An individual retirement account (IRA) is offered by financial institutions and can offer tax benefits for individuals saving for retirement. If you are eligible, there are a few ways to invest in an IRA to reduce taxes through the different types of IRAs available:

- Traditional: Typically, tax-deductible contributions in which you don’t pay taxes on IRA earnings until you retire. Withdrawals are then taxed as income.

- Nondeductible: Applies if you or your spouse has a retirement plan through an employer, but exceed the IRA income limits, in which case you may not be able to receive the same tax deduction as a traditional IRA. You can still contribute to the IRA and get benefit of tax-deferred growth on your IRA earnings.

- Roth: Contributions typically aren’t tax deductible and are made with after-tax funds. Earnings and withdrawals are not

- SEP: “Simplified Employee Pension,” which is a traditional IRA, but is funded by an employer or self-employed individual.

- SIMPLE: “Savings Incentive Match Plan for Employees” is similar to a 401(k) plan, but has lower contribution limits and has lower administrative costs

- Self-directed: Follow the same eligibility and contribution rules as a traditional or Roth, but with the ability to invest in other assets like real estate and precious metals, such as a gold IRA.

Because these accounts can provide tax benefits for retirement savings, there are an abundance of IRA investment rules that must be followed. These rules pertain to contributions, withdrawals, storage, types of assets that can be included in your portfolio, and payments.

More specifically, we’re focusing on self-directed IRAs and the gold IRA rules that you need to know to make the most of your investments.

Before you invest in an IRA of any kind, read on to learn more about the 2020 IRA rules and how they may affect your next investment, particularly if you are planning to invest in a precious metals IRA.

CARES Act and IRA Rules & Regulations

Before we dive into the general IRA regulations, it’s important to note recent changes that may affect IRAs as part of the Coronavirus Aid, Relief, and Economic Security Act (CARES). Here are the provisions to take note of:

- Required minimum distributions (RMDs) are waived for 2020 and include inherited IRAs and traditional IRAs, 401(k)s, and 403(b)s for people over 72.

- Take an early withdrawal up to $100,000 without paying a 10% penalty, if you are a “qualified individual”: you, a spouse, or dependent are diagnosed with COVID-19, you experience financial difficulties due to job loss, furlough, reduction in hours, or lack of childcare. You’ll want to consult with your tax advisor to determine if you’re a qualified individual before taking a withdrawal.

- Limits on how much can be borrowed from employer retirement plans are increased for “qualified individuals”.

If you have questions about how these provisions may or may not affect your IRA, consult with your employer, financial advisor, or tax advisor. To learn more about how this affects self-directed IRAs, particularly precious metals, contact us.

Who Can Invest in an IRA?

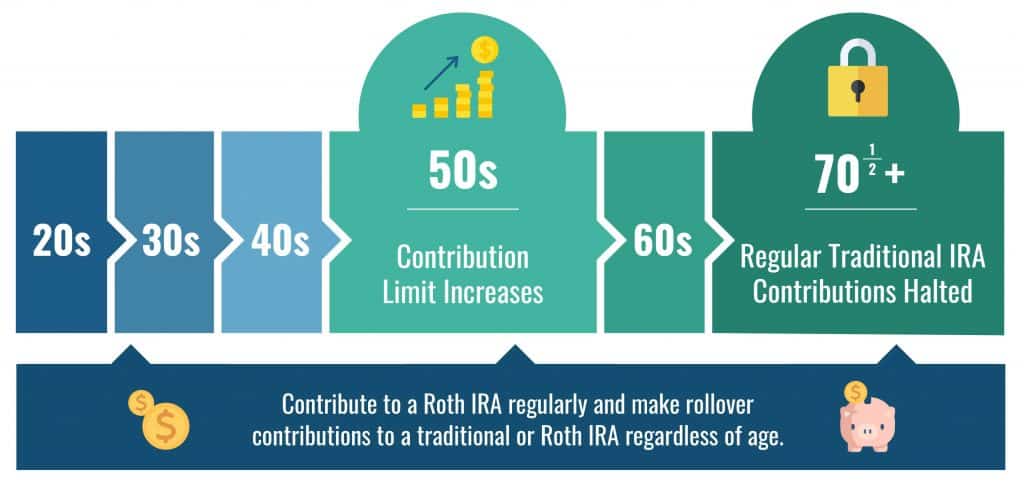

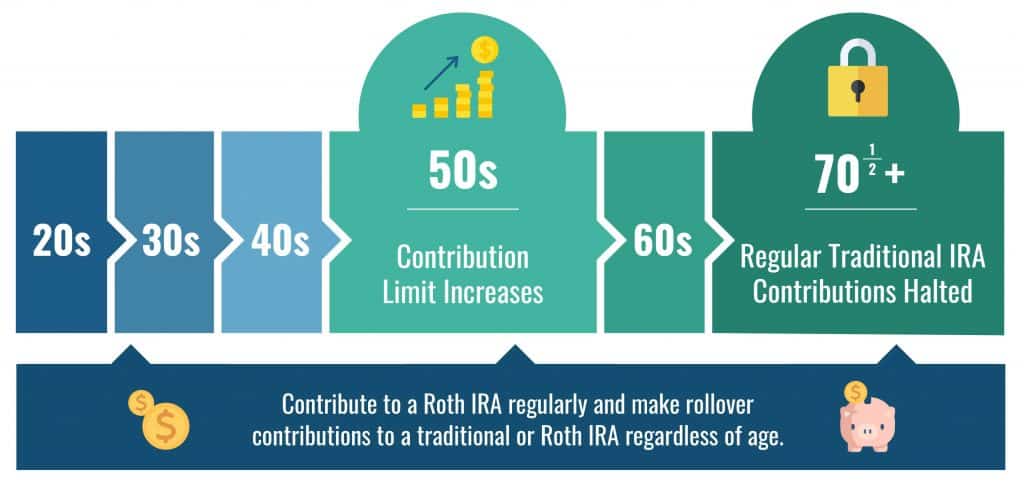

Here are 3 basic guidelines to follow when considering an investment in an IRA.

- Once you reach the age of 72, you can no longer make regular contributions to a traditional IRA, unless you have earned income in the year you contribute.

- You can still contribute to a Roth IRA regularly and make rollover contributions to a traditional or Roth IRA regardless of age.

- As stated above, once you reach the age of 50 years old, your contribution limit increases.

General IRA Contribution Rules

Several IRA investment rules apply to contributions that define the amount you’re allowed to contribute to the account and when. Once you exceed this amount, you will be penalized. The amount you are allowed to contribute is determined by your age, income, and tax filing status, as follows:

- There are penalties for exceeding contribution limits. If you exceed the set limits, the penalty is 6% per year as long as any excess amounts remain in the IRA.

- If you have an IRA, you are not allowed to invest in collectibles.

- Withdrawing any distributions before reaching the age of 59 ½ incurs a 10% penalty plus income tax (note the change included in the CARES act stated above). Exceptions include death or disability of the IRA owner, withdrawals to pay certain medical bills, first time home purchases, and higher education expenses.

- You are prohibited from using the account as a margin account or security for a loan, or from selling property to your IRA.

What’s the Difference Between a Traditional IRA and a Self-Directed IRA?

When it comes to investing in a gold IRA, or any other type of self-directed IRA, it’s important to understand how they differ from a traditional IRA. The benefit of choosing self-directed IRAs is investing in alternative assets outside of the typical stocks and bonds. These may include:

Precious metals IRAs can include investments in gold, platinum, silver, and palladium, and offer a sound alternative to typical assets like cash, stocks, and bonds, but the gold IRA rules can affect what precious metals you can invest in. Continue on to the following sections to learn more about what a gold IRA is and how to successfully invest in one.

What is a Gold IRA?

A gold IRA is a form of self-directed IRA in which investors can use pre-tax dollars to invest in gold and defer taxation until they decide to take a distribution. They can even use a gold IRA rollover to add existing retirement assets to a gold IRA.

There are many advantages to including precious metals in your IRA portfolio, including:

- Stability for your investment portfolio

- Lessens risk as you age and plan for retirement

- Lock in gains you’ve made in stocks and transfer that wealth into precious metals

Gold IRA Rules

Investing in gold is a great way to keep your portfolio diversified, but to take advantage of it and maximize your savings, you need to be aware of the self-directed and gold IRA rules.

First, it’s important to understand the rules that govern self-directed IRAs and acceptable investments as a whole. These include IRC subsections 408(m)(1) and 408(m)(2), which state:

- “The acquisition by an individual retirement account or by an individually-directed account under a plan described in section 401(a) of any collectible shall be treated (for purposes of this section and section 402) as a distribution from such account in an amount equal to the cost to such account of such collectible.

- Collectible defined:

For purposes of this subsection, the term “collectible” means-

-

- any work of art,

- any rug or antique,

- any metal or gem,

- any stamp or coin,

- any alcoholic beverage, or

- any other tangible personal property specified by the Secretary for purposes of this subsection.”

Specific rules for self-directed IRAs as they pertain to gold and other precious metals include subection 408(m)(3), which sets guidelines and exceptions for coins and bullion:

- The gold must have a fineness “equal to or exceeding the minimum fineness” of a contract market, which for gold is .995, or 99.5% purity

- Gold must be held by an IRA custodian. Goldco does not recommend home storage due to IRS regulations.

- IRA contribution limits apply

- If you already own gold, you cannot add that gold to your IRA, but you can open a gold IRA and purchase new gold to add

IRA Deductions and Contributions

Investing in an IRA to reduce taxes is not uncommon, but there are deduction limits set by the IRS to be aware of.

- Roth IRA contributions cannot be deducted

- Work retirement plan deductions may be limited if you or your spouse are covered by a retirement plan through your employer, and if your income exceeds certain levels

- No work retirement plan means you are allowed to take a deduction in full if you and your spouse (if married) aren’t covered by an employer-sponsored retirement plan

IRA Contribution and Deduction Limits for 2020

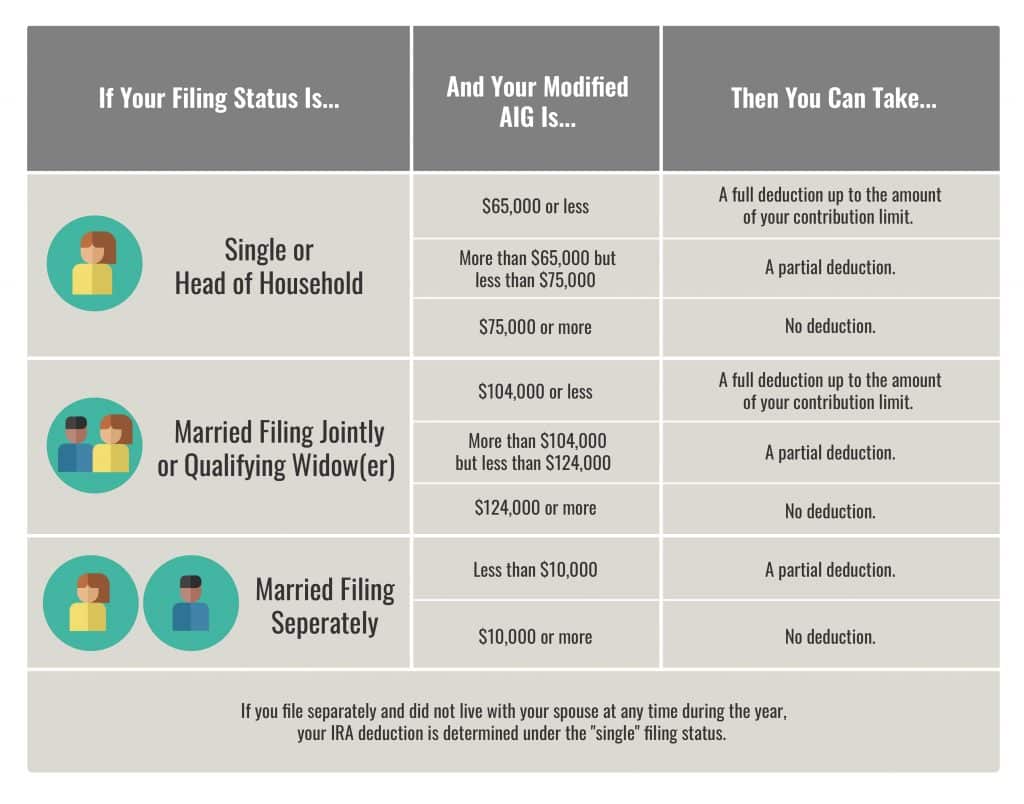

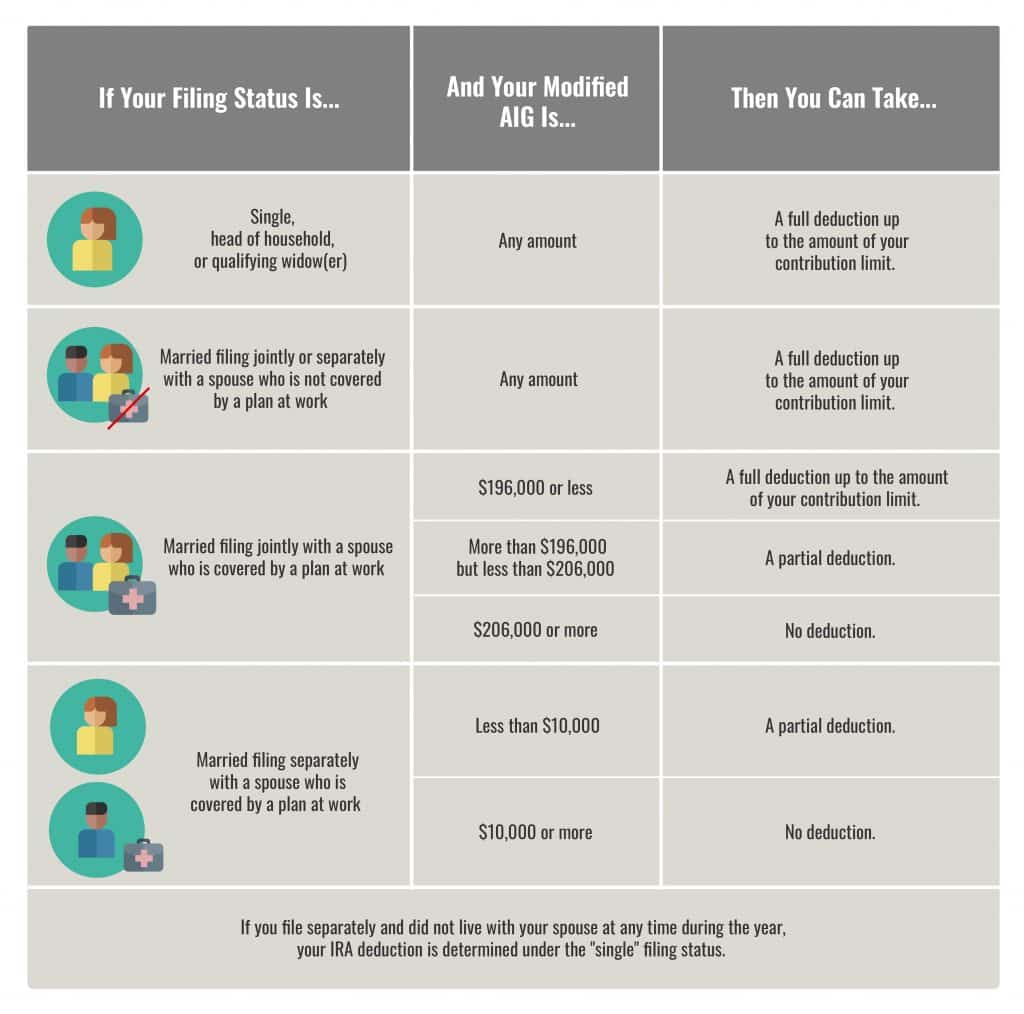

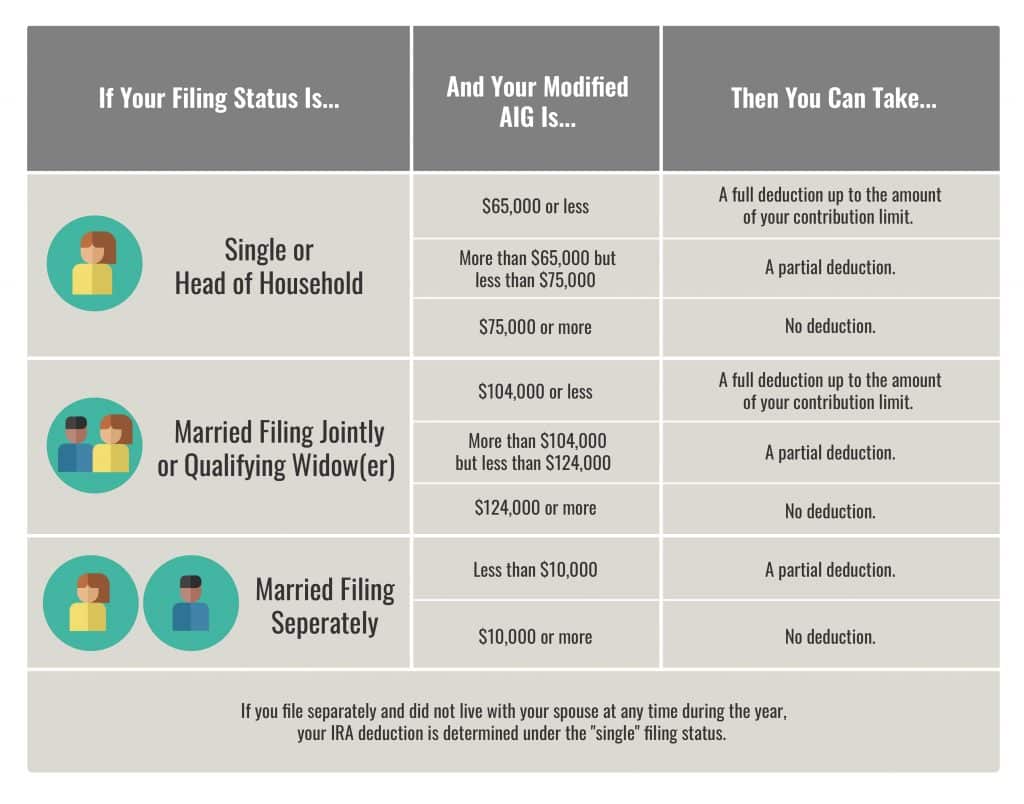

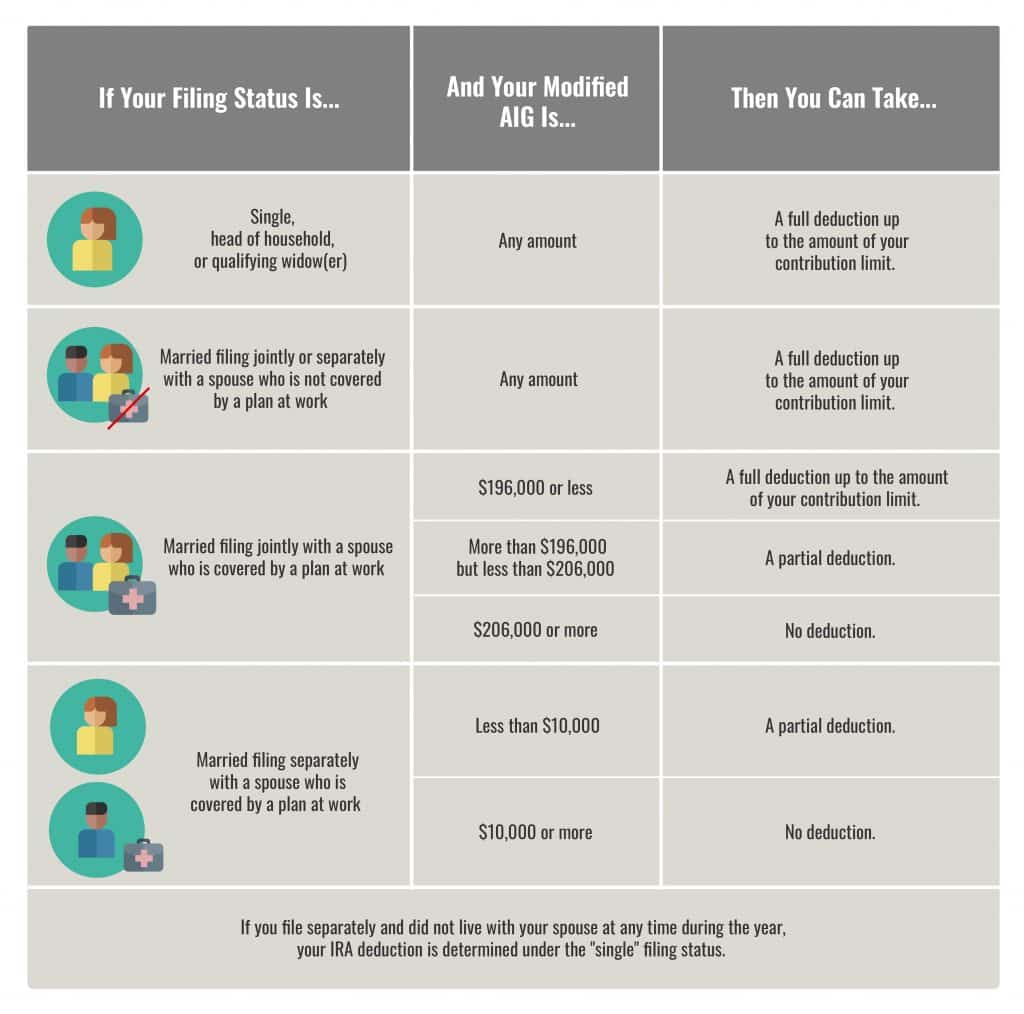

To better understand IRA investment rules and gold IRA rules related to contributions and deductions in 2020, refer to the following charts:

2020 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions If You ARE Covered by a Retirement Plan at Work

2020 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions if You are NOT Covered by a Retirement Plan at Work

Learn About Advantages of Investing in A Gold IRA

We believe that a gold IRA is a great way to diversify and protect your investment portfolio. With incredible potential for growth and the ability to safeguard your existing wealth, gold is an unmatched investment asset.

To learn more about protecting your life’s retirement savings or how to start your own gold IRA, contact us today.

Continue reading Chapter 3 to learn more about the advantages of diversifying your IRA with gold and precious metals.