6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

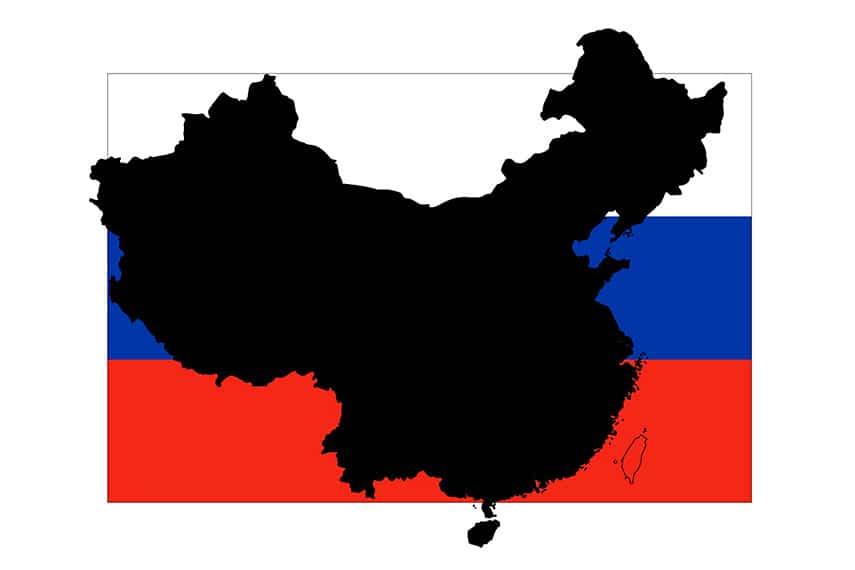

The time is coming when the dollar will no longer be the world’s reserve currency. In all likelihood it will be the Chinese yuan that replaces the dollar, as China is making moves to internationalize its currency, make it more convertible, and use it in foreign trade with more and more nations. The progress made by the yuan is slow and steady, but the end goal is clear.

Every day brings more and more news that indicates that the dollar’s days of dominance are done. One of the more recent indications is that Russia is expected to begin issuing its first yuan-denominated debt either this year or in 2020. That’s a huge step for both Russia and China, as it implies a great deal of trust in the strength of the yuan.

The danger with issuing debt in another country’s currency is that it leaves you open to exchange rate risk. Many homebuyers in Eastern Europe found that out the hard way after they took out dollar-denominated mortgages, then watched as the dollar strengthened against their home currencies. That put them underwater even though the mortgages should have been payable under the previous exchange rates.

If Russia’s issuance of yuan-denominated debt ends up becoming part of a larger trend, expect yuan-denominated debt to take on greater importance in world debt markets. It will still be a while before yuan-denominated debt reaches the importance of dollar-denominated debt, or before investors trust Chinese government securities as much as US Treasury securities, but that day is likely coming quickly.

Investors and retirees who have another 20, 30, or 40 years to live may very well see the yuan eclipse the dollar in their lifetimes. That would erode the standard of living of many US retirees, who benefit from the dollar’s status as the world’s reserve currency. Their investments in dollar-denominated bonds and dollar-denominated stocks will decline as the US dollar drops in value when it loses its reserve currency status.

Only by investing in gold can investors adequately protect themselves from that risk. Because gold is an international asset that is purchased around the globe, it acts as the ideal hedge against currency risk. As painful as it will be to see the US dollar lose its status as the world’s reserve currency, investors can ease the pain by making sure that they’re investing in gold to protect themselves.