3 Things That You Should Know About Inflation

Only a few short years ago, the United States experienced the highest inflation rates in over 40 years as inflation rates peaked at over 9% That was a wake up call for many Americans who had been...

Economy

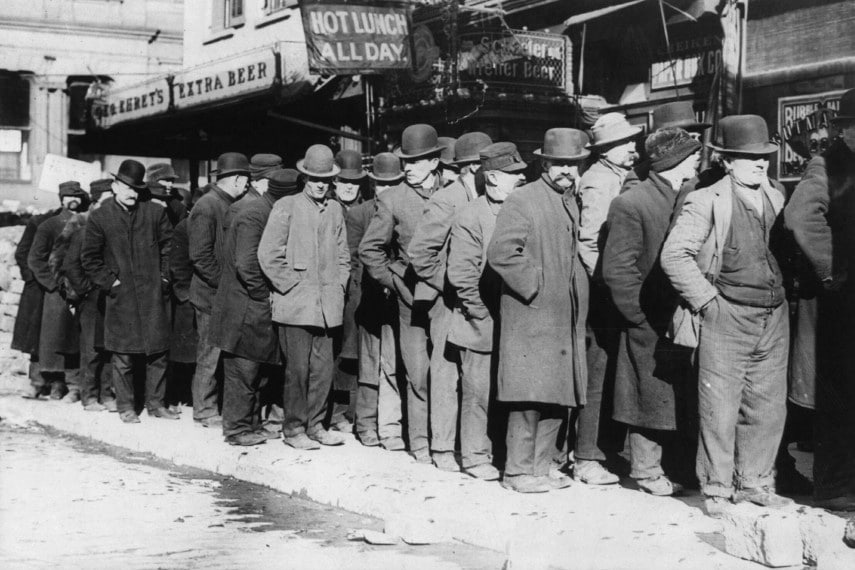

According to government statistics and the mainstream media, the US economy is in the middle of an economic recovery. Stock markets are sky high, employment is supposedly improving, and the worst of the lockdown-induced recession is behind us. But anecdotal evidence from around the country is beginning to undermine that narrative.

What little economic recovery there has been is partially due to the trillions of dollars of monetary and fiscal stimulus that has been pumped into the economy. But you can’t print your way to prosperity. At some point the government can’t keep spending trillions of dollars that it doesn’t have, and economic reality will set in.

We’re already hearing stories that not all is well with the economy. Prices are rising throughout the economy, from food to fuel to housing. Many industries are facing shortages of raw materials and labor, making it difficult to stay in business. And that is leading to increased numbers of furloughs and layoffs, putting the kibosh on workforce recovery.

With so much going on right now, and so much uncertainty about the future, it’s no wonder many investors are wary about plowing even more of their money into stocks, bonds, and other conventional financial investment assets. They’re starting to get anxious about the future, and they’re looking for safety and security.

One of the biggest fears that both investors and consumers have is that of rising inflation. It has been nearly 40 years since Americans have had to deal with high inflation, as official inflation figures for the past decade have hovered around 2% annually. With the Federal Reserve intent on boosting inflation, it’s not out of the question that inflation could get out of hand.

With trillions of dollars of monetary and fiscal stimulus entering the economy over the past year, it’s no surprise that prices have been rising. Unlike the aftermath of the 2008 crisis, when the Fed largely neutralized its quantitative easing (QE), this latest round of stimulus hasn’t been neutralized, and as a result money supply figures have shot up tremendously. We’re still likely to feel the effects of that money supply growth for months to come, as inflation often lags growth of the money supply.

If you’ve been paying attention to prices over the past several months, you’ve probably seen the cost of gas at the pump increase significantly. Or maybe you’ve seen the cost of food at the grocery store increase. And if you’re in the market for a house, you’re probably pulling your hair out at the price increases that have occurred over the past year.

These rising prices are the natural result of creating trillions of dollars out of thin air. We can only hope that Congress and the Fed realize what they’ve done and nip this in the bud. Otherwise, if there’s further stimulus spending, prices will only get higher and higher.

One thing that Americans haven’t had to deal with on a regular basis is shortages of basic goods. Millions of people experienced tremendous shock last year as store shelves quickly became denuded of toilet paper, cleaning products, eggs, and flour.

While supplies of basic goods and foodstuffs have gotten more or less back to normal, albeit at higher prices, that may not last forever. There are already indicators that some industries are beginning to face slowdowns due to shortages of raw materials.

The building sector has had to deal with massive price increases on lumber and other raw materials, driving up the cost of building a house. At some point you would have to imagine that the supply of new houses will start to slow, as costs will become too great.

Shortages of computer chips have impacted numerous industries, including the automotive industry. Some reports indicate that manufacturing plants have had to stop work building cars because they can’t get the chips they need to build the cars.

Home appliances such as dishwashers and refrigerators are similarly in short supply, with waiting lists running up to several months. That’s the same for generators and other home electrical equipment. Every day it seems that more and more industries are starting to see shortages that keep them from doing business. And for consumers who aren’t used to having to wait to buy appliances, this is a drastically different marketplace than it was before COVID.

Because these shortages are affecting manufacturing, entire plants are shutting down until they can get the materials they need to go back into production. As shortages roll through the economy, it’s not out of the question to think that we might end up seeing a wave of rolling furloughs and layoffs throughout the manufacturing sector. And that, of course, will exacerbate shortages of finished consumer goods.

These layoffs and furloughs could short circuit any good news we’re seeing from the labor market. Combine that with the generous federal government unemployment benefits that are reportedly causing labor shortages in the restaurant and fast food industry and keeping the unemployed from reentering the job market, and you have the recipe for a really big mess.

In essence we have a trifecta of factors combining to bring down the economy, with rising inflation, shortages of goods and workers, and continued high unemployment. The stage is set for suppression of business activity and a return of a 1970s-style stagflationary environment. Are you prepared for that?

Despite the optimism from mainstream media’s talking heads, the reality is that the US economy is horribly flawed and nearly broken. Any economy that relies on stimulus spending created out of thin air for its continued performance is an economy that is on its last legs. The likelihood of a major economic correction continues to grow by the day, and the next recession could make 2008 look like nothing.

That’s why more and more investors are looking to protect their existing savings and investments, to keep them safe from loss. As Warren Buffet famously said, the first rule of investing is not to lose money. And the second rule is not to forget the first rule.

Too many investors today are blindly chasing gains, oblivious to the dangers that may be lurking just around the corner. When markets finally correct, and stock markets fall back to more normal price levels, they may find out just how bad it can be to lose money. Do you remember the 50% losses of 2008? Now just imagine that happening again, or perhaps something even worse. Can you afford those types of losses again?

Protecting your savings and investments is a wise move regardless of which way the economy is going. But with higher inflation and a weakening economy, protecting your investments becomes more important than ever. Waiting too long to protect your investments could cost you dearly when markets turn south, and could derail your plans for a comfortable retirement.

Thousands of people have already begun protecting their investments with gold and silver. These precious metals have a track record of performance during times of weak economic growth, high inflation, and financial turmoil. Both gold and silver saw annualized gains of over 30% during the 1970s, when stock markets stagnated and stagflation wreaked havoc on the economy.

Gold and silver also saw phenomenal growth in the aftermath of the 2008 financial crisis, setting all-time highs while stock markets struggled to recover. Many who remember that have vowed that the next time a crisis hits, they’ll own gold and silver to protect their assets.

If you’re looking to protect your assets, particularly those in tax-advantaged retirement accounts such as a 401(k), IRA, or TSP account, an investment in gold can be made with relative ease. By opening a gold IRA or silver IRA, you can invest in physical gold or silver coins while still enjoying the same tax advantages as your existing retirement accounts. You can even fund your gold IRA or silver IRA by rolling over or transferring funds from your existing retirement accounts without tax consequences.

Don’t leave your assets exposed to inflation and stock market volatility any longer than you have to. Contact the experts at Goldco today and learn more about how gold and silver can help protect your retirement savings.