Recent Events Driving Gold and Silver Prices Higher

To say that 2024 has been an interesting year is quite the understatement After all, who would have had “Trump assassination attempt” on their 2024 bingo card What promised to be a heated...

Economy

If there’s anything that typifies the excesses of our modern society, it’s the amount of debt that exists. Wherever you look, debt levels continue to increase and hit record levels.

Debt isn’t something that can be avoided, however. Without the ability to take on debt, hardly anyone in our society would be able to buy a house. And higher education, cars, and other high-priced goods and services are increasingly being funded by debt as well.

The amount of debt in existence today has been characterized as a bubble, one that cannot continue to keep growing. There’s a finite limit to how much you can borrow against the future, and we may be pushing close to those limits.

Debt isn’t just one colossal entity, however. There are numerous debt bubbles adding to the whole, including corporate debt, household debt, and government debt.

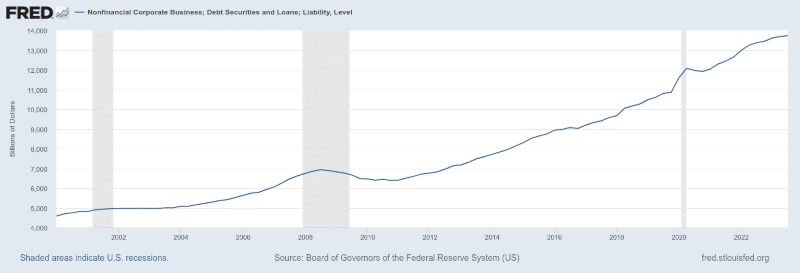

Right now corporate debt seems to be indicating the worsening position of debtholders, as corporate debt defaults grew by 80% in 2023. This year is expected to get even worse, as the effects of higher interest rates take effect.

For years companies were able to take advantage of low interest rates to issue massive amounts of debt. Total corporate debt today is nearly double what its peak was in 2008, at nearly $14 trillion.

As that debt matures, companies that have been reliant on debt to fund their operations will find themselves having to roll that debt over at higher interest rates. And now that the federal funds rate is 5.5% rather than 0.25%, interest expense on newly issued debt is going to be significantly higher.

Companies that were already facing difficulty are going to find things even more challenging. And companies that already were only able to pay interest expense, the so-called zombie companies that may comprise at least 10% of US companies, may be the next to fall into default.

Household Financial Situation Deteriorating

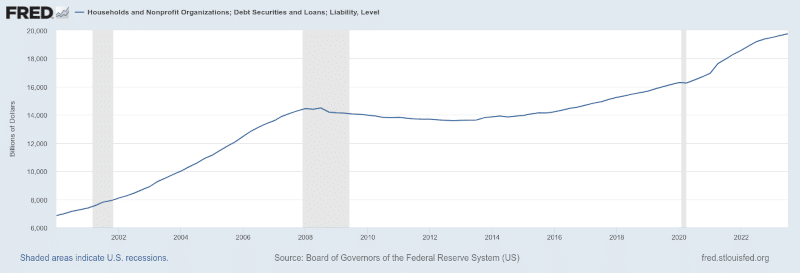

Corporations aren’t the only ones facing financial difficulty either. US households are also facing record amounts of debt.

While the rise in household debt hasn’t been quite as meteoric as the rise in corporate debt, it’s still over 36% higher than it was during 2008.

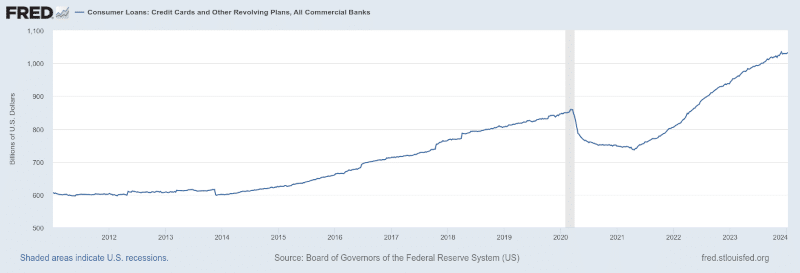

One reason for that is that credit card debt has increased significantly, rising 72% over the past ten years.

Unfortunately, credit card delinquencies are rising too, and are now at the highest level they’ve been since 2012. That could continue to worsen in 2024 as American households find themselves increasingly cash-strapped.

Of course, the biggest debtor of them all today is the US government, with the national debt having passed $34 trillion at the end of 2023 and showing no signs of slowing down. The outlook for the future isn’t any better, with budget deficits expected to exceed $1 trillion each year going forward.

The government too is going to experience difficulties with the vast amount of debt it has incurred. Interest expense on the debt alone is expected to surpass $1 trillion this year.

If the national debt keeps expanding, interest expense on that debt will keep rising. Eventually the government will find itself in a real pickle, having to either issue ever more debt just to pay off interest on the old debt, or having to make hard decisions about which federal government programs to take money from in order to service the national debt.

$1 trillion exceeds military spending and rivals Medicare and Social Security. If the debt situation becomes much worse, interest on the national debt could become the number one category of spending for the federal government.

A government that indebted is going to look for ways to fund itself, and eventually it’s probably going to try to squeeze taxpayers for more money too. Unless Congress is able to restore some semblance of fiscal discipline, the outlook for the future looks grim.

Even if you’re not part of the growing debt bubble, that doesn’t mean that you won’t be impacted when it bursts. You can do everything right – pay off your mortgage, pay off your credit card bills each month, buy cars with cash, etc. – and still see your financial well-being harmed once these debt bubbles burst.

The collapse of household debt may not impact you, but the collapse of corporate and government debt bubbles could. Collapsing corporate debt could lead to a financial collapse like 2008, or even worse, as corporations declare bankruptcy left and right as they find themselves unable to service their debt.

A government debt bubble collapsing could be catastrophic, particularly if it involves an all-out debt default, something that has in the past seemed nearly impossible. A debt default would reverberate throughout the world, and would likely lead to higher interest rates and a significant decrease in trust in the US government’s finances going forward.

While it’s not possible to completely insulate yourself from these effects of collapsing debt bubbles, you can take steps to try to cushion the blow. And one way of doing that is by owning precious metals.

Precious metals like gold and silver have served as safe haven assets and inflation hedges for centuries. When economies falter, currencies collapse, and nations face turmoil, gold and silver are among the first assets people turn to in order to help protect their wealth.

Today there are more options than ever to make gold and silver a part of your wealth protection plan. That includes protecting your tax-advantaged retirement savings with a gold IRA or silver IRA.

Gold and silver IRAs work just like any other IRA account, only that they own physical gold and silver coins or bars rather than conventional financial instruments. The gold and silver in your IRA accrues gains tax-free, and when you take a distribution you can either take it in cash or in physical metal.

Best of all, a gold or silver IRA can be funded with a tax-free rollover or transfer from an existing 401(k), 403(b), TSP, IRA or similar retirement account. So if you’ve ever wondered about the options for putting your existing tax-advantaged retirement assets into precious metals, a gold IRA or silver IRA is one option you might want to explore.

With gold having recently set all-time highs and fears of recession growing all the time, many Americans are understandably nervous about the future of their finances. And many have already turned to silver and gold to help safeguard them.

If the threat of a 2008-style debt bubble collapse is something that keeps you up at night, maybe it’s worth taking a look at gold and silver. After all, do you want to put your hard-earned wealth at risk of 2008-style losses?

Gold and silver’s track records in the aftermath of the 2008 financial crisis were remarkable, and expectations are for them both to perform well during the next recession. So if you’re thinking about getting gold and silver to help you, give Goldco a call to learn more about the benefits of owning precious metals.