6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

If you don’t know what a reverse repo is, you can be excused for not knowing that. Most people who follow markets don’t even know what they are or how they work, let alone follow trends in reverse repo markets. But they can be a useful indicator of how screwed up monetary policy is today.

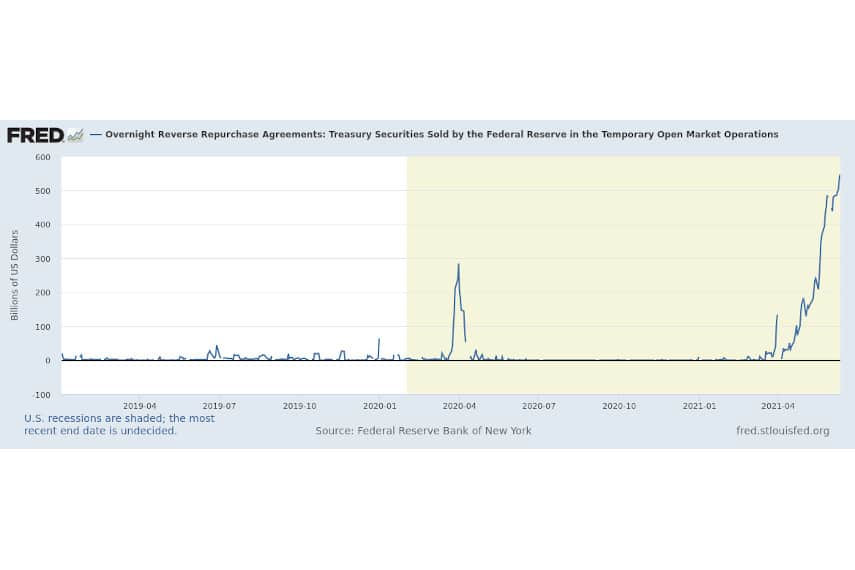

Last week the amount of money entering the Federal Reserve’s reverse repo lending facility set a new record, at over $547 billion on Friday. That’s an enormous amount of money just sitting on the sidelines. It could be innocuous, companies just not knowing what to do with all the money they have. Or it could be an indicator that something is wrong with markets, or that companies are afraid of what the future will hold.

No matter what the case may be, this record-breaking activity in reverse repo markets is significant, and investors should be paying attention to what is going on.

Repo is financial market shorthand for repurchase agreement. So a reverse repo is a reverse repurchase agreement.

A repurchase agreement is an agreement entered into by central banks and financial institutions in which the central bank loans money to the banks in exchange for collateral, normally government securities such as Treasury bonds. A reverse repurchase agreement then is an agreement in which the banks deposit funds at the central bank in exchange for collateral, again normally Treasury bonds.

In practice, the Federal Reserve’s policy is only to engage in repo operations with its primary dealers. It allows a wider range of banks and financial institutions to participate in reverse repo operations.

The effect of repo operations is to increase the amount of reserve balances in the banking system, and is thus considered expansionary. The effect of reverse repo operations is to decrease the amount of reserve balances in the banking system and is thus considered contractionary.

The Fed’s overnight reverse repo operations have been ongoing since 2013, and are an attempt by the Fed to help control short-term interest rates and keep them from falling into negative territory.

Normally the amount of money changing hands in these overnight reverse repos is relatively small. But occasionally we see huge spikes in the amount of money being deposited by banks, as was the case last week. This is the first major spike we’ve seen since last March when the COVID lockdowns were first implemented.

$500+ billion isn’t a drop in the bucket, even if there have been trillions of dollars of new money created over the past year. And it could be an indicator of potential trouble in financial markets. Here are three reasons why.

With so much money having flowed into markets in such a short amount of time, it’s not inconceivable that many banks may not be able to loan out all the money they’ve received. Remember, significant amounts of money were made to individuals in the form of direct stimulus payments, rather than flowing directly from the Fed to banks as is usual practice.

Since it takes time for money to make its way through the financial system, we may now be seeing the result of stimulus payments finally ending up in the banking system. With no more stimulus coming in the foreseeable future, households may finally be starting to pull back on spending, which also would mean taking out fewer loans. So banks may find themselves with hundreds of billions of dollars in money sitting in reserves that they are unable to loan out, hence their desire to hand them over to the Fed.

One of the ways the Fed increases the money supply is by purchasing assets, largely Treasury securities. Right now the Fed holds over $5 trillion worth of Treasury securities, or about 23% of the outstanding debt held by the public. That means that $5 trillion of Treasury debt is unavailable to financial markets.

For financial institutions that need or want Treasury securities for whatever reason, the Fed is therefore a prime source for Treasuries. So if financial institutions need Treasuries for short-term purposes, the Fed is one of the only games in town. But if so many companies are in need of Treasuries that they’re borrowing $500 billion a night, that could be an indicator of weakness in the financial system that should worry both investors and financial regulators.

The final possibility is that banks are fearful of the future and so they’re rushing to what they see as a relatively safe haven of Treasury securities. For whatever reason, they’d rather have Treasury securities rather than cash on their balance sheets when a crisis hits.

Right now, there’s a bit of trepidation in markets about holding short-term versus long-term Treasury securities, as the Fed has indicated that it might begin tapering its purchases of Treasury securities. And that could put financial institutions in a holding pattern until the Fed makes a final decision at its FOMC meeting this week.

If banks are rushing to protect their assets, it’s probably a good idea for individual investors to start thinking about doing the same. Anytime there’s unusual activity in the markets, or indications that something out of the ordinary is taking place, it’s worth taking a second look at your investments to make sure they’re secure.

Right now, many people are waiting for the next crisis to occur. They realize that high unemployment, massive government stimulus, and rising inflation are signs that all is not well with the economy. They realize that stock markets won’t be flying high forever, that debt markets could freeze up or collapse at any moment, and that safety and security might be best secured by alternative assets such as precious metals.

Gold and silver have helped protect the assets of numerous investors over the years, and they’ll continue to help protect investor assets well into the future. During the 1970s stagflation and the aftermath of the 2008 financial crisis, gold and silver gained value while other assets floundered. And with the economy on the verge of another crisis, gold and silver could really surge over the next few years.

If you’re nearing retirement and worried about protecting your retirement savings, it’s worth looking into gold and silver. With a gold IRA, you can invest in physical gold coins or bars while still enjoying the same tax advantages as your current retirement account. You can even roll over funds from your existing 401(k), IRA, TSP, or similar retirement accounts into a gold IRA without tax consequences, allowing you to lock in the gains you’ve already made and start benefiting from gold’s potential for future gains.

Don’t let yourself get blindsided by market shifts and potential crises like so many did in 2008. Start taking steps today to protect your hard-earned wealth. Call the experts at Goldco and learn more about how gold and silver can help safeguard your savings.