How to Start a Gold IRA

One of the main questions people ask when saving for retirement is how to maximize their investment growth. For many people, relying on stocks, bonds, mutual funds, and CDs has been their go-to, particularly when it’s done through a 401(k) or IRA account.

But these financial assets may not always offer enough diversification, stability, or security, which is where a self-directed IRA can be useful. Self-directed IRA accounts can invest in a wider variety of assets, including real estate, private equity, and precious metals like gold and silver.

Investing in a variety of assets may help people hedge their losses, maintain their gains during tough economic times, and keep their assets secure during market volatility. Thankfully, you don’t have to be rich or at retirement age to start diversifying into alternative investments.

If you have a 401(k) or IRA and have wondered about how a gold IRA works, now may be a good time to learn about the benefits of these alternative investment options. Having a gold IRA could end up helping you navigate ever-changing markets and can help secure and grow your investments.

For those who have never purchased precious metals before, the process may seem confusing. That’s why we’ve put together this guide, to help you understand what a gold IRA is and how it works.

If you’ve read the three previous chapters of this guide, you should now have a solid understanding of how a gold IRA works, what its benefits are, and the rules that gold IRAs are subject to. Now in this chapter you’ll find out how to start a gold IRA.

5 Steps to Start a Gold IRA

Beginning the process of opening a gold IRA is simple, especially when you partner with precious metals experts like Goldco who know the ins and outs of this type of IRA. While it’s not difficult to start investing in precious metals, you want to make sure you know all the rules and follow them so that you can avoid unnecessary taxes and penalties.

1. Choose the Type of Gold IRA

The type of self-directed gold IRA you set up will be dependent on how you want to fund your IRA. Most people will choose to fund their gold IRA through a rollover from an existing retirement account such as a 401(k), and they’ll often choose to open a Traditional gold IRA so that they can invest with their pre-tax retirement savings.

If you’re transferring or rolling over funds from a Roth account, you will need to choose a Roth gold IRA. You can also open a Roth gold IRA if you want to do a Roth conversion.

2. Decide on a Funding Source

The funding source for your gold IRA is dependent on what type of gold IRA you open. If you open a Traditional gold IRA, you can’t fund it with transfers or rollovers from Roth accounts such as a Roth IRA or Roth 401(k). But a Roth gold IRA can be funded with rollovers from pre-tax or Roth accounts.

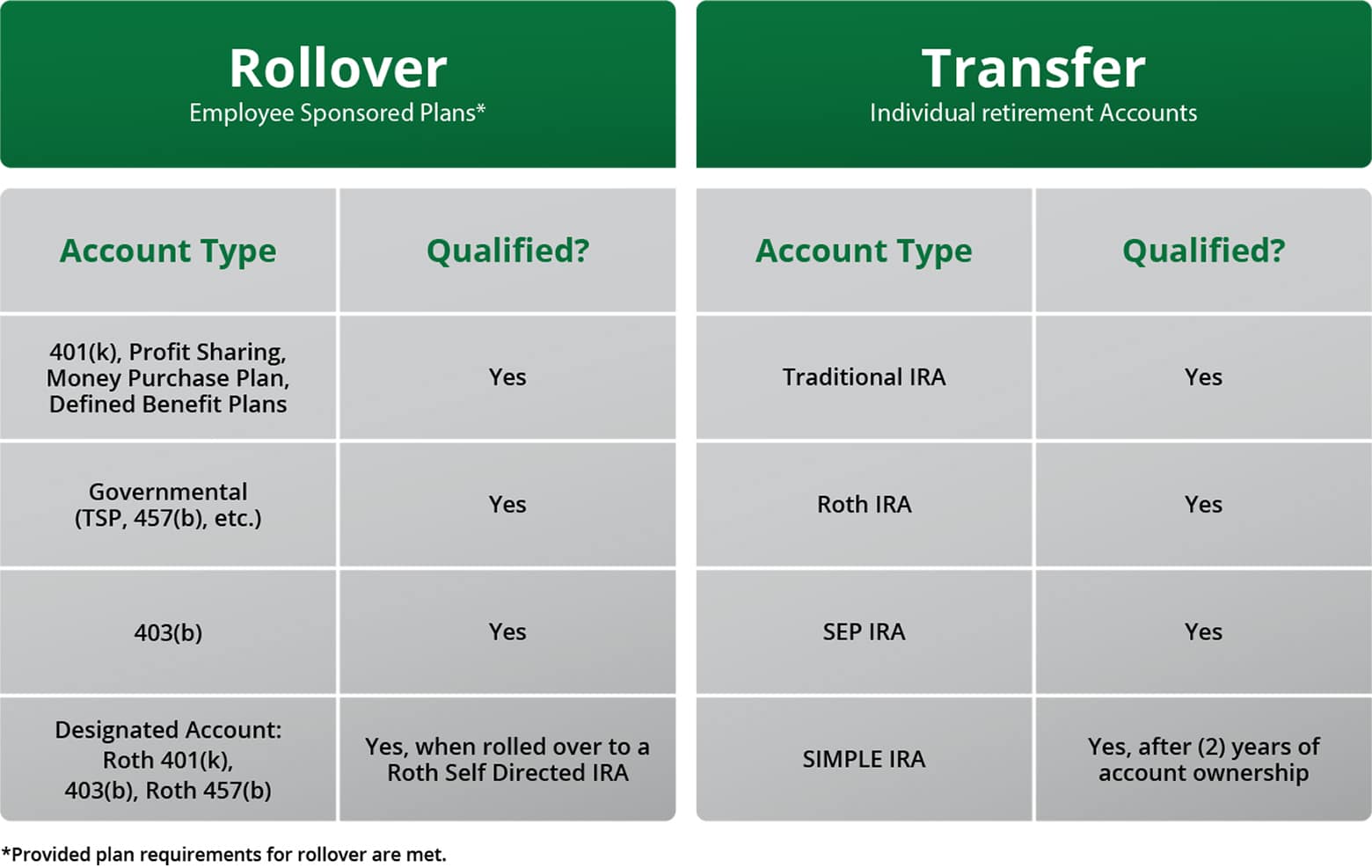

Numerous types of retirement accounts can be used to fund a gold IRA. The chart below contains information on which types of accounts can be used to fund a gold IRA.

You may want to check with your tax advisor before making any changes to see if there are tax implications and confirm that your current retirement accounts allow transfers or rollovers.

3. Choose a Self-Directed Gold IRA Custodian

Like any other IRA assets, gold IRA assets need to be administered by a custodian per IRS regulations. Working with precious metals investing experts, like those at Goldco, can help you find a custodian experienced with gold IRA investing to make sure your gold IRA is opened properly.

Once you have chosen your gold IRA custodian, you can open your gold IRA. When your gold IRA account is open, you can then start the rollover process.

4. Fund Your Self-Directed Gold IRA

Once you have opened your gold IRA, you can start the rollover process. Normally this is done by informing your plan administrator or IRA custodian of your rollover intentions.

Then you’ll sell assets in your current retirement account and roll them over into your gold IRA. Your current plan administrator or IRA custodian will normally be responsible for sending funds to your gold IRA custodian.

It can be very important to work with gold IRA specialists to make sure that the rollover process goes smoothly, that your funds end up where they’re supposed to, and that you’ve adhered to all IRS regulations. While the rollover process can be simple, if you make a mistake you may inadvertently open yourself up to tax liabilities or penalties.

After your funds have been rolled over to your gold IRA, you can then begin the process of determining which gold coins or gold bars you want to buy with those funds.

Learn More About Diversifying with Gold and Silver with the Free Wealth Protection Guide

Learn More About Diversifying with Gold and Silver with the Free Wealth Protection Guide

5. Select, Purchase, and Store Your Gold

Now that your self-directed gold IRA is funded, it’s time to choose which gold coins or gold bars you want to buy. Remember that certain types of gold coins aren’t eligible for IRAs.

That’s why it can help to work with partners like Goldco who offer IRA-eligible gold coins to ensure that you don’t expose yourself to tax liability by buying the wrong type of gold.

After you’ve purchased your gold coins or gold bars, they will be administered by your IRA custodian and stored at a bullion depository. This ensures that your gold is there when you need it.

Safeguard Your Retirement with Gold

By setting up a self-directed gold IRA, you can rest easy knowing your assets are protected with gold. Diversifying your portfolio with gold can be a great way to protect your hard-earned retirement savings from market fluctuations and economic crises.

There’s no better time than today to start thinking about buying gold. With the economy facing its fair share of difficulties, a gold IRA may be just what you need to help you protect your assets.

Setting up a self-directed gold IRA can be done easily, especially when you work with Goldco’s experts.

Whether you want to learn more about gold IRAs, start the gold IRA rollover process, or just buy gold coins, Goldco can help you protect your retirement savings with gold.

No matter your age or stage in life, Goldco has precious metals options for everyone.

By simply filling out our contact form, we’ll connect you with experienced representatives who can answer your questions, offer valuable reference materials, and help you navigate the gold purchase process.

We’re ready to help you facilitate the diversification of your retirement portfolio so you can feel more in control of your financial future.