6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

In the early days of 2008 we were told that the weakness in the housing market was confined to housing and wouldn’t spill over into the broader economy. Of course, many of the people pushing that tale had been telling us for years that there wasn’t a housing bubble at all.

Looking back, we can see how wrong those prognostications were, and how obvious it was that not only was there a housing bubble, but also that its collapse would bring down the rest of the economy with it. Given what we know about housing then, why would we believe that problems in the housing market couldn’t have the same effect today?

We continue to be told that the housing market today is strong and robust, that low supply and continued demand will make up for rising interest rates, etc. But what if all of this is just a repeat of 2008?

One of the major differences between 2008 and today is that the Federal Reserve has taken a much larger role in the housing market. While the Fed’s monetary policy pre-2008 was definitely responsible for the development of the housing bubble, by keeping interest rates too low for too long, the Fed’s direct involvement in mortgage markets began in earnest with the Fed’s program of quantitative easing (QE) in response to the 2008 financial crisis.

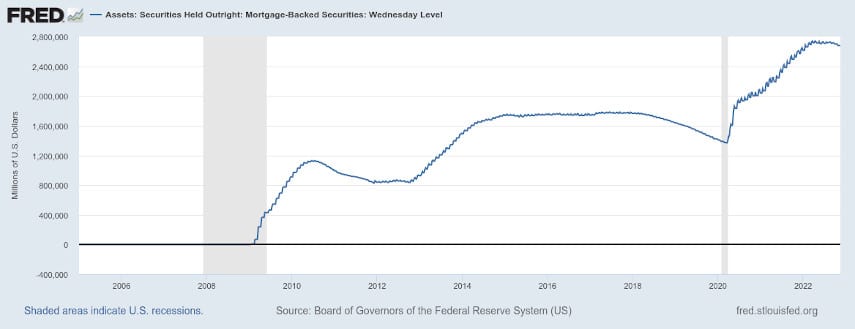

Along with buying US Treasury securities, the Fed also bought agency mortgage-backed securities (MBS) as part of its QE program. Since 2009 the Fed’s purchases increased so much that at one point it held nearly $3 trillion in mortgage-backed securities on its balance sheet.

To put this into perspective, the latest data available indicates that total outstanding MBS amounts to about $12.2 trillion. So the Fed as a single entity owned 20-25% of the total amount of mortgage-backed securities in existence. That makes the Fed the 800-pound gorilla in the mortgage market.

If you wonder how mortgage rates got as low as they did, down to under 3%, that’s why. With the Fed hoovering up trillions of dollars in mortgage-backed securities, it was the mortgage industry’s backstop. Why worry about underwriting standards when you had a large entity buying up as many mortgages as you could originate?

This wasn’t without its difficulties, however, and not just with respect to creating a housing bubble. For instance, how would the Fed think to unwind this position? Surely the brilliant economic minds at the Fed thought about this, right?

In May the Fed announced that it was going to start reducing the size of its balance sheet, and it announced how it was going to do so. Starting June 1, the Fed was going to start selling off both Treasury securities and agency MBS.

The runoff in Treasury securities was going to start at a maximum of $30 billion per month and increase after three months to $60 billion per month. The runoff in agency MBS was to start at $17.5 billion per month and increase after three months to $35 billion per month.

Taking that at face value, that means the Fed should be able to sell up to $270 billion in Treasury securities through the end of November, as well as $157.5 billion in agency MBS. And how much has the Fed actually sold so far?

As of June 2, the Fed had $5.77 trillion in Treasury securities on its balance sheet and $2.707 trillion in agency MBS. By November 17, the Fed had sold $235 billion worth of Treasury securities but just $30.6 billion in agency MBS. In other words, the Fed has reached 87% of its cap in Treasury securities, but only 19% of its cap in agency MBS. Why the disconnect?

Because the Fed was such a major player in the mortgage market, its monetary policy actions played a huge role in the fall in interest rates and the corresponding rise in housing prices. And now its actions in selling agency MBS will have a similar effect on the downside.

At the time the Fed made its announcement, monthly issuance of agency MBS was $179 billion in April, down from over $290 billion in August 2021. So the Fed was committing to adding a maximum of 10% to the monthly market supply of agency MBS.

Total agency MBS issuance in October of this year was $107 billion. With the current $35 billion cap, the Fed could add up to 33% to the monthly market supply of agency MBS.

What do you think this would do to the market demand for MBS if the Fed decided to max out its cap? Obviously it would put a severe dent in MBS demand, and would likely lead to higher interest rates. That’s why the Fed has been so restrained in its sales of MBS, because it realizes that if it really pushes its tightening, it could completely destroy the housing market.

The really sobering fact here, however, is that the Fed has hardly begun running off its MBS holdings, and yet mortgage rates have shot up to over 7%. How much higher would they have gotten had the Fed pushed its MBS sales to the max – 10%, 15%, 20%?

Looking at just the figures for outstanding agency MBS, which were $9.3 trillion in Q4 2021, we see that the Fed may very well still own close to 30% of the agency MBS market. There is just no way the Fed is going to be able to wind down its holdings without having a massive negative impact on the housing market.

If you thought things were bad for the housing market now, they will only get worse if the Fed gets serious about winding down its MBS holdings. And it could end up making 2008 look like nothing in comparison. Yet most people are completely oblivious to this danger. They think that because inflation rates have started to decline slightly, the Fed is now in control of things. But that’s not really the case.

We obviously are facing a situation that could end up being far worse than 2008. But because most people don’t understand how deeply the housing market relies upon the Fed, they don’t realize the precarious situation in which the housing market finds itself. So if the Fed continues tightening policy, and increasing the sales of its MBS holdings, these people won’t have any inkling of the reckoning that could be coming.

Many people were taken by surprise in 2008 too. They weren’t ready for the financial carnage that occurred, and their savings and investments reflected that. Many watched helplessly as the wealth they had accumulated for years or decades evaporated in front of their very eyes.

But many also watched as gold and silver took off in the aftermath of the crisis, the one shining spot of hope in the middle of years that seemed bleak. Many of those people vowed that the next time a crisis threatened, they would prepare themselves by buying gold and silver.

Demand for gold and silver today has skyrocketed now that recession appears to be on the horizon, and supplies of physical gold and silver are in short supply. If demand is this strong now, just imagine how strong it might get once the recession finally arrives.

If you’re looking to protect your hard-earned savings and investments against the next recession, now is the time to start thinking about it. With the potential for another housing market crash taking the economy into an even worse recession, you can’t be too careful with your money.

With over $1 billion in successful precious metals placements and over a decade of experience helping thousands of satisfied customers protect their wealth with precious metals, Goldco’s experienced representatives work hard to ensure that our customers are able to benefit from owning gold and silver. Call Goldco today to learn more about how gold and silver can help safeguard your savings.