Many successful savers are those who protect their portfolios from major losses, not necessarily those who make the biggest gains. As Warren Buffett famously said, “the first rule of investing is never to lose money, and the second rule is never to forget the first rule.”

“The first rule of investing is never to lose money, and the second rule is never to forget the first rule.”

One time-honored way of safeguarding wealth against loss is to purchase gold. People have sought the safety and security of gold for centuries, and today is no different.

When stock markets crash or fears of market weakness emerge, many rush to the safe haven of gold. But even outside times of financial difficulty, gold can be a smart way to diversify your portfolio, protect your wealth, and make solid gains.

One popular method of acquiring precious metals is through a gold IRA. Gold IRAs offer the same tax advantages as conventional IRAs, but allow individuals to protect their retirement savings with tangible physical gold, which can help safeguard against volatility in financial markets.

Given gold’s reputation for long-term stability, it is a sought-after asset for those looking to protect and diversify their savings portfolios. If you’re looking to protect your retirement savings, ensure that you have enough to live comfortably in retirement, and pass money on to your heirs, keep reading our beginner’s guide to a gold IRA to find out more about the numerous advantages of a gold-backed IRA.

Unlike conventional IRAs with which you may be familiar, a gold IRA is a type of self-directed IRA. Before we address gold IRAs, it is important to understand the basics of a self-directed IRA.

A self-directed IRA (SDIRA) is an IRA that gives you greater control and flexibility over the assets you can hold within the account. It allows you to purchase alternative assets that aren’t found in most conventional IRAs. While self-directed IRAs require the use of a custodian who administers the account, you as the account holder actually get to manage the account directly.

Some common forms of alternative assets allowed in a self-directed IRA include:

- Real estate

- Promissory notes

- Gold, silver, and other precious metals

- Cryptocurrency

- Mineral rights and water rights

- Commodities

A gold IRA is simply a type of self-directed IRA that focuses on purchasing precious metals such as gold coins and gold bars.

How Does A Gold IRA Work?

A gold IRA allows individuals to hold gold and other precious metals while still enjoying the same tax advantages of an IRA retirement account. Just like conventional IRAs, a gold IRA can be set up as a traditional IRA account, where pre-tax contributions are made, or as a Roth IRA, where post-tax dollars are used. Those with SEP or SIMPLE IRAs also have the option to use a gold IRA to grow their retirement savings through precious metals.

A common method of funding gold IRAs is through rollovers or transfers from existing retirement accounts such as a 401(k), 403(b), TSP, IRA, or similar account into a gold IRA. This allows individuals to lock in gains they may have made in their current retirement accounts and transfer that wealth into precious metals, which can provide more protection and stability.

Gold is a tangible asset that anyone can own and hold, and it offers stability against inflation, financial turmoil, and economic downturns. Thanks to provisions in the tax code, people can hold gold within a gold IRA,people can hold gold within a gold IRA,, allowing them to gain all the same tax benefits as a conventional IRA.

There are many advantages to including gold, silver or other precious metals in your IRA portfolio, including:

- Stability for your savings portfolio;

- Lessening risk as you age and plan for retirement;

- Locking in gains you’ve made and transfering that wealth into precious metals.

People can contribute to a new gold IRA account or, more commonly, roll over a portion of their current retirement accounts (401(k) rollover) into a gold IRA to diversify their portfolio. With the possibility of a recession always looming, it’s worth considering adding precious metals like gold to your retirement planning.

What Is a Gold IRA Rollover?

A rollover IRA is a term for an individual retirement account (IRA) that is funded by moving funds from a 401(k), 403(b), TSP, or similar retirement account into an IRA. The main difference between a 401(k) and an IRA is that an IRA is normally opened by an individual, whereas a 401(k) is offered by an employer.

With a rollover IRA, individuals can use existing retirement funds to access a wider variety of assets than those typically available in a 401(k) plan. By opting for a self-directed IRA, there are even more possibilities, such as adding physical gold through a gold IRA for additional portfolio diversification.

Rollover IRAs are most often created when changing jobs or retiring, as they allow employees to move their current 401(k) or other retirement account balances into an IRA account that will offer a broader range of options and potentially superior performance.

When performing an IRA rollover, funds from existing tax-advantaged accounts can be rolled over into a new IRA tax-free. You can even roll over funds from multiple retirement accounts into a single self-directed IRA, making it easier for you to consolidate and manage your retirement savings.

With a gold IRA rollover, individuals can minimize the tax impact of their gold assets too, since distributions are normally subject to ordinary income tax rates. Particularly for those in lower tax brackets, that can result in gold held in an IRA being taxed at a lower rate than if it were not in an IRA. And for those people who own a Roth gold IRA, they won’t be taxed at all on the gains on their gold purchases.

![Gold IRA Rollover Process for Beginners [step-by-step]](https://i.ytimg.com/vi/CiV7HKd-_qY/maxresdefault.jpg)

The Precious Metals Strategic Edge: Portfolio Diversification

Diversification is a strategic way of managing your portfolio to include various types of assets to reach specific financial goals over the long term. A well-balanced mix of assets can offer you the potential to improve returns and protect your principal without subjecting yourself to unnecessary concentration and risk.

Loading up on one stock or one industry could be costly if that stock or industry suddenly plummets. Likewise, reacting suddenly when the market changes can lead to knee-jerk decisions that don’t benefit you in the long term.

A diversified retirement portfolio can’t always offer large gains or prevent losses, but it is a strategy that some financial planners and fund managers use to create balance. One effective way to diversify is through precious metals like gold and silver.

You don’t want to leave your portfolio vulnerable to the ups and downs of financial markets. Taking control of your future by holding a gold IRA can be a good option for protecting and diversifying your portfolio. Purchasing physical gold through a gold IRA could provide:

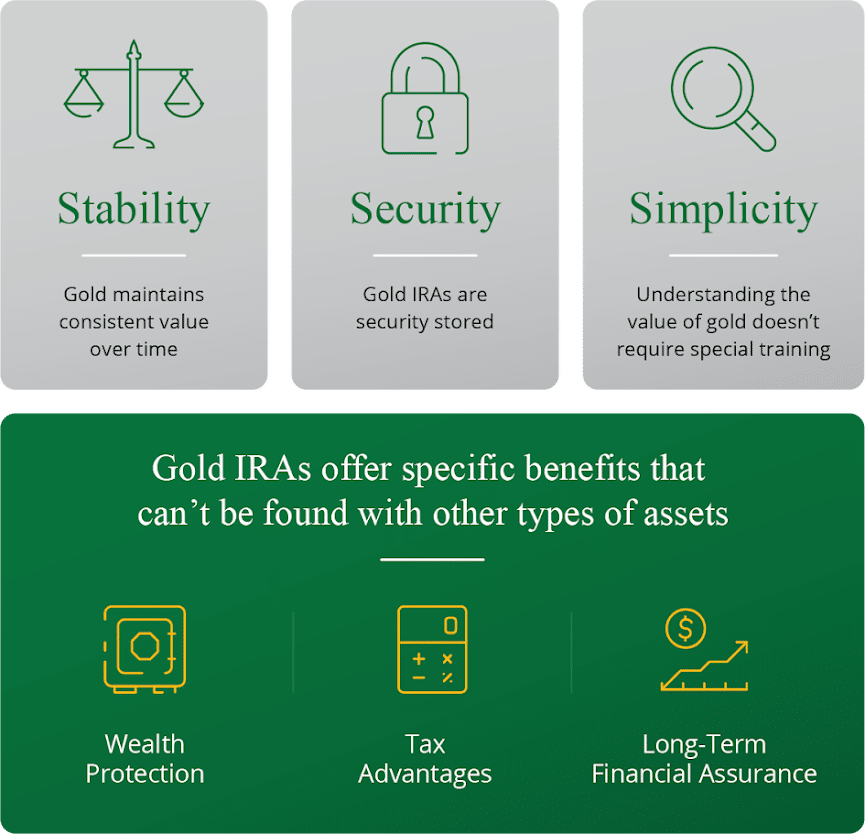

- Stability: Gold has consistently grown in value and maintained its purchasing power over time. While the US dollar has lost over 97% of its value since 1913, the price of gold has increased over 9,000%. Silver has fared well against the dollar too, with the silver price increasing over 4,500% since 1913.

- Security: The gold that you own in your gold IRA is securely stored at a bullion depository. You can take a distribution of either cash or gold from your gold IRA whenever you want, subject to any applicable taxes and IRS regulations, and after age 59½ those distributions are penalty-free.

- Simplicity: Understanding the value of gold doesn’t require special training, and you can easily check daily gold prices on your own.

Additionally, gold IRAs offer specific benefits that can be superior to those of other types of retirement assets. These include:

- Wealth Protection: Gold has consistently grown in value over time, whereas the US dollar has consistently weakened over time through inflation and currency devaluation.

- Tax Advantages: Use pre-tax dollars to purchase gold, accrue tax-free gains, and only pay taxes upon distribution, just like a conventional IRA. Even better, you can learn how to diversify your 401(k) or IRA by rolling over existing assets to a gold IRA.

- Long-Term Financial Growth: Gold can be a great long-term choice because it holds its value against inflation and can help protect portfolio value during times of recession.

- Financial Control: Diversifying your assets with a gold IRA puts you in control of your wealth.

What Are the Benefits of a Gold IRA?

As you work towards building a well-diversified portfolio, it can help to make sure you know all your options, especially when it comes to gold. Whether you’re interested in rolling over existing retirement savings into a gold IRA or just making direct cash purchases of gold, we’re here to help clarify the benefits associated with this precious metal.

Precious metals like gold have numerous advantages as part of a well-diversified portfolio, and tax-advantaged retirement accounts do too. Putting the two together can result in a powerful tool to help you achieve your financial objectives.

Individuals who included gold into their portfolios during the 2008 financial crisis experienced significantly better performance compared to those who maintained only stocks.. And those portfolios that held gold continued to grow stronger after the crisis hit its lowest point, in many cases for years afterward.

Let’s take a more detailed look at the benefits of a gold IRA.

1. Gold Can Help Portfolio Diversification

A diversified portfolio may mean thinking outside the box of purchasing stocks and bonds, which is what many Americans are most familiar with. Concentrating your assets in one place also concentrates your risk. Ever heard the saying, “Don’t put all of your eggs in one basket”?

By diversifying your portfolio with gold, you can ensure that your assets aren’t completely at the mercy of Wall Street for their performance. If financial markets take a downturn, if bond markets become illiquid, if stock markets crash, those traditional assets may all perform poorly.

Alternatives like gold IRAs can leave a portion of your portfolio protected during challenging economic times, helping you diversify and shift risk away from financial assets and leaving a portion of your portfolio protected during those times when the stock market experiences weakness. Very often, the weaker the stock market and the economy perform, the better precious metals perform, potentially making them ideal assets to protect your portfolio when a recession is on the horizon.

2. Protection Against Market Fluctuations and Volatility

Physical gold acts as a hedge against dips in volatile markets. The boom and bust of the business cycle is all but a certainty, with stock market crashes and recessions occurring with unfortunate regularity.

Gold has acted as a hedge against other assets. Unlike paper assets like stocks and bonds that can become worthless as the companies that issue them fail, gold has always been worth something, and has remained in demand for thousands of years.

3. More Control Over Your Assets

Holding a gold IRA also can provide you with a greater element of control over your assets. For many people who may save for retirement through an employer-sponsored 401(k) plan, the options available to them are often limited.

That’s why so many people roll over assets from a 401(k) account to an IRA account, because IRAs generally offer more options. And with a gold IRA, the options become even greater.

By opening a gold IRA, you can gain an extra element of control over your portfolio, as you are the one who determines what types of gold or silver you hold.

A great advantage of having a gold IRA is that assets can be transferred easily and without tax consequences among retirement accounts. So someone who wants to roll over a portion of a 401(k) account into a gold IRA can do so relatively easily. And if that person decides in the future to sell some of those precious metals assets to buy into stocks or bonds, that type of transaction can be done too.

With the control over your assets that you get from a gold IRA you can:

- Help diversify your portfolio;

- Give yourself greater peace of mind;

- Ensure that the decisions you make will directly impact your retirement and financial well-being.

4. Potential for Gold Price Growth

There’s a dirty little secret that mainstream financial firms don’t want you to know about: Gold is the best performing asset of the 21st century. In fact, it’s grown significantly more than stock markets have.

But you’ll still see stocks recommended for asset growth rather than gold. Why? Well, there are two potential reasons:

- Nostalgia about the 1982-2000 stock market boom. That was a period of unprecedented growth, with stock markets growing around 17% per year on average. But we haven’t seen growth like that since then, and we may never see growth like that again.

- Many financial firms make their money off fees associated with stock trades, asset management, etc. They don’t make money selling people gold because people hold gold for the long term. Plus some firms don’t offer gold custodial services.

Financial advisors and stockbrokers want to be able to charge for each trade, plus take a small management fee every year for each type of asset you own. But if you own gold for years and years, they can’t charge you trading fees because your assets are safe, secure, and not moving.

While gold may be bad for some financial firms, it’s good for you because your gains aren’t being nickeled and dimed to death through fees.

With a gold IRA you’ll generally end up paying a few hundred dollars a year in custodial and storage fees. But compare that to the 1-2% annual fee you would likely pay to a financial advisor to manage your assets, which is on top of all your other expense ratios, and you see that fees on your gold could end up lower than those on conventional financial assets.

Traditional advisor fees can be death by a thousand cuts, but a gold IRA may eliminate that and keep more money in your pocket.

With a gold IRA, you can benefit from gold’s stability, take advantage of future price growth which can sometimes be substantial, and still have immediate access to your money should you wish to sell your gold or transfer your wealth into other assets.

5. IRA Tax Advantages

A gold IRA offers the same tax advantages as a conventional IRA. You can purchase gold with pre-tax dollars (or post-tax dollars with a Roth gold IRA), roll over existing retirement assets with no tax consequences, and defer taxation until you decide to take a distribution.

And just like with contributions to a Traditional IRA, annual contributions to a Traditional gold IRA can even be tax-deductible. That also means that all the same IRA rules apply to a gold IRA:

- Early distributions may incur income taxes and an additional 10% penalty;

- Required minimum distributions (RMDs) must be taken after age 73, except for a Roth gold IRA, which is exempt from RMDs;

- Annual contributions are limited to $6,500 (or $7,500 if you’re over age 50).

Rollover contributions to a gold IRA are not limited by the normal annual contribution limit, so you can roll over $10,000, $100,000, or $1 million or more from existing retirement accounts into a gold IRA, and you can do it tax-free.

That allows you to protect your retirement savings with gold without having to take a tax hit. And when you choose to take a distribution, you can choose to take it either in cash or in physical gold.

For some people, keeping gold in an IRA can even offer better tax treatment than gold held outside an IRA. That can keep taxes from eating away at your returns. Don’t underestimate the benefits of a gold IRA to allow you to use pre-tax dollars to buy gold.

Is a Gold IRA Right for You?

Gold IRAs can offer many advantages to Americans, whether you’re nearing retirement or are earlier in your career. You don’t need to put all of your assets into a gold IRA, as simply moving small percentages of your assets into precious metals can reap long-term benefits.

Some people may wonder if a 401(k) or self-directed IRA is better. Very often they wonder this after they’ve left an employer and still have 401(k) assets held in their old retirement plan.

When you leave your employer, you have the option to roll over your retirement savings into an IRA, which may be a good opportunity to explore a self-directed gold IRA, which offers diversity and assets that can be more stable through economic downturns.

How to Move Your 401(k) to Gold Without Penalty

Retirement planning isn’t something that you start doing when you’re a few years away from retirement. It’s something you start as early in your career as you can. There’s no substitute for time in the market when it comes to building up your retirement savings.

As you get older, you may start looking into more ways to protect the money you’ve already put aside for retirement. If you have a 401(k) from a previous employer that is sitting idle, or if your current 401(k) options don’t leave you enthused, a 401(k) to IRA rollover could offer you more options to put your money to better use.

One popular 401(k) rollover option is to roll over 401(k) assets into a gold IRA. The rollover process can allow you to move your 401(k) into gold tax-free and penalty-free.

A gold IRA is a type of self-directed IRA, an IRA that allows you to take greater control over your assets. Moving retirement savings into a self-directed IRA can give you the potential for more options like real estate, private bonds, private equity, and precious metals like gold and silver.

Precious metals are a popular option because gold and silver have been used as a time-tested means of storing wealth that can weather numerous economic changes, giving your portfolio diversity and stability. The price of precious metals often increases even in tough economic times, meaning that your portfolio can still get a boost even during the worst throes of a financial crisis.

Like all 401(k) and other retirement plans, a gold IRA has rules and regulations that you need to be aware of. The last thing you want to do is decide to roll over your 401(k) and be hit with taxes and penalties because you didn’t do things correctly.

So, how do you move your 401(k) to gold without penalty? This guide will help you understand what a 401(k) is, how it works, its benefits, and how to effectively roll over your 401(k) to gold without incurring taxes and penalties

Who Can Contribute to an IRA?

Anyone with earned income, and their spouses if married filing jointly, can start and contribute money to an IRA. You can contribute to an IRA even if you have a 401(k) or similar retirement plan at work. The only limit is to how much money you are able to contribute to your accounts.

Types of IRA Accounts

If you are eligible to start an IRA, there are numerous types of IRAs available. These include:

- Traditional IRA: Contribute with pre-tax dollars, gains accrue tax-free, withdrawals are taxed as regular income. If your income is below certain thresholds, your contributions to an IRA may be tax-deductible.

- Roth IRA: Contributions aren’t tax deductible and are made with post-tax dollars. Earnings and withdrawals are not taxed.

- SEP IRA: Simplified Employee Pension, which is similar to a Traditional IRA, but is funded by an employer or self-employed individual.

- SIMPLE IRA: Savings Incentive Match Plan for Employees, which is similar to a 401(k) plan, but has lower contribution limits and lower administrative costs.

- Self-Directed IRA: Follows the same eligibility and contribution rules as a Traditional or Roth IRA, but with the ability to hold alternative assets like real estate and precious metals, such as a gold IRA.

Because these accounts provide tax benefits for retirement savings, there are an abundance of IRA rules that must be followed. These rules include requirements for contributions, withdrawals, and the types of assets that can be included in your portfolio.

We’ll start off with some general IRA rules and then focus more specifically on self-directed IRAs and the gold IRA rules that you need to know.

General IRA Contribution Rules

The IRS sets contribution limits on IRAs, which must be followed in order to avoid penalties. The following guidelines will help you understand contribution limits for IRAs:

- Limited to $7,000 in contributions per year ($8,000 if you’re over age 50).

- Contributions are across all IRAs, so if you have multiple IRA accounts, you are limited to that $7,000 total across all your accounts.

- Contributions are per person, not per account–potential to contribute to multiple IRAs in the same year.

- Rollovers or transfers from 401(k), TSP, IRA or similar accounts into an IRA or other eligible retirement plan are not subject to annual contribution limits.

IRA Penalties

The IRS sets forth penalties for not following regulations dealing with retirement accounts. Here are a few IRA rules to be mindful of so you know how to move a 401(k) to a gold IRA without any penalties:

- If you exceed the annual contribution limits, you may incur a penalty of 6% per year. Example: if you exceed the contribution limit by $500, you would be penalized $30 every year until the mistake is corrected

- If you have an IRA, you are not allowed to hold collectibles, which includes artwork, rugs, antiques, stamps, and other items as defined by subsection 408(m)(2) of the Internal Revenue Code. Tax penalties may result. This does not include qualified precious metals that are exempt under subsection 408(m)(3).

- Withdrawing any distributions before reaching the age of 59½ incurs a 10% penalty plus any taxes due. Exceptions include death or disability of the IRA owner, withdrawals to pay certain medical bills, first time home purchases, and higher education expenses.

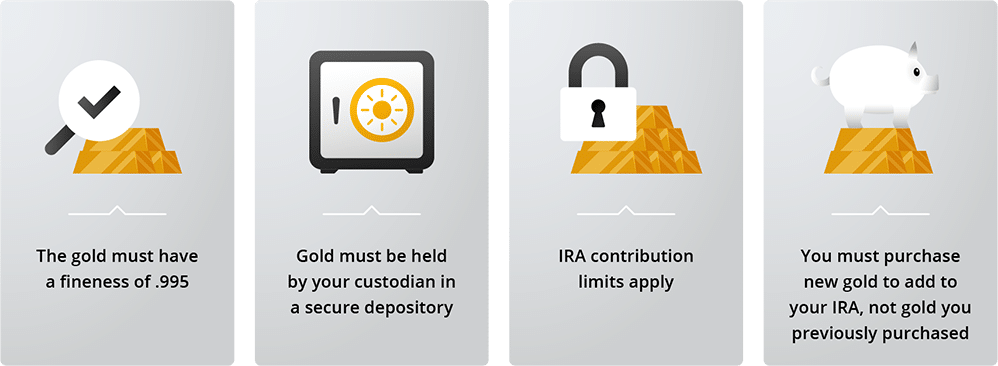

Gold IRA Rules

Gold can be a great way to keep your portfolio diversified, but to take advantage of it and maximize your savings, you should be aware of the self-directed and gold IRA rules.

First, it’s important to understand the rules that govern self-directed IRAs and acceptable assets as a whole. These include subsection 408(m) of the US tax code, which prohibits IRA accounts from acquiring collectibles and defines collectibles as:

- “any work of art,

- any rug or antique,

- any metal or gem,

- any stamp or coin,

- any alcoholic beverage, or

- any other tangible personal property specified by the Secretary for purposes of this subsection.”

There are, however, exceptions made for some coins and bullion in subsection 408(m)(3), namely:

- Gold American Eagle coins minted by the US Mint are not considered collectibles.

- Other gold coins or bars must have a fineness “equal to or exceeding the minimum fineness” of a contract market, which for gold is .995, or 99.5% purity.

- Gold must be held by an IRA custodian. Home storage of IRA assets is illegal and can result in massive fines and penalties.

In addition, If you already own gold, you cannot add that gold to your IRA. But you can open a gold IRA and purchase new gold to add to your IRA.

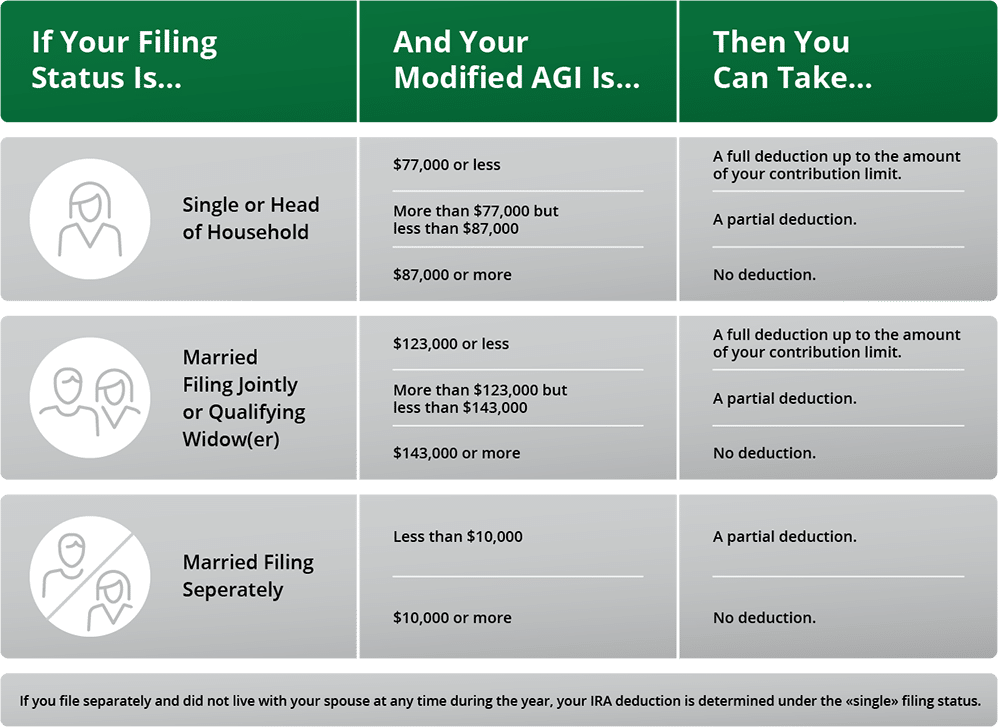

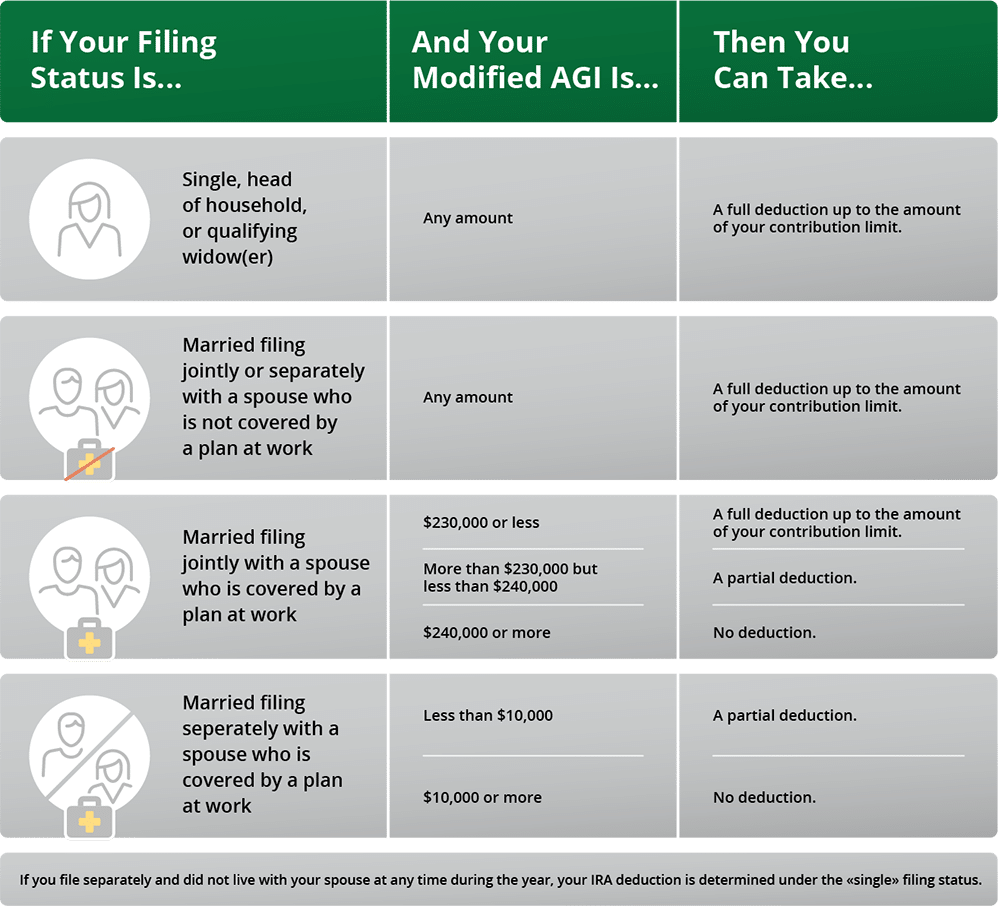

Tax-Deductible IRA Contributions

Using an IRA to reduce taxes is not uncommon, but there are deduction limits set by the IRS to be aware of. Some general rules include:

- Roth IRA contributions cannot be deducted.

- Work retirement plan deductions may be limited if you or your spouse are covered by a retirement plan through your employer, and if your income exceeds certain levels.

- No work retirement plan means you are allowed to take a deduction in full if you and your spouse (if married) aren’t covered by an employer-sponsored retirement plan.

IRA Contribution and Deduction Limits for 2024

To better understand IRA rules related to contributions and deductions in 2024, refer to the following charts:

2024 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions If You ARE Covered by a Retirement Plan at Work

2024 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions if You are NOT Covered by a Retirement Plan at Work

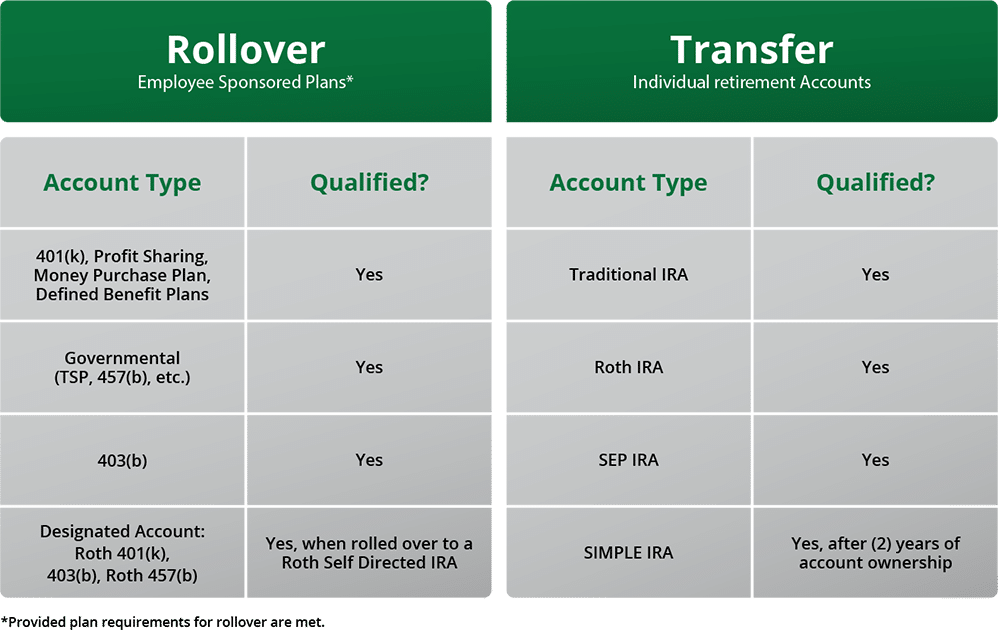

401(k) to IRA Rollover Rules

Rollovers allow you to move existing retirement assets from a 401(k), 403(b), TSP, or similar retirement account into an IRA. Since rollover contributions are not subject to the annual IRA contribution limits, they can be a useful tool in building up your retirement savings.

In general there are three types of rollovers:

- Direct Rollover – a direct rollover occurs when a distribution from a 401(k) or similar retirement plan is made directly to another retirement plan or to an IRA account. No taxes are withheld from this rollover.

- Trustee-to-Trustee Transfer – this transfer occurs when a distribution from an IRA occurs and the distribution amount is sent directly from the first IRA custodian to another IRA custodian or to a retirement plan. No taxes are withheld from this transfer.

- 60-Day Rollover – this rollover occurs when a distribution from an IRA or retirement plan is made to you. You then have 60 days to roll over all or a portion of that distribution into an IRA or retirement plan. Because taxes will be withheld from this distribution, you will have to use other funds if you wish to roll over the full amount of the distribution.

Because of the potential tax consequences of a 60-day rollover, people who want to move a 401(k) to a gold IRA without penalty generally choose the direct rollover or trustee-to-trustee transfer. These ensure that their retirement savings are rolled over without taxes or penalties. `

Additionally, there is a one-per-year IRA rollover rule. This means that you can only make one rollover from the same IRA per year.

You also can’t within that 1-year period make a rollover from the IRA to which you distributed that rollover. You can read more about it at the IRS website.

This one-per-year rule does not apply to:

- rollovers from traditional IRAs to Roth IRAs (Roth conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers (e.g. IRA to 401(k))

- plan-to-IRA rollovers (e.g. 401(k) to IRA)

- plan-to-plan rollovers (e.g. 401(k) to 401(k))

There are additional restrictions on rollovers, such as the fact that RMDs cannot be rolled over. When you decide on doing a rollover, the IRS website has lots of useful information on the topic, including a rollover chart that shows which accounts can be rolled over into which.

You may also want to consult a tax professional to ensure that you aren’t making mistakes that could subject yourself to unnecessary taxes.

Which Gold Coins and Gold Bars Are IRA-Eligible?

By choosing IRA-eligible gold coins and other precious metals products, you can take advantage of the incredible opportunity that precious metals offers. But as with other aspects of a gold IRA, it’s helpful to know the rules prior to purchasing your gold so that you can ensure that your purchases remain tax-free and penalty-free.

Buying IRA-Eligible Gold

![Purchasing Gold? Different Types of Gold…[watch this before buying]](https://i.ytimg.com/vi/iI_gVTDNXs0/maxresdefault.jpg)

When learning how to buy gold for a gold IRA, it’s important to understand the rules. As discussed above, IRAs are forbidden from acquiring collectibles. But because of the exceptions in the Internal Revenue Code, there are numerous gold coins which are still IRA-eligible.

Some of the rules that have to be followed when buying gold coins or gold bars include:

- Level of fineness for gold IRA coins and bars – .995

- Many older gold coins are not eligible for gold IRAs, but among more recently produced coins there are exceptions laid out in the Code. Here are some of the more popular IRA-eligible gold coins:

- Gold American Eagle

- Gold American Buffalo

- Canadian Gold Maple Leaf

- Gold Lucky Dragon

- Gold Australian Saltwater Crocodiles

- UK Royal Mint Gold Lunar Series Coins

- Gold Wright Flyer

- Gold Washington Monument

- Gold Independence Hall

- Gold Phoenix

- Gold Liberty

- Gold Valor

- Gold IRA assets must be administered by your custodian and stored at a bullion depository.

- If you already own gold, you cannot add that gold to your IRA, but you can open a gold IRA and purchase new, IRA-eligible gold.

Additional IRA-Eligible Precious Metals

You can also hold other types of precious metals coins and bullion that meet IRS specifications. Those include silver, platinum, and palladium that meet the following minimum fineness:

- Silver – .999

- Platinum – .9995

- Palladium– .9995

3 Steps to Start a Gold IRA

Beginning the process of opening a gold IRA is simple, especially when you partner with precious metals experts like Goldco who know the ins and outs of this type of IRA. While it’s not difficult, you want to make sure you know all the rules and follow them so that you can avoid unnecessary taxes and penalties.

1. Choose the Type of Gold IRA

The type of self-directed gold IRA you set up will be dependent on how you want to fund your IRA. Most people will choose to fund their gold IRA through a rollover from an existing retirement account such as a 401(k), and they’ll often choose to open a Traditional gold IRA so that they can contribute with their pre-tax retirement savings.

If you’re transferring or rolling over funds from a Roth account, you will need to choose a Roth gold IRA. You can also open a Roth gold IRA if you want to do a Roth conversion.

2. Fund Your Account

The funding source for your gold IRA is dependent on what type of gold IRA you open. If you open a Traditional gold IRA, you can’t fund it with transfers or rollovers from Roth accounts such as a Roth IRA or Roth 401(k). But a Roth gold IRA can be funded with rollovers from pre-tax or Roth accounts.

Numerous types of retirement accounts can be used to fund a gold IRA. The chart below contains information on which types of accounts can be used to fund a gold IRA.

You may want to check with your tax advisor before making any changes to see if there are tax implications and confirm that your current retirement accounts allow transfers or rollovers.

Choose a Self-Directed Gold IRA Custodian

Like any other IRA assets, gold IRA assets need to be administered by a custodian per IRS regulations. Working with precious metals specialist, like those at Goldco, can help you find a custodian experienced with gold IRAs to make sure your gold IRA is opened properly.

Once you have chosen your gold IRA custodian, you can open your gold IRA. When your gold IRA account is open, you can then start the rollover process.

Fund Your Self-Directed Gold IRA

Once you have opened your gold IRA, you can start the rollover process. Normally this is done by informing your plan administrator or IRA custodian of your rollover intentions.

Then you’ll sell assets in your current retirement account and roll them over into your gold IRA. Your current plan administrator or IRA custodian will normally be responsible for sending funds to your gold IRA custodian.

It can be very important to work with gold IRA specialists to make sure that the rollover process goes smoothly, that your funds end up where they’re supposed to, and that you’ve adhered to all IRS regulations. While the rollover process can be simple, if you make a mistake you may inadvertently open yourself up to tax liabilities or penalties.

After your funds have been rolled over to your gold IRA, you can then begin the process of determining which gold coins or gold bars you want to buy with those funds.

3. Select Your Precious Metals

Now that your self-directed gold IRA is funded, it’s time to choose which gold coins or gold bars you want to buy. Remember that certain types of gold coins aren’t eligible for IRAs.

That’s why it can help to work with partners like Goldco who offer IRA-eligible gold coins to ensure that you don’t expose yourself to tax liability by buying the wrong type of gold.

After you’ve purchased your gold coins or gold bars, they will be administered by your IRA custodian and stored at a bullion depository. This ensures that your gold is there when you need it.

Safeguard Your Retirement with a Gold IRA

By setting up a self-directed gold IRA, you can rest easy knowing your assets are protected with gold. Diversifying your portfolio with gold can be a great way to protect your hard-earned retirement savings from market fluctuations and economic crises.

There’s no better time than today to start thinking about buying gold. With the economy facing its fair share of difficulties, a gold IRA may be just what you need to help you protect your assets.

Setting up a self-directed gold IRA can be done easily, especially when you work with Goldco’s experts.

Whether you want to learn more about gold IRAs, start the gold IRA rollover process, or just buy gold coins, Goldco can help you protect your retirement savings with gold.

No matter your age or stage in life, Goldco has precious metals options for everyone.

By simply filling out our contact form, we’ll connect you with experienced representatives who can answer your questions, offer valuable reference materials, and help you navigate the gold purchase process.

We’re ready to help you facilitate the diversification of your retirement portfolio so you can feel more in control of your financial future.