6 Indicators of a Potential Recession

It seems that in the media today there are more and more mentions of the dreaded R-word: recession With growing economic uncertainty, the threat of potential recession seems to be growing as...

Economy

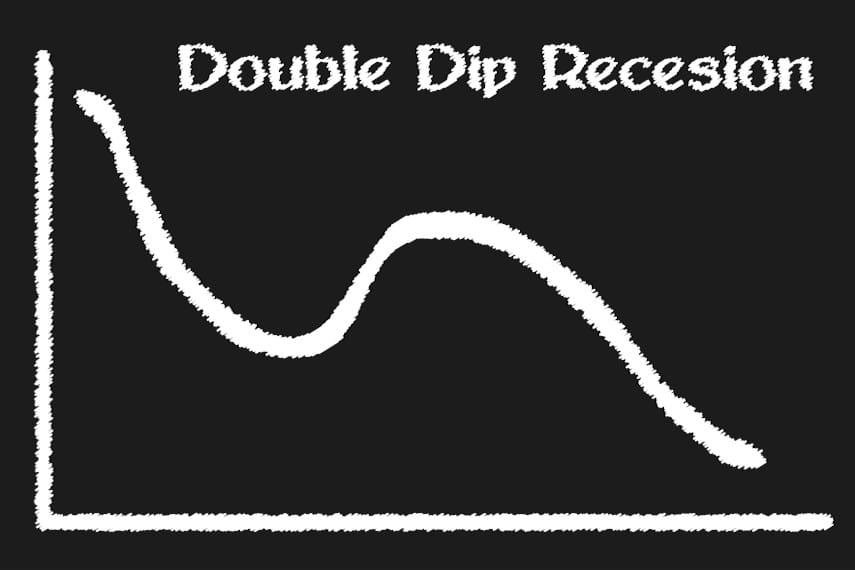

A recession is normally defined as two successive quarters of contracting economic growth. And normally once a recession is over, economic growth picks up for at least a few years. But today there are increasing fears that the US economy is facing a double dip recession.

A double dip recession is just what it sounds like; a recession followed by a short recovery and then relatively quickly by another recession. The US has faced that before, most notably the “depression within a depression” from 1937 to 1939. But that’s so far in the past that almost no one alive today even remembers what it was like. And perhaps more importantly for investors, no one knows how investors maintained their wealth through that period.

One of the reasons double dip recessions can be so calamitous is because, like the Spanish Inquisition, no one expects them. We saw a 35% drop in stock markets last year as a result of the lockdowns, and two consecutive quarters of falling growth. The overall drop in GDP was on par with the Great Depression, if not worse, while tens of millions of Americans were out of work.

But once restrictions were lifted the economy bounced back relatively quickly. And while we’re still facing significant hurdles due to last year’s disruptions, economic activity has largely returned to normal.

What we’re possibly on the brink of, however, is a double dip recession. The lockdown-driven recession was a only a delay in the inevitable, a speed bump on the way to a really massive financial meltdown. You could liken it to a minor venting of steam from a boiler to reduce pressure, but that pressure is building up once again and could be about to blow.

The chances of a double dip recession are growing every day, and there are four major reasons why.

Consumer spending makes up 70% of the economy, and it’s well known and understood that consumer spending drives economic growth. By that measure, the recession last year wasn’t much of a recession, as consumers continued to spend. But the reason they spent was because the federal government was shoveling out free money as fast as it could print it.

The result today is that many consumers are spent. They’ve spent the last year working from home, doing projects around the house, and buying things online with their stimulus money. Now that stimulus funds have dried up, and supply chain issues have led to shortages of and waiting lists for cars, electronics, and consumer appliances, US consumers are all tapped out.

They just can’t keep spending because they aren’t able to. And if they can’t continue spending, then US economic growth could slow down as a result.

The US government was incredibly generous with its fiscal stimulus both to households and to businesses. But that help is gradually coming to an end. Once the money dries up, we’re back to depending on economic fundamentals for growth, and that doesn’t look good.

As with previous recessions, the government tried to paper things over with money. And like previous recessions, the worst was staved off for a while. But now that the free money is gone and households have to fend for themselves, many are realizing that it’s going to be difficult.

You can’t keep an economy going by pumping in stimulus funds for years. And you can’t forestall a recession by continually creating stimulus. At some point you have to come back to economic reality. And the economic reality is that the US economy still faces significant difficulties in getting back on a growth trajectory.

Millions of Americans remain out of work and dependent on unemployment benefits for their survival. And despite the attempts of businesses to raise pay, and governments to end excessive unemployment benefits that might have discouraged people from seeking work, many of those Americans still have not returned to the workforce.

As long as that’s the case, businesses are going to have a hard time moving forward with growth. And with millions of households making less money than they did before the lockdowns, the ability of households to weather another recession, much less a severe economic crisis, is significantly diminished.

Of course the elephant in the room is the Federal Reserve. The root cause of the coming recession is the Fed’s mismanagement of monetary policy, keeping interest rates at near zero levels for over a decade while pumping trillions of dollars into the financial system.

It shouldn’t be shocking to anyone that the result of this massive amount of money creation is a massive bubble throughout the economy. Asset prices in all sectors have blown to insane heights, from stock markets to houses to used cars. And prices continue to rise, as we haven’t seen the last of the inflationary effect of these trillions of dollars.

What makes it worse is that the Fed fails, nay refuses, to see its role in creating this mess. And because it can’t get the cause right, it by extension will fail to find the correct solution. So rather than correcting its mistakes and softening the blow of a recession, it’s all but inevitable that the Fed will undertake actions that not only might hasten the occurrence of a double dip recession, but also might make the effects of that recession even worse.

If you’re worried about recession, you’re probably wondering how you can protect your savings. Millions of Americans are in that same boat. And many of them are trusting their savings to gold.

Gold’s track record through major recessions is solid, with over 30% average annualized growth through the stagflation of the 1970s. And in the aftermath of the 2008 financial crisis gold nearly tripled in price.

With the outlook for the next few years looking gloomy, there’s every reason to believe that gold could continue to gain in price as the economy tiptoes toward recession. So if you’re looking to protect your assets before the recession, now is the time to start thinking and planning.

You can invest in gold with relatively little effort, by buying gold coins that you can store at home. Or if you have savings in tax-advantaged retirement accounts such as a 401(k), IRA, TSP or similar accounts, you can roll over or transfer those assets into a gold IRA. A gold IRA allows you to invest in gold coins or bars while retaining the same tax advantages as your existing retirement accounts.

Regardless of which method you choose to invest in gold, it’s important to work with partners you can trust. At Goldco, we have over a decade of experience helping thousands of satisfied customers protect their portfolios with gold. And with established relationships with mints around the world, we have a selection of authentic gold coins that offer something for everyone.

Don’t leave your savings at risk if the economy turns toward recession. Call the precious metals experts at Goldco today to learn more about how you can protect your hard-earned wealth with gold.