How to Move Your 401(k) to Gold Without Penalty

Retirement planning isn’t something that you start doing when you’re a few years away from retirement. It’s something you start as early in your career as you can. There’s no substitute for time in the market when it comes to building up your retirement savings.

As you get older, you may start looking into more ways to protect the money you’ve already put aside for retirement. If you have a 401(k) from a previous employer that is sitting idle, or if your current retirement plan options don’t leave you enthused, a 401(k) to IRA rollover could offer you more options to put your money to better use.

One popular option is to roll over 401(k) assets into a gold IRA. The rollover process can allow you to move your 401(k) into gold tax-free and penalty-free.

A gold IRA is a type of self-directed retirement account that gives you greater control over your assets. Moving your savings into this kind of account can open up more options, such as real estate, private bonds, private equity, and precious metals like gold and silver.

Purchasing precious metals is a popular option because gold and silver have been used as a time-tested means of storing wealth that can weather numerous economic changes, giving your portfolio diversity and stability. The price of precious metals often increases even in tough economic times, meaning that your portfolio can still get a boost even during the worst throes of a financial crisis.

Like all 401(k) and other retirement plans, a gold IRA has rules and regulations that you need to be aware of. The last thing you want to do is decide to roll over your account and be hit with taxes and penalties because you didn’t do things correctly.

So, how do you move your 401(k) to gold without penalty? This guide will help you understand what a 401(k) is, how it works, its benefits, and how to effectively roll over your 401(k) to gold without incurring taxes and penalties

What Is a 401(k) Plan?

Section 401(k) of the Internal Revenue Code allows individuals to make contributions to a retirement account in a tax-deferred manner. This means that they will not be taxed on that contribution until they take a distribution (at age 59½ or later). The following guidelines are set forth by the IRS:

- Elective salary deferrals are excluded from the employee’s taxable income (except for designated Roth deferrals).

- Employers can contribute to employees’ accounts through matching.

- Distributions, including earnings, are includible in taxable income at retirement (except for qualified distributions of designated Roth accounts).

Employer matching is a valuable way for individuals to save additional money for retirement if an employer offers that plan, and some even refer to it as “free money.”

If you’ve worked for multiple employers, you may have multiple accounts that aren’t being actively managed. Very often these orphaned accounts are automatically held in “safe” assets that don’t make much money. It’s also important to remember that management fees and fund fees can still be taken out of your 401(k) even when you aren’t actively contributing.

One way to avoid these situations is through a 401(k) rollover, in which you move assets from your 401(k) to an IRA. That has the added benefit of potentially broadening your financial choices.

401(k)s are subject to required minimum distributions (RMDs), which require individuals aged 73 and older to take a specific amount in distributions each year. Without dedicated planning, RMDs could cause you to pull more money from your retirement accounts than you want, which could subject you to more taxes than you would like.

What Are the Benefits?

There are many more benefits to a 401(k) plan that include:

- Allowing employees to save money easier by automatically withdrawing from their paychecks into their retirement accounts.

- Employer matching contributions to help employees build their nest egg for retirement.

- Tax-deferred contributions, meaning that the money you contribute will not be taxed. If you are making $45,000 a year and you contribute $5,000 to your 401(k), you will be taxed on $40,000 of income rather than the full $45,000, meaning you pay lower taxes on your income. These contribution limits can change annually. Check with your accountant or with the IRS for the latest contribution limits. You will, however, need to pay income taxes on your distributions in the future.

- Potential for borrowing from your 401(k) to pay for: unforeseen medical emergencies, burial or funeral expenses for the family, education, purchase of a principal residence, to prevent eviction, and to repair damage to your principal residence after certain casualty losses. While this is an option, it may hamper your future retirement savings.

To add to these benefits, you can consider a gold IRA rollover. Knowing how to roll over your 401(k) means keeping all the great benefits of a tax-advantaged retirement account, plus the peace of mind of knowing that your assets can be secured with precious metals.

Who Can Open in an IRA?

Anyone with earned income, and their spouses if married filing jointly, can start and contribute money to this retirement account. You can contribute even if you have a 401(k) or similar retirement plan at work. The only limit is to how much money you are able to contribute to your accounts.

Types of IRA Accounts

If you are eligible, there are numerous types of IRAs available. These include:

- Traditional: Open with pre-tax dollars, gains accrue tax-free, withdrawals are taxed as regular income. If your income is below certain thresholds, your contributions may be tax-deductible.

- Roth: Contributions aren’t tax deductible and are made with post-tax dollars. Earnings and withdrawals are not taxed.

- SEP: Simplified Employee Pension, which is similar to a Traditional IRA, but is funded by an employer or self-employed individual.

- SIMPLE: Savings Incentive Match Plan for Employees, which is similar to a 401(k) plan, but has lower contribution limits and lower administrative costs.

- Self-Directed: Follows the same eligibility and contribution rules as a Traditional or Roth IRA, but with the ability to purchase alternative assets like real estate and precious metals.

Because these accounts provide tax benefits for retirement savings, there are an abundance of rules that must be followed. These rules include requirements for contributions, withdrawals, and the types of assets that can be included in your portfolio.

We’ll start off with some general rules and then focus more specifically on self-directed and gold IRA rules that you need to know.

General Contribution Rules

The IRS sets contribution limits which must be followed in order to avoid penalties. The following guidelines will help you understand contribution limits for IRAs:

- Limited to $7,000 in contributions per year ($8,000 if you’re over age 50).

- Contributions are across all IRAs, so if you have multiple accounts, you are limited to that $7,000 total across all your accounts.

- Contributions are per person, not per account–potential to contribute to multiple accounts in the same year.

- Rollovers or transfers from 401(k), TSP, IRA or similar accounts into an IRA or other eligible retirement plan are not subject to annual contribution limits.

Penalties

The IRS sets forth penalties for not following regulations dealing with retirement accounts. Here are a few rules to be mindful of so you know how to move a 401(k) to a gold IRA without any penalties:

- If you exceed the annual contribution limits, you may incur a penalty of 6% per year. Example: if you exceed the contribution limit by $500, you would be penalized $30 every year until the mistake is corrected

- If you have an IRA, you are not allowed to hold collectibles, which includes artwork, rugs, antiques, stamps, and other items as defined by subsection 408(m)(2) of the Internal Revenue Code. Tax penalties may result. This does not include qualified precious metals that are exempt under subsection 408(m)(3).

- Withdrawing any distributions before reaching the age of 59½ incurs a 10% penalty plus any taxes due. Exceptions include death or disability of the account owner, withdrawals to pay certain medical bills, first time home purchases, and higher education expenses.

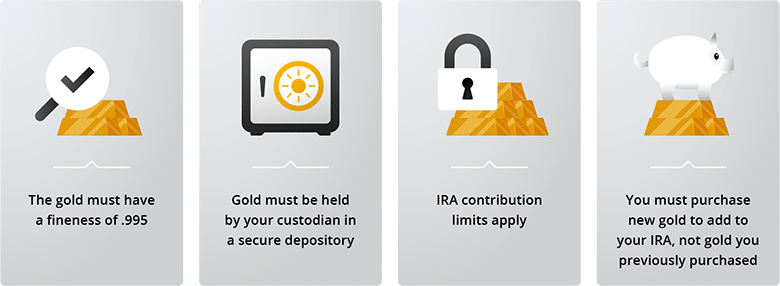

Gold IRA Rules

Purchasing gold can be a great way to keep your portfolio diversified, but to take advantage of it and maximize your savings, you should be aware of the self-directed and gold IRA rules.

First, it’s important to understand the rules that govern self-directed IRAs and acceptable assets as a whole. These include subsection 408(m) of the US tax code, which prohibits accounts from acquiring collectibles and defines collectibles as:

- “any work of art,

- any rug or antique,

- any metal or gem,

- any stamp or coin,

- any alcoholic beverage, or

- any other tangible personal property specified by the Secretary for purposes of this subsection.”

There are, however, exceptions made for some coins and bullion in subsection 408(m)(3), namely:

- Gold American Eagle coins minted by the US Mint are not considered collectibles.

- Other gold coins or bars must have a fineness “equal to or exceeding the minimum fineness” of a contract market, which for gold is .995, or 99.5% purity.

- Gold must be held by an custodian. Home storage of IRA assets is illegal and can result in massive fines and penalties.

In addition, if you already own gold, you cannot add that gold to your IRA. But you can open a gold IRA and purchase new gold to add to your account.

Learn More About Diversifying Your Savings With The Ultimate Gold & Silver Guide

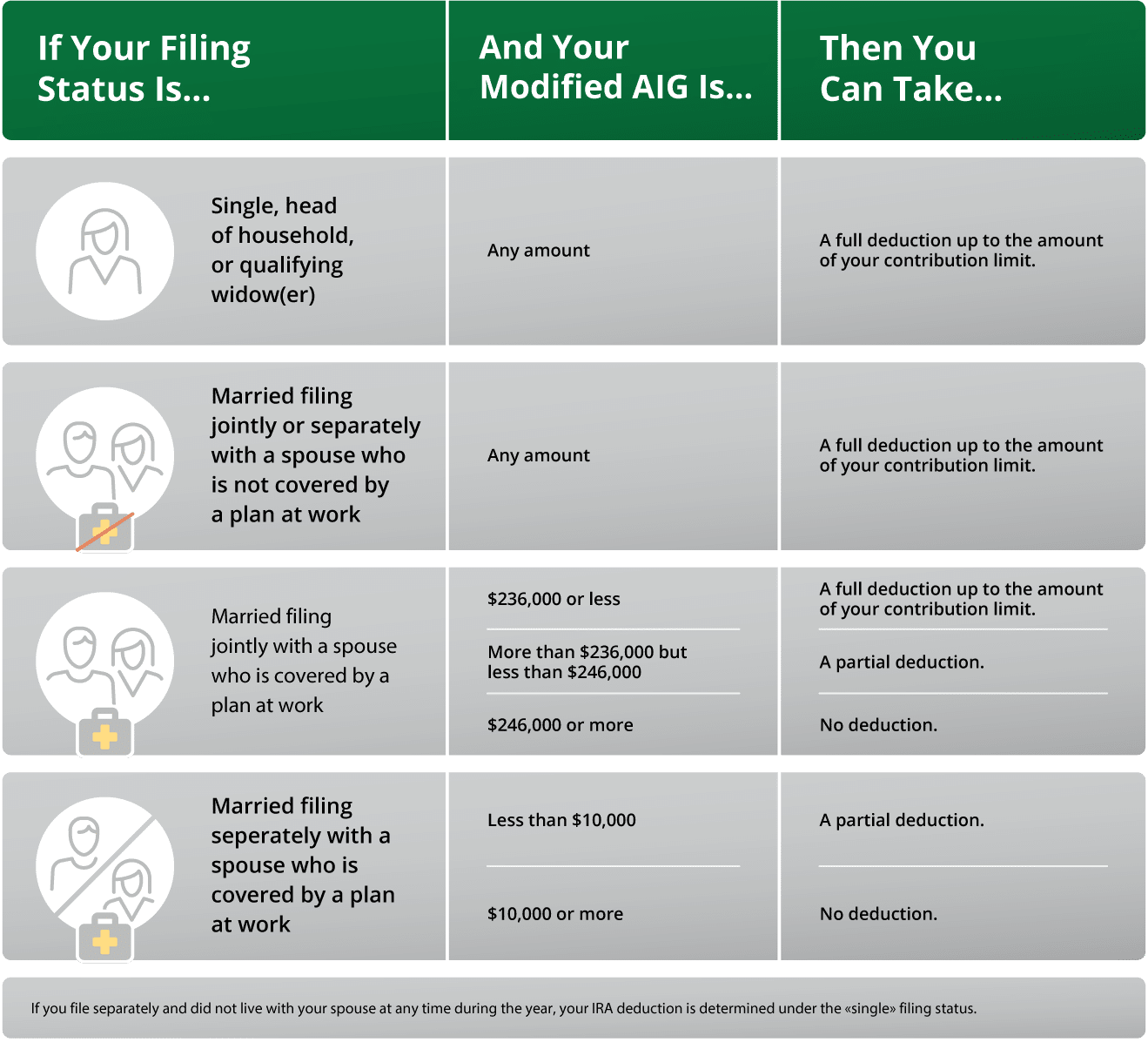

Tax-Deductible Contributions

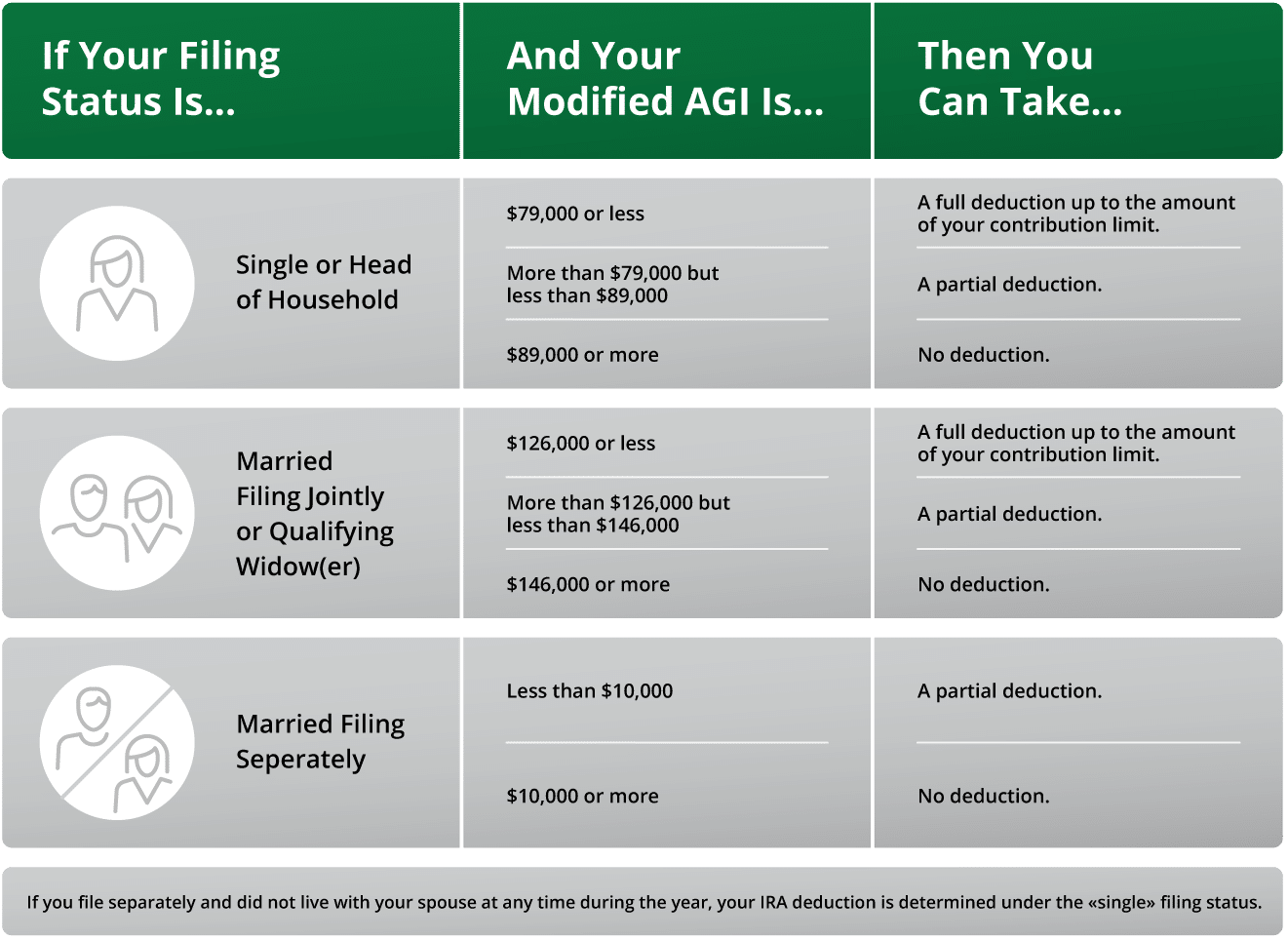

Opening an IRA to reduce taxes is not uncommon, but there are deduction limits set by the IRS to be aware of. Some general rules include:

- Roth account contributions cannot be deducted.

- Work retirement plan deductions may be limited if you or your spouse are covered by a retirement plan through your employer, and if your income exceeds certain levels.

- No work retirement plan means you are allowed to take a deduction in full if you and your spouse (if married) aren’t covered by an employer-sponsored retirement plan.

Contribution and Deduction Limits for 2025

To better understand rules related to contributions and deductions in 2025, refer to the following charts:

2025 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions If You ARE Covered by a Retirement Plan at Work

2025 IRA Contribution and Deduction Limits Effect of Modified AGI on Deductible Contributions if You are NOT Covered by a Retirement Plan at Work

Rollover Rules

Rollovers allow you to move existing retirement assets from a 401(k), 403(b), TSP, or similar retirement account into an IRA. Since rollover contributions are not subject to the annual contribution limits, they can be a useful tool in building up your retirement savings.

In general there are three types of rollovers:

- Direct Rollover – a direct rollover occurs when a distribution from a 401(k) or similar retirement plan is made directly to another retirement plan or to an IRA account. No taxes are withheld from this rollover.

- Trustee-to-Trustee Transfer – this transfer occurs when a distribution from an IRA occurs and the distribution amount is sent directly from the first IRA custodian to another custodian or to a retirement plan. No taxes are withheld from this transfer.

- 60-Day Rollover – this rollover occurs when a distribution from an IRA or retirement plan is made to you. You then have 60 days to roll over all or a portion of that distribution into an IRA or retirement plan. Because taxes will be withheld from this distribution, you will have to use other funds if you wish to roll over the full amount of the distribution.

Because of the potential tax consequences of a 60-day rollover, people who want to move a 401(k) to a gold IRA without penalty generally choose the direct rollover or trustee-to-trustee transfer. These ensure that their retirement savings are rolled over without taxes or penalties. `

Additionally, there is a one-per-year rollover rule. This means that you can only make one rollover from the same IRA per year.

You also can’t within that 1-year period make a rollover from the IRA to which you distributed that rollover. You can read more about it at the IRS website.

This one-per-year rule does not apply to:

- rollovers from traditional IRAs to Roth IRAs (Roth conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers (e.g., IRA to 401(k))

- plan-to-IRA rollovers (e.g., 401(k) to IRA)

- plan-to-plan rollovers (e.g., 401(k) to 401(k))

There are additional restrictions on rollovers, such as the fact that RMDs cannot be rolled over. When you decide on doing a rollover, the IRS website has lots of useful information on the topic, including a rollover chart that shows which accounts can be rolled over into which.

You may also want to consult a tax professional to ensure that you aren’t making mistakes that could subject yourself to unnecessary taxes.

Which Gold Coins and Gold Bars Are Eligible?

By choosing eligible gold coins and other precious metals products, you can take advantage of the incredible opportunity that precious metals offer. It is helpful to know the rules prior to purchasing your gold so that you can ensure that your purchases remain tax-free and penalty-free.

Buying Eligible Gold

When learning how to buy gold for a gold IRA, it’s important to understand the rules. As discussed above, IRAs are forbidden from acquiring collectibles. But because of the exceptions in the Internal Revenue Code, there are numerous gold coins which are still eligible.

Some of the rules that have to be followed when buying gold coins or gold bars include:

- Level of fineness for eligible coins and bars – .995

- Many older gold coins are not eligible, but among more recently produced coins there are exceptions laid out in the Code. Here are some of the more popular eligible gold coins:

- Gold American Eagle

- Gold American Buffalo

- Canadian Gold Maple Leaf

- Gold Lucky Dragon

- Gold Australian Saltwater Crocodiles

- UK Royal Mint Gold Lunar Series Coins

- Gold Wright Flyer

- Gold Washington Monument

- Gold Independence Hall

- Gold Phoenix

- Gold Liberty

- Gold Valor

- Gold IRA assets must be administered by your custodian and stored at a bullion depository.

- If you already own gold, you cannot add that gold to your IRA, but you can open a gold IRA and purchase new, eligible gold.

Additional Eligible Precious Metals

You can also purchase other types of precious metals coins and bullion that meet IRS specifications. Those include silver, platinum, and palladium that meet the following minimum fineness:

- Silver – .999

- Platinum – .9995

- Palladium– .9995

Ready to Start?

The rules governing how to move a 401(k) to a gold IRA without penalty may seem difficult at first, but the more you learn about them, the more they begin to make sense. Goldco has had thousands of customers navigate the process, with over $3 billion in precious metals placements. If they can do it, so can you.

But it’s crucial to understand the rules and regulations before you start. Not paying attention to these rules and regulations or, even worse, deliberately flouting them, could cost you dearly.

Once you’ve familiarized yourself with the rules and think you’re comfortable with moving your 401(k) to a gold IRA without penalty, you’ll want to learn the steps to start. Follow the next chapter in this guide to learn more about the five easy steps to getting started.