Could Trump’s Tariffs Impact the Gold Price?

One of the key initiatives President Trump promised when he was elected was the implementation of tariffs on a wide variety of imports from numerous countries According to Trump, tariffs would, among...

Political

With political uncertainty still reigning in Washington, there’s economic uncertainty on Wall Street as well. Until the Presidential election is finally determined, we won’t know for sure what government economic policy will look like in the coming year. But barring a last-minute collapse in the Electoral College, it looks increasingly likely that Joe Biden will be elected President in December. And he is already telegraphing his intentions, which include a high likelihood of more government spending and dovish monetary policy.

Biden has apparently stated his desire to name Janet Yellen, the former Fed Chairman, as his Treasury Secretary. Given Yellen’s track record at the Fed, that’s an indicator that Biden plans to boost government spending, increase government debt issuance, and have the Treasury and Fed closely cooperate in order to monetize all that debt. While that’s bad news for the economy in the long run, that’s good news for gold.

With government spending likely to increase, particularly if Democrats are able to take control of the Senate too, the stage is set for a continued increase in the price of gold. Here are four factors to look at when considering how and why gold will benefit from rising government spending.

In general, gold tends to perform better when the economy is underperforming. Some of its biggest rises in price have come during times of economic turmoil, such as during the stagflation of the 1970s and in the aftermath of the 2008 financial crisis. Now that the US economy is once again on shaky ground, and the government feels the need to resort to more stimulus spending to boost the economy, that will result in more government debt issuance.

Federal budget deficits were already projected to be in the trillion-dollar range in the coming years, but additional stimulus spending will boost those sums. With the Federal Reserve highly likely to monetize much of that debt and increase the size of its balance sheet, the dollar will continue to weaken as a result of this debt issuance, increasing the relative value of gold.

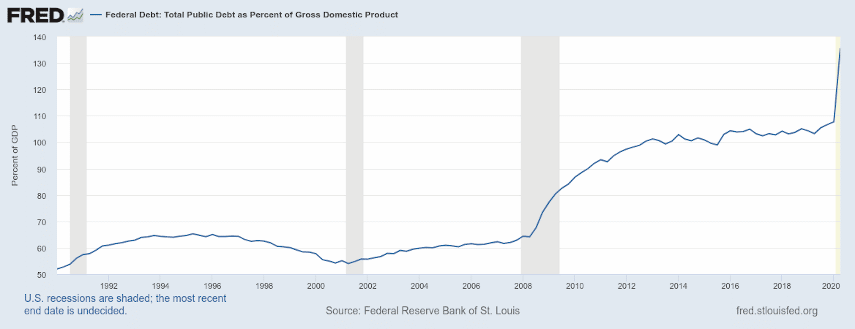

Debt to GDP ratio has often been used as a measure of the fiscal stability of a country. The US had a high but manageable debt to GDP ratio of around 60-65% before the 2008 financial crisis. After the crisis, the debt to GDP ratio exploded, reaching over 100% in 2013. And as a result of the COVID stimulus spending in early 2020, the debt to GDP ratio has skyrocketed yet again, to over 135%.

Debt to GDP ratio has often been used as a measure of the fiscal stability of a country. The US had a high but manageable debt to GDP ratio of around 60-65% before the 2008 financial crisis. After the crisis, the debt to GDP ratio exploded, reaching over 100% in 2013. And as a result of the COVID stimulus spending in early 2020, the debt to GDP ratio has skyrocketed yet again, to over 135%.

Major increases like that indicate a deteriorating fiscal situation that could end up leading to long-term financial instability. While there has been much focus on the overall size of the national debt, the debt to GDP ratio is a better indicator of the ability of that debt ever to be paid off. And with that ratio having pushed ever higher in recent years, the path of the government’s fiscal situation looks increasingly rocky.

Countries that suffer from high debt to GDP ratios suffer from weak economic growth and stagnating economies. Among the countries with higher debt to GDP ratios than the US are Japan, Greece, Portugal, and Italy, none of whom have economies we particularly want to emulate. If the United States government’s debt to GDP ratio continues to spiral out of control, there’s a very real risk of economic stagnation. That would likely mean poor returns for stock and bond investments, and an increasingly important role for gold in many investors’ portfolios.

It isn’t just governments who are heavily indebted in the United States – corporations and households are carrying record amounts of debt as well. With a worsening economy and rising unemployment, that leaves them liable to severe financial difficulty if the economy gets any worse. Corporations currently hold more than 50% more debt than they did during the 2008 financial crisis, and they have come to expect being able to roll over their debt. They may find out the hard way that they won’t be able to continue doing that as the economy worsens.

Millions of households experienced financial difficulty during the 2008 crisis, and the next crisis could be even worse. With millions of Americans still out of work, unemployment benefits expiring at the end of the year, and the prospect of higher taxes in 2021, American households are on the edge. And next year could tip many of them over the edge.

Monetary stimulus in the aftermath of the 2008 financial crisis, in the form of quantitative easing, ended up being quite beneficial for gold. The gold price nearly tripled from its 2008 lows to its 2011 highs, as it was one of the few assets that continued to grow in price during an incredibly weak market.

In part, gold’s rise was fueled by some of that monetary stimulus, which flowed into the financial system and from there into gold investments. The stimulus in early 2020 similarly helped lead to a spike in the gold price, and we’re witnessing a lull in gold’s growth as markets pause to see which way the government will go.

Every indication is that the government wants to continue spending money, and that the Federal Reserve wants to continue pursuing accommodative monetary policy. If that ends up being the case, and trillions more dollars enter the financial system, that should provide a significant boost to the gold price.

With uncertainty reigning in Washington, now is the time to buy gold. With the current drop in the gold price, you can even take advantage of lower prices to get into gold before it really takes off. Once Joe Biden is officially confirmed as President-elect, and especially once the new Congress begins its spending negotiations in earnest, things will start to move quickly.

If you’re currently sitting on a retirement account that you want to protect against the possibility of a market crash, there’s no reason to keep waiting. Act now before the crash, so that when push comes to shove, you won’t be bemoaning your lost assets.

With a gold IRA, you can roll over or transfer assets from existing retirement accounts such as an IRA, 401(k), TSP, or similar account into an investment in gold, without tax consequences. You’ll enjoy the same tax advantages as your current retirement accounts while simultaneously benefiting from the peace of mind you’ll get from investing in gold.

So why wait? Contact the experts at Goldco today to find out more about making gold a part of your investment portfolio.