3 Easy Steps to Roll Over Your TSP Into an IRA

Over 70 million Americans today have 401(k) accounts, making them one of the most popular types of retirement accounts Federal employees don’t have 401(k) accounts, but instead have the Thrift...

Precious Metals

Due to recent volatility in stock and bond markets, many investors have turned their attention to precious metals as a hedge against that volatility. With memories of the 2008 financial crisis and its aftermath still fresh in many investors’ minds, their thoughts naturally turn to gold and silver, two assets that protected investors’ assets during the crisis. While stock markets lost over 50% of their value during the crisis, gold increased in value by over 25% and continued to gain value over the next few years.

Precious metals have always been sought after by investors, and particularly during financial downturns. Their ability to keep gaining value while financial markets come crashing down around them is unparalleled. And while there are numerous precious metals to invest in, gold and silver stand head and shoulders above the rest in their ability to offer investors solid returns during tough financial times.

As with any other asset, investing in gold or silver can lead to both gains and losses. But for investors who are looking for long-term wealth appreciation and asset protection, precious metals investing is tough to beat. So, what are the differences in gold vs. silver investment between investing in gold versus silver? Read on to find out.

When you begin to think about investing in gold and silver, price and affordability will probably be at the top of your list. And there are a few differences between gold and silver that you’ll need to keep in mind.

One of the first things that you’ll notice about silver and gold is the difference in their price. At around $25 per ounce for silver and around $1,900 per ounce for gold, there’s quite a disparity there. Throughout history, the price of gold has always been more expensive than silver as its supply is less than silver, and demand for gold is greater.

The price ratio between silver and gold can fluctuate quite a bit. Sometimes, the silver price is more affordable than gold, and at other times gold is more affordable than silver. Savvy investors will pay attention to those trends and invest in gold and silver when either is more affordable.

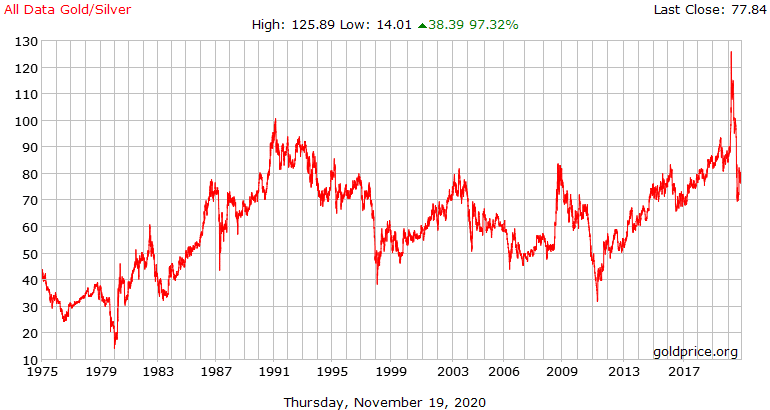

Changes in that ratio indicate which metal is valued more than the other, and can give investors an idea of whether to invest in gold or silver. Since gold and silver were first able to float freely in relation to each other in 1971, the price ratio between gold and silver has normally fluctuated between 40:1 and 60:1.

When the ratio falls below that range, it’s an indicator that gold is possibly undervalued or silver is overvalued. And when it rises above that range, it’s an indicator that silver is undervalued or gold is overvalued. Recently, the gold to silver ratio reached record highs of well over 100:1. It has since corrected, and investors who took advantage of the high ratio to invest in silver likely benefited greatly.

Silver is often referred to as “poor man’s gold,” as it allows those without a lot of money or who are just starting out their investing to invest in precious metals without the sometimes significant outlays required by investing in gold. A 20-coin roll of one-ounce silver coins will cost only a fraction of what a single one-ounce gold coin would.

Those who are dead set on investing in gold can purchase smaller gold coins such as 1/10-ounce or 1/20-ounce coins, but they’ll often have to pay higher premiums to buy those coins. There is a use for those coins, but for investors just looking to benefit from intrinsic metal value they’re not the optimal choice.

For those investors who have saved and accumulated a significant amount of assets, gold can be a much better option than silver. With its high value per ounce and its high density, gold allows investors to store a huge amount of wealth in a very small footprint. A roll of one-ounce gold coins is worth nearly $40,000 and can be held in the palm of your hand. A similar value of silver coins would require multiple large boxes.

If you’re looking for a compact store of wealth, you’ll probably favor gold. But if storage space isn’t a concern, there’s no reason not to favor silver.

While neither gold nor silver prices are as volatile as stock prices, there is a difference in volatility between the two. Gold and silver normally move in tandem, with silver rising or falling along with gold. That’s due to the fact that both metals are heavily demanded by investors looking for safe stores of wealth.

Silver’s greater use by industry, particularly today in manufacturing solar cells, leads to slightly greater price movements. And because of silver’s lower price, a 50-cent rise in silver’s price is a greater gain percentage-wise than a $20 rise in the gold price.

That greater volatility won’t normally make a difference to investors looking to hold silver in the long term. But it does mean that investors who know they’re going to take a distribution in the near future need to pay attention to price movements so that they can time their silver sales to take maximum advantage of silver’s price movements.

With any precious metals investment comes the need for storage. Whether you choose to buy physical coins and store them at your home, store them in a bank safe deposit box, or invest in gold and silver through a precious metals IRA and store your gold or silver with a custodian, you need to keep your precious metals safe from thieves. That’s an important aspect of precious metals investing that differs from investing in purely financial assets.

That storage, and any insurance you decide to purchase, adds an extra cost that can eat into your annual returns. Investors need to decide for themselves what level of storage and security they want to pay for.

You can take the risk of keeping gold and silver at home without a safe, but if you’re robbed, your entire investment is for naught. You can buy a safe and pay for insurance through your homeowner’s policy, but the upfront cost for a safe and the annual cost of insurance can add up to thousands of dollars over your period of ownership.

If you choose to rent a safe deposit box from a bank, you’re limited as to when you can access your precious metals. And if the bank goes out of business, you might have to wait quite a while to get your investment back.

Finally, you can invest through a precious metals IRA and store your gold and silver with a custodian who works with bullion depositories to keep your assets safe.. Costs for storage and insurance are then minimized by being spread over all the different owners who store their assets with that depository.

Remember too that gold is easier to store than silver since it is less bulky. That means that you’ll pay less in storage costs per square foot, although you’ll likely pay more insurance per square foot. However you decide to store your precious metals investments, you’ll want to make that decision before you invest to spare yourself any unwelcome surprises.

While gold and silver are both favorites of investors, their differing roles in the economy mean that demand for them varies, leading to differing moves in their price.

Gold’s primary demand is normally from the jewelry industry. Much of the jewelry demand comes from China and India, particularly the Indian wedding season. That jewelry isn’t owned so much as a form of ostentation but is rather held as a traditional form of gold as an investment.

Jewelry demand also forms a key part of the demand for silver, although it’s not quite as extensive or impactful as jewelry demand in the gold market.

Investor demand for gold has always been a major driver in the gold market. Due to current economic turbulence, gold investment demand has overtaken demand from the jewelry industry. Whether it’s demand for physical gold coins and bars, or demand from exchange-traded funds, gold demand from investors has spiked this year. Given the numerous economic and geopolitical factors governing safe haven investment demand, it’s safe to say that investor demand for gold and silver should increase in the coming years.

Investor demand for silver is expected to increase significantly also in 2020, and should rise even further in 2021. With the outlook for the economy looking rough, silver could be in the early stages of a bull market that will see investor demand skyrocket, more than making up for any loss in silver demand from a falloff in industrial demand.

The major difference between gold and silver is that roughly half of silver’s demand normally comes from industry, whereas industrial demand for gold is normally less than 10% of the gold market. For decades, silver’s primary use aside from coinage was in the production of photographic film. Once film usage went by the wayside, industrial demand for silver sank. But silver demand from industry could increase significantly in the future due to increased demand for solar panels. Since silver is the primary element in those panels, increased use of solar energy will require more panel production, and will therefore require greater use of silver.

Silver could also end up being used in industries in which it isn’t already, such as replacing platinum and palladium in catalytic converters, or being used in electric vehicle batteries. As the industrial uses of silver multiply, silver demand should increase.

Because industrial demand for gold plays such a small role in the gold market, don’t expect changes in demand from industry to play any major role in affecting the gold price. That holds just as true for normal times as for times of economic distress.

Gold and silver are abundant in the earth’s crust but, because of the vast amount of time and energy that it takes to identify gold and silver deposits and mine them profitably, most gold and silver won’t ever be mined. That means that the above-ground supply of both of those metals is relatively finite. With only small amounts of mined metal being added to above-ground stores each year, and increasing demand from investors and industry, prices of gold and silver are set to rise.

Gold mining is an expensive and resource-intensive task. Several tonnes of rock have to be crushed just to get one ounce of gold. Even with rising gold prices, it’s not possible for mines to increase their production rapidly, so mining output should remain relatively stable.

The other major contributor to gold supply is recycling, which should increase somewhat as the gold price increases. Think of people selling gold jewelry, melting coins, or recycling electronics with gold-plated semiconductor pins. But there’s a finite supply of gold that’s able to be recycled, and at some point supply constraints will creep in, limiting the amount of recycled gold that can be added to world supply.

Silver production from mines often results as secondary production at mines that primarily produce lead, tin, nickel, or other metals. As demand for those metals falls due to the economic slowdown, we can expect silver production to fall as well.

Silver recycling, like gold recycling, doesn’t make up a huge percentage of silver supply. And once again, supply will likely be finite. With so much silver being used in industrial products that aren’t easily recycled, and only so many people willing to melt down the family silverware, expect supply constraints to help drive up the silver price too.

Whether you invest in a gold IRA or a silver IRA, the options available to you are numerous. While there are restrictions on investing in certain coins or bars, experts like those at Goldco can help you navigate the investment process and inform you of your options when it comes to investing in physical gold or silver coins or bars.

The process of starting a gold or silver IRA isn’t difficult at all, and you can even roll over existing retirement savings into a new precious metals IRA. By investing in precious metals you gain the confidence of knowing that your wealth is protected in the form of physical assets that have stood the test of time and safeguarded investors for centuries.

If you’re mid-career and looking to hedge a portion of your investment portfolio, or nearing retirement and looking to get most of your retirement assets into safe havens, the experts at Goldco can give you all the advice you need to get started in precious metals investing. Their experience in helping investors just like you get started in investing in gold and silver will give you the edge you need to achieve your investment goals.