2022 that Russia would invade Ukraine, they wouldn’t have believed you The idea that in this day and age any country would just unilaterally attack...

Economy

If you thought inflation had disappeared, well, think again. Inflation has been quietly picking up steam again, rising the past two months. The latest inflation data from the Bureau of Labor Statistics (BLS) shows inflation rising at 3.7% year on year, up from 3.2% a month ago and 3% the month before that.

Now, an increase was expected by many analysts, with the official reasoning being that gasoline and energy prices are to blame. But there are more important factors at play here, and this newfound resurgence in inflation could impact you in a major way.

As Milton Friedman famously said, inflation is always and everywhere a monetary phenomenon. Rising prices of food or energy aren’t in themselves inflationary, they’re a symptom of inflation. The real inflation is the inflation of the monetary supply which results in, all other things being equal, a rise in prices.

The effects of inflation aren’t going to manifest themselves in the same way in different sectors of the economy. That’s why you have some goods that rise higher in price than others, or why some services see greater price increases than others. But at the end of the day, the root cause of those price increases is the rising supply of money.

The Federal Reserve began tightening monetary policy many months ago, starting with interest rate hikes and continuing with cuts to its balance sheet. The federal funds rate currently stands at 5.25-5.50%, while the Fed’s balance sheet has dropped by over $800 billion, or nearly 10% from its peak.

Despite that, inflation is still rising. Why?

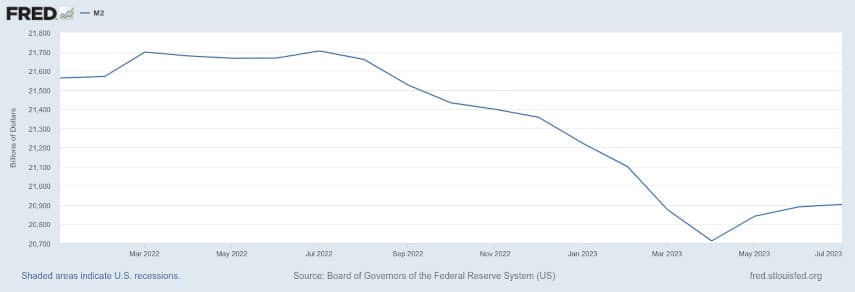

Well, look at the money supply like Friedman would. The M2 money supply is the broadest money supply measure we have today and, surprise, surprise, it’s no longer falling like it once was when CPI figures were declining. In fact, if you look at seasonally adjusted M2 figures, it’s actually rising again.

That explains why inflation figures are rising. But why is M2 suddenly reversing course, even as the Fed continues to shrink its balance sheet and hike interest rates?

That one’s a little tougher to figure out. It could be that we’re still seeing the lingering effects of the Fed boosting its balance sheet back in March to combat the bank failures that occurred back then. But if M2 continues to resist pressure to fall in the coming months, even as the Fed’s balance sheet continues to decrease, then we’ll have to look at other possibilities.

The most concerning possibility is that the Fed has lost control over the money supply. If that were the case, then nothing the Fed does would necessarily impact inflation. And a Federal Reserve whose actions could no longer impact the money supply and inflation in any meaningful way would be a scary thing to contemplate.

While that’s a longer-term and more far-fetched scenario, the most likely short-term impact of the latest inflation data is that the Fed is likely to hike rates yet again at next week’s Federal Open Market Committee (FOMC) meeting. With two successive jumps in inflation figures, a rate that came in higher than the 3.6% estimated rate, and an inflation rate that is now nearly double the Fed’s 2% target, there’s no way the Fed won’t raise rates again.

The only question now is whether the Fed can get inflation back under control. For a while it looked like they were doing it, but a rising M2 money supply and rising inflation is understandably sowing doubt among millions of Americans who have already had to endure the impact of high inflation to their pocketbooks.

With the Fed likely to raise interest rates at least once more, if not twice, in its bid to get inflation back under control, those rates are going to impact Americans’ financial well-being.

On the positive side, anyone who is investing in Treasury bonds, CDs, and money market funds is likely going to see a nice bump in the interest rates they’re receiving. Interest rates at 5% and up are already welcome after more than a decade of nearly zero, but the Fed could end up pushing things to 6% or higher after all is said and done. So for those happy to park their cash on the sidelines and wait, higher interest rates will be nice to see.

On the negative side, however, higher interest rates could speed up the occurrence of recession and exacerbate its negative effects once it occurs. Many businesses are already getting squeezed by higher interest rates. The higher interest rates climb, the more business activity will be suppressed. And don’t forget the housing market, which has already seen a bloodbath as buyers can no longer afford houses at current prices and interest rates.

With all of that in mind, it’s no wonder more and more Americans are looking to protect their wealth. Whether they’re looking to hedge against rising inflation or looking to protect their assets against loss from recession, asset preservation is starting to become a priority once again. And one thing that many people are starting to buy as both a safe haven and a hedge is gold.

Gold has a reputation for maintaining its value against inflation over the long run, while it also has a reputation for maintaining its value during recessions and crises, when other assets are losing value. During the 2008 crisis, for instance, the gold price gained 25% during the same period markets fell more than 50%.

Many people expect gold to perform similarly during the next crisis, which is why demand for gold has been so strong this year. Whether making direct cash purchases of gold or buying gold through a gold IRA, Goldco has gold purchase options for any size budget.

A gold IRA can be funded with rollovers from 401(k), 403(b), TSP, IRA, and similar retirement accounts, allowing you to transfer assets tax-free to a gold IRA, buy gold with your retirement savings, and still enjoy the same tax advantages as any other IRA account.

With so much uncertainty surrounding the future of the economy, now is the time to start thinking about protecting the wealth you’ve worked so hard to build up. Call Goldco today to learn more about how you can help safeguard your savings with gold.