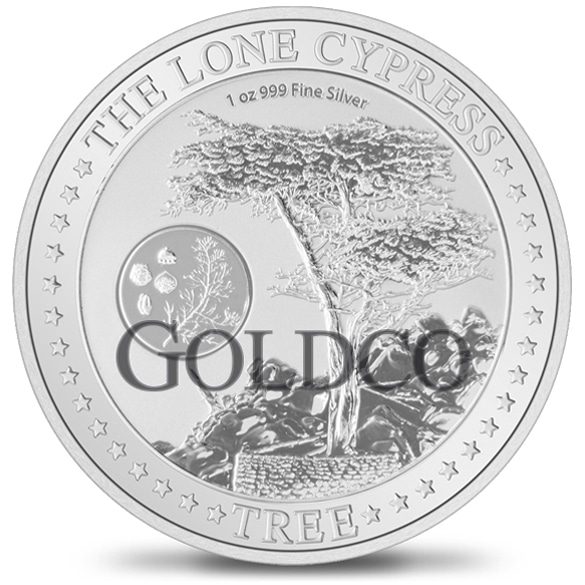

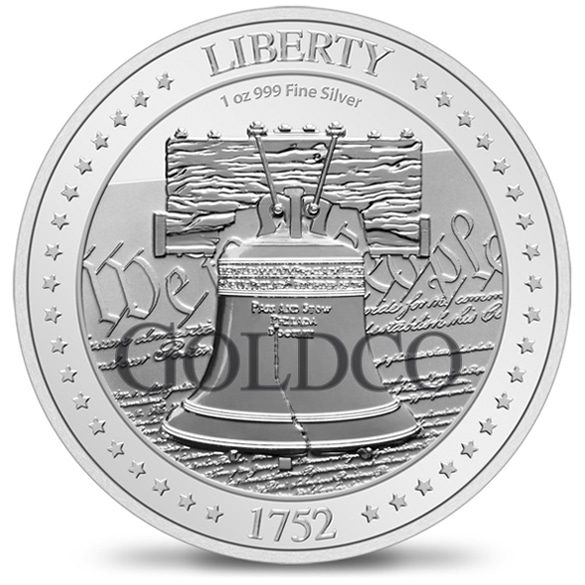

The most popular assets in a precious metals IRA are gold and silver. In addition, for investors interested in diversifying their portfolio, we also offer platinum and palladium. You can choose from a variety of products, such as coins or bars, in each category. We also offer both common bullion products and premium bullion products. Regardless of which precious metals you choose, the IRS approves for IRA inclusion only metals which are of a mandated fineness. Our Specialists can help you pinpoint the right mix of precious metals to meet your investment goals.