The seeming dichotomy between markets and the economy appears to be growing by the day. Retailers are seeing declining sales and rising inventories while households are increasingly financially strapped. But markets seem to be acting as though everything is a-okay.

Because of this slow market contraction, it’s almost as though everyone is waiting for the other shoe to drop. Things that you think might happen, such as a stock market correction or a major rise in precious metals prices, aren’t happening right now.

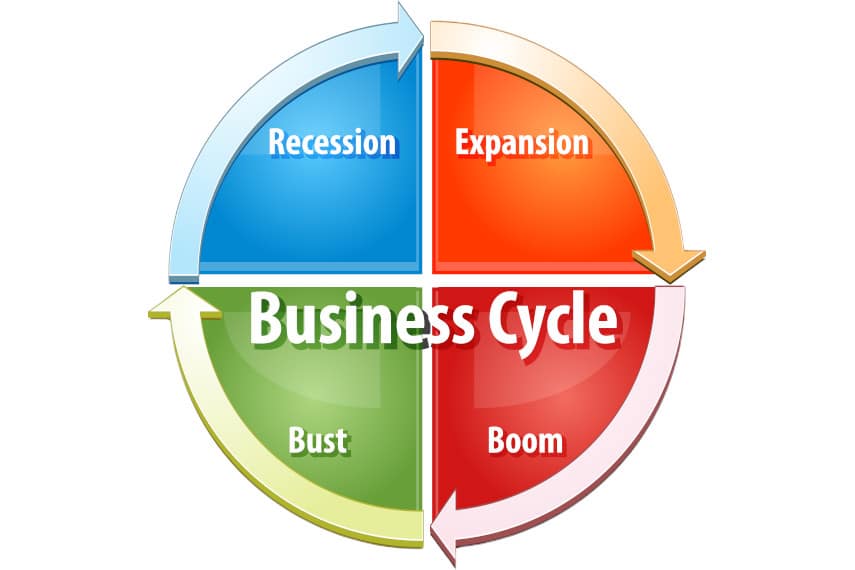

Many people realize that a recession is imminent, but the signs of how serious it might be seem to be slow to develop. But while that may make many investors impatient, especially those hoping to benefit from a future rise in precious metals prices, this slow motion development can still benefit other investors.

Will the Fed Pivot?

The big question that everyone wants to ask is if the Fed will pivot and when? Central banks are united in their desire to fight inflation, but they haven’t been united in their actions.

The decision by the Bank of England to support its bond market by engaging in bond purchases, for instance, was a defection from the disinflationary monetary regime pushed by the Federal Reserve and other world central banks. It was an instance of monetary easing undertaken at the same time the Bank of England was also trying to raise interest rates.

With even US Treasury markets seeing problems with liquidity, there is speculation that the Fed will have to pivot sooner or later, abandoning aggressive interest rate hikes in order to restart asset purchases or shore up bond markets. And that speculation has been helping to buoy markets in recent weeks.

If you think of the underlying economic fundamentals, with shipping slowing, earnings missing, and recession on the horizon, you would think Wall Street would be pessimistic about the future. But you would never see that from looking at markets, which seem to be brushing everything off in the hope of ever higher growth.

It seems that this is the last gasp of optimism from markets that think that a Fed pivot is inevitable. But even if a pivot does occur, will it be too little, too late? And could it end up exacerbating the underlying conditions that are leading to recession?

Money Creation Is No Panacea

The Fed, like most central banks, sees money creation as the answer to all economic problems. Stock markets crashing? Create money. Banks failing? Create money. Foreign currencies in crisis? Create money.

To Wall Street, this money creation has been a great boon over the past 14 years, allowing firms to make massive profits with relatively little risk. Now that it may be coming to an end, Wall Street is in a panic.

Wall Street traders think that money creation boosts markets. Over the long run, that’s true, as there’s a 97% correlation between the M2 money supply and the Dow Jones Industrial Average index. But that correlation can break down at times.

Just look at what happened during the aftermath of the 2008 financial crisis, when the Federal Reserve began its quantitative easing. It took a long time for markets to reflect the amount of money that had been pumped into the financial system.

Over the last 14 years it was easy to see that more money created and pumped into the financial system has resulted in elevated asset prices, high-flying stock markets, and growing real estate values. But those didn’t materialize overnight. So a Fed pivot and return to quantitative easing next year might not have the positive result Wall Street thinks it might.

Depending on how severe the next recession is, more QE could only be enough to take the edge off a really bad crisis. Or if inflation hasn’t come down to more reasonable and manageable levels, new QE could send inflation soaring once again, making a bad crisis even worse.

Protecting Yourself With Precious Metals

One of the most confusing aspects of recent market movements has been the fact that precious metals prices thus far don’t seem to have priced in the possibility either of recession or of a Fed pivot. Stock and bond markets seem to be pricing in that possibility, but precious metals markets have remained relatively flat and seem to be underperforming.

While this may make for some nervousness in the short term, it’s important to remember that investing in precious metals isn’t a short-term get rich quick scheme, it’s a long-term method of hedging against inflation and recession and trying to diversify a portfolio to help mitigate overexposure or loss. If you think of it that way, the current prices of gold and silver can be seen as “sale” prices for those looking to pad their portfolios with additional precious metals before the recession hits.

As equities traders who buy the dip are fond of saying, every downturn in the markets means that assets are on sale. And if gold and silver perform during the next recession as they did during the 2008 financial crisis, these sale prices could be the last time to buy gold and silver on the cheap for a good long while.

Of course, it’s important to remember that market prices are always higher than quoted spot prices due to premiums on the coins and bars that are popular for precious metals investors, including those looking to invest through a gold IRA. And with the recent surge in demand for precious metals, premiums have risen to higher levels than before and obtaining physical coins and bars has become incredibly difficult.

Thankfully Goldco has established relationships with mints around the world so that we can offer you authentic gold and silver coins directly from the producer. And by cutting out the middleman we can also get you your gold and silver quicker.

If you’re looking to take advantage of today’s gold and silver prices to add to your existing gold and silver holdings, or if you’re looking to take the first step in protecting your portfolio with precious metals, call Goldco today to learn more about your gold and silver investment options.