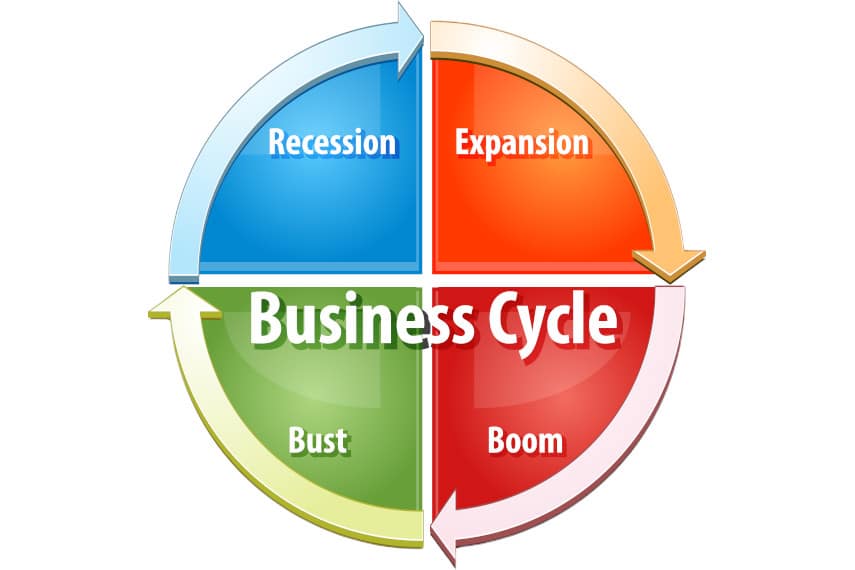

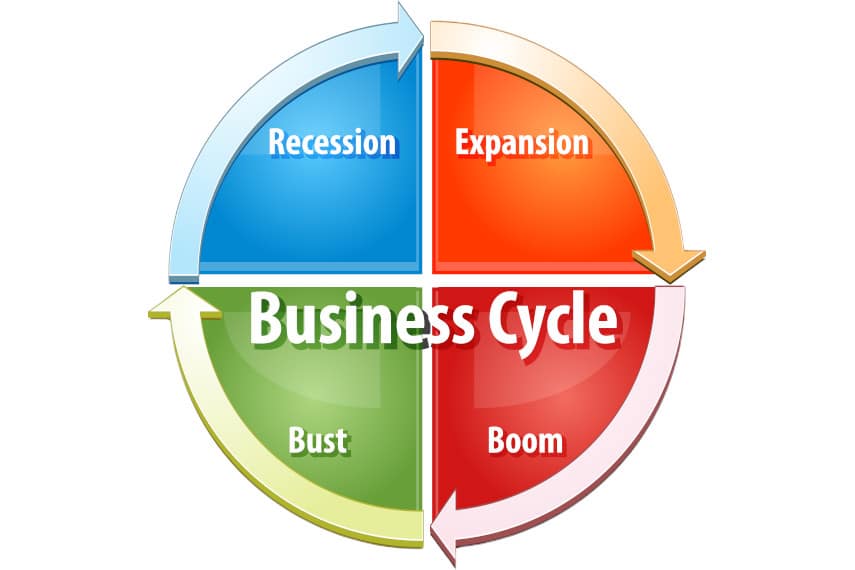

Anyone who has been alive long enough has seen the operation of business cycles. The euphoria of the boom phase gives way to the recession of the bust phase, and the cycle repeats itself.

This century we’ve seen the collapse of the dotcom bubble, the implosion of the housing bubble, and the COVID recession that was largely self-inflicted but that may have taken a bit of the air out of an impending bubble.

Now today we find ourselves on the verge of yet another shift in the boom-bust business cycle, as high-flying stock markets and rising inflation are colliding with an economy whose labor market is starting to weaken, and whose productivity is faltering.

Yet because we haven’t entered the bust phase yet, some pundits are questioning whether or not the business cycle itself is dead. The Biden administration desperately needs good economic news for the November elections, which is why the concept of the “soft landing” has come into vogue.

Despite its long history of failing to anticipate recessions and actually making recessions worse, the Federal Reserve is probably facing less criticism from the mainstream media today than at any time since Alan Greenspan was at the Fed’s helm.

Yet despite all this wishful thinking, the underlying facts haven’t changed. Monetary intervention and manipulation of interest rates has real effects, not just in the short term, but in the long term too. And we may be about to find out just what those effects are.

Business Cycle Theory

Those who studied the business cycle in the past sought to explain why so many otherwise savvy and astute businessmen all made the same mistakes at the same time. Why were men who had successfully run businesses for years or even decades suddenly running into difficulty?

The best answer to that question comes from the Austrian School of economics, with its Austrian Business Cycle Theory. According to that theory, changes to the interest rate induce certain behaviors that alter the structure of production.

Artificially lowering interest rates through injections of newly created money into the economy results in resources being redirected into longer-term projects that wouldn’t be profitable at lower interest rates.

Those lower interest rates are signaling to producers that consumers are forgoing present consumption in order to consume more in the future, as a greater supply of loanable funds would, all other things being equal, result in a lower interest rate.

Because the source of the lower interest rate comes from money created out of thin air by a central bank or other government monetary authority, however, consumers don’t actually change their patterns of consumption. So when those longer-term projects come to fruition, there is no market for them because consumers have used up the resources they could have had to make use of them.

This is called malinvestment, the process by which resources are allocated away from consumers’ needs to projects that don’t fulfill consumers’ needs. But it takes a while, often years, for this malinvestment to become evident.

Once the malinvestment is discovered, businesses have to adjust and retool, cutting their losses and adjusting their operations in order to realign with economic reality. This is the recession, the bust phase of the boom-bust cycle, in which businesses lay off workers, shut down factories, and sell off assets in order to get back to basics.

Why Some Think the Business Cycle Is Dead

All the wishful thinking in the world can’t eliminate the fact that the boom-bust cycle is alive and well today. The Federal Reserve is still very much in the business of manipulating interest rates and injecting money into the economy, to the detriment of American households and businesses.

We know from Austrian Business Cycle Theory that the bust will come, but when it will come is unknown. There’s no doubt that this boom-bust cycle has been a strange one.

The economy was already showing signs of weakness in late 2019, as overnight funding markets began to show signs of stress. The self-inflicted recession of 2020 short-circuited what might have been a more severe recession, and the ensuing fiscal and monetary stimulus papered over any remaining problems.

That stimulus led to a boom of sorts, but also to high inflation, which induced the Fed to begin raising interest rates. Inflation remains problematic, however, and the Fed’s interest rate hikes have impacted the economy negatively, although their full effect is likely still to be felt.

But the fact that stock markets are still flying high has many people thinking that the Fed could actually engineer a soft landing. They have forgotten the lessons of past crises, that stock markets are lagging indicators, and that they normally start to fall only after the recession has set in.

In other words, talk of the demise of the business cycle is wishful thinking on the part of those who want the boom phase to continue indefinitely. But like everyone who hopes that the boom will never end, those people will likely end up sorely disappointed.

What Happens Next?

Anyone hoping that the US economy will continue growing ad infinitum without recession, or that stock markets will be at permanently high plateaus, is likely to be dismayed once the recession occurs. The big question is whether the next recession will be a relatively mild one, if it will be on par with 2008, or if it will be even worse than 2008.

Remember how we were reassured by policymakers in Washington in early 2008 that everything was going to be just fine? Yet by the end of the year panic set in, and everyone thought the US financial system was on the verge of collapse.

Many people back then lost significant portions of their savings and assets in that crash, and it took them years to recover. Could you afford to withstand 2008-style losses?

While 2008 may have been a while ago, the memory of those losses remains fresh in many people’s minds. And that’s why so many people are looking to protect themselves today ahead of the next crash.

Many of those people also remember how gold fared in 2008, as it gained 25% during the same time period that markets fell more than 50% (October 2008 to March 2009). And they remember that gold bounced back from its 2008 lows to nearly triple in price until it hit all-time highs in 2011.

More recently gold has once again hit new all-time highs, and continues to trade above $2,300 an ounce, thanks to strong safe-haven demand. And if gold were to perform during the next recession the way it did in 2008, there’s no telling how high gold could go.

If you understand that boom-bust cycles aren’t over, and you’re worried about the coming crash, now is the time to start thinking about shoring up your wealth with gold. Whether you’re looking to convert cash assets to gold or looking to protect tax-advantaged retirement savings with a gold IRA, there’s no time like the present to make gold a part of your portfolio.

With over $2.5 billion in precious metals placements and thousands of satisfied customers, Goldco has worked hard for years to bring the benefits of gold to Americans in all walks of life. Give us a call today to learn more about how gold can help you safeguard your financial well-being during the next economic downturn.