3 Words You’ll Never Hear Anyone in Washington Say

There are three words you’ll never hear come out of the mouth of anyone in a position of power in Washington, DC In fact, these three words are so difficult to say that it’s likely there are more...

Federal Reserve

In his much awaited speech at the Kansas City Fed’s annual Jackson Hole conference last week, Federal Reserve Chairman Jerome Powell announced a move away from the Federal Reserve’s traditional inflation targeting. Instead of targeting a certain inflation rate, such as 2%, the Fed is moving to “average inflation targeting.” While that may not sound like much of a change, it’s a big deal for investors like you.

Inflation is an increase in the money supply. The effect of inflation, all other things being equal, is a rise in prices. But as with many aspects of economics that the mainstream gets wrong today, inflation has become a similarly confused topic.

Today mainstream economists define inflation as an increase in the general price level. In essence, they’ve gotten things backwards, defining the effect as the cause, and forgetting about the cause. Increases in the money supply are almost taken for granted. That has had a dangerous impact on the US economy.

Because of that confusion about what inflation actually is, the Fed looks at price inflation to get its cues on inflation, ignoring the increase in the money supply. That results in two major errors that the Fed makes.

The first error the Fed makes is believing that inflation is a natural phenomenon endemic to economic activity. That’s a self-serving attitude, since it’s the Fed’s monetary creation that is actually inflation and that causes prices to rise. But by pretending that inflation is a market phenomenon rather than a monetary phenomenon, the Fed can deflect blame from its own policies.

Whenever inflation gets too high, the Fed throws up its hands and pretends it had nothing to do with it. And if the Fed tries to boost inflation but fails, it similarly pretends that its monetary policy can’t be held responsible for inflation or price increases.

Because the Fed deflects blame from itself, it will never actually get to root of the problem. And thus inflation will be with us as long as we have a central bank manipulating the money supply. As long as the general public and Congress fail to realize what is happening and bring the Fed to heel, the problem of inflation will never go away.

The Fed’s inflation ignorance isn’t new. It has made this same mistake before, during the “Roaring ‘20s” and the development of the stock market bubble that crashed at the onset of the Great Depression.

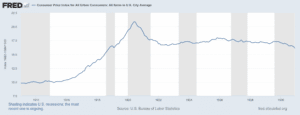

If you look at CPI figures for the 1920s, you’ll see them start high at the beginning of the decade as the result of all the money created to fight World War II. But things calm down after that, and inflation, or rather price inflation, seems muted throughout the rest of the decade. From a level of 16.9 in January 1922, CPI only rose to 17.1 by January 1930. On the surface, everything looked calm and collected, with a stable price level. So what caused the stock market bubble and subsequent crash?

If you’ve had any economics training, you’re probably familiar with the equation of exchange, MV=PQ, where M is the money supply, V is the velocity of money, P is the price level, and Q is production or economic output.

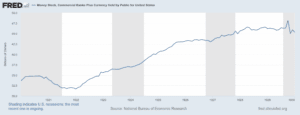

We know that the price level P was relatively constant during the 1920s. But economic production was booming, with an average 4.2% annual growth rate, or over 40% growth for the decade. So if P is constant and Q is increasing, then we would expect either M or V to rise also. Since the velocity of money is relatively constant, then it must be that M was also increasing. And in fact that’s what we see, with the US money stock increasing 43% from January 1920 until its peak in October 1929.

Because the Fed was looking at “inflation” data that was showing a constant price level, it assumed everything was okay. But underneath the surface a lot was going on, with the massive increase in the money supply causing an unsustainable bubble that eventually burst and led to the Great Depression.

This focus on “inflation” was the result of a fear of deflation. When the money supply is actively decreased, the effect, all other things being equal, is a fall in prices. This type of deflation was thought to be synonymous with economic recessions. But rather than just trying not to shrink the money supply, the Fed focused instead on looking at the price level as a proxy. Thus, decreasing prices were seen as “deflation” and recessionary or, in other words, the effect was being confused with the cause.

Going back to MV=PQ, if money supply stays constant and economic output Q is increasing, and because V is generally constant, we expect the price level P to fall. That makes perfect sense, that as more goods are produced their price decreases. So when prices fall, there are two possible causes: either the money supply is contracting (weak economy) or economic output is increasing (strong economy).

Because of that fear of falling prices being a symptom of a weak economy, the Fed has traditionally reacted to falling prices by creating more money. That’s what happened in the 1920s, as increased production should have led to falling prices. But the Fed got causation backwards, increased the money supply, and that increased money in the financial system caused the bubble that burst and resulted in the Great Recession.

Unfortunately, the Fed didn’t learn from its mistake of the 1920s, and it continues making the same mistakes today, flooding the financial system with liquidity every time there’s a crisis. Powell’s recent speech about inflation just underscores that.

The 2008 financial crisis was caused by the Fed’s loose monetary policy, keeping interest rates too low for too long. By creating new money and credit, asset prices rose, especially in the housing market. That’s another economic fallacy that the Fed and mainstream economists believe in, that higher prices mean growing wealth.

When the crash came in 2008, rather than allowing prices to fall as debts were liquidated and unproductive assets were repurposed, the Fed injected trillions of dollars into the financial system to keep prices artificially elevated. While that worked to a certain extent, the Fed was puzzled that despite all that new money in the system, prices as measured by CPI were still under the Fed’s 2% annual target.

That’s because the Fed’s money pumping was pulling one way, while prices wanted to go the other way. So we have a situation somewhat similar to the 1920s, in that the Fed is trying to paper over the “problem” of falling prices with new money, and is wondering why price levels aren’t increasing at the level they want them to.

What the Fed has done, therefore, is adopt average inflation targeting, with 2% average inflation as a target. What time frame the Fed is looking at is unclear, but that means that if CPI has been rising at under 2% for some time, the Fed is going to try to boost inflation so that it averages over 2% over some period of time known to Fed policymakers.

Since CPI has been under a 2% average for over a decade, get ready for a big monetary push to get inflation up to 3-5% or more for some length of time. And since we know that CPI actually underreports actual price increases that most Americans experience, this push for increased CPI will actually mean much higher prices for goods and services in the economy.

What this means for investors is the death of traditional growth assets such as stocks and bonds. The push for higher inflation will mean a devaluation of the dollar as more and more dollars are created. Dollar-denominated assets such as stocks and bonds will continue to fall in value as the dollar is devalued, and their annual returns in real terms will fall as well.

This continued destruction of the dollar means that the entire monetary system is no longer about providing currency to those who need it to make economic transactions, it’s about serving the interests of the Fed in manipulating the performance of the US economy. The dangers of creating trillions of dollars out of thin air have been forgotten in the push to boost inflation, and in pursuit of its goal the Fed may very well cross the line and push things toward hyperinflation.

For investors, this means that gold is the only game in town anymore. It’s the only asset that can be relied upon to remain resistant to inflation. And as the monetary system continues to break down, any eventual reset of the system will require gold to get restarted.

This coming collapse of the monetary system is why so many investors are moving their assets into gold today, which is why gold recently climbed to record high prices. Those who think this is as far as gold will get will likely be sadly mistaken, as gold should continue to rise in price as the economy falters and the monetary system breaks down.

If you’re worried about the future of your investments, and the purchasing power of your dollars, you owe it to yourself to look into investing in gold today. With an uncertain future and a monetary system that the Fed seems intent on destroying, those who invest in gold stand the best chance of withstanding an eventual collapse of the monetary system. Contact the experts at Goldco today to find out how you can protect your investments with gold.