During boom times, many people focus on making as much money as they can. And when the boom turns into bust, they look to protect the money that they made during the boom.

For many people, wealth protection means looking to safe haven assets to preserve their wealth. While people may look to grow their wealth during the boom, during the bust they’re trying not to lose their money.

That means that strategies that reap rewards during a boom may be ditched during a recession. And many people will gladly hold onto assets that don’t change value at all rather than risk losing money during a recession.

What you choose to do, and which assets you choose to hold, are largely determined by your appetite for risk and your overall financial goals. But for many people there are two assets that have vied for prominence as safe havens during recessions and times of financial turmoil: gold and cash.

Both gold and cash have their benefits and drawbacks, and each can play a role in protecting your wealth against loss. So which is better for you: gold or cash?

Gold vs. Cash Historically

100-150 years ago, we might not have been asking these questions, as gold and cash were virtually the same thing. The banknotes that people would have used to make payment were redeemable for gold on demand at any bank, and thus were treated as being as good as gold.

With the abolition of private gold ownership in 1933, and the eventual closing of the gold window in 1971, however, the relationship between gold and cash was irrevocably severed. The Federal Reserve Notes we use in commerce today aren’t backed by anything and aren’t redeemable for anything.

Rather than gold acting as money, it’s really an alternative to cash. Today, if you’re fed up with constant inflation and the continued devaluation of the dollar, buying and owning gold is something you might do instead of holding cash, in order to keep the value of your portfolio from losing money to inflation.

Advantages of Cash

Cash has many advantages. Here are four important ones.

- Wide Acceptance

- Speed of Use

- Portability

- Anonymity

Wide Acceptance:

One of the major advantages of cash is its wide acceptance and anonymity. Go anywhere in the country and you can use cash to buy things. Even with the growing use of credit cards and electronic payments, there are very few businesses that don’t accept cash.

With the rising cost of credit card processing, many businesses will even offer you a cash discount if you pay in cash. And if you ever need to buy something from an individual, just about everyone will accept cash as payment.

Speed of Use:

Cash payments are instant. As soon as money changes hands, the transaction is done.

There are no funds to be cleared by banks behind the scenes, no credit card bills to pay every month. Cash payments settle instantly.

And if you rely on cash as your primary source of spending, it can also help you stick to your budget. Once your cash is gone, you can’t spend anymore, thus limiting your ability to overspend.

Portability:

Cash is also easily portable, and a wallet can fit thousands of dollars in it. Inflation is slowly eating away at the value of the $100 bills we have, but you can still fit enough money into your wallet to purchase a huge amount of food, a major appliance, or even a cheap used car.

Anonymity:

One of the major advantages of cash is its anonymity. There is no record of any purchase or sale using cash, nor does either party have to know the other’s identity.

While some people or entities may abuse this for nefarious purposes, it has many benefits for the average American who would rather not see his purchases aggregated, analyzed, and sold by private corporations to advertisers and government agencies.

The war on cash is an effort to eliminate this anonymity and make every financial transaction transparent to the government. That’s one reason that many people today distrust efforts to push electronic payments.

Disadvantages of Cash

Of course, everything has its disadvantages as well as its advantages. Here are some of cash’s disadvantages.

- Security and Loss

- Bulk

- Health Concerns

- Counterfeiting

- Inflation

Security and Loss:

Like anything else you own, cash is at risk of getting stolen. And the more cash you have, the worse the theft of it would impact you.

If you have large amounts of cash at home, you’re probably worried that it could get stolen at any time. And the same goes for carrying large amounts of cash outside the house too.

Storing large amounts of cash, if you choose not to use a bank or a safe deposit box, means keeping a safe handy to make sure that your cash doesn’t walk off. And even then, you’ll want to bolt that safe down to make sure it doesn’t get stolen either.

Bulk:

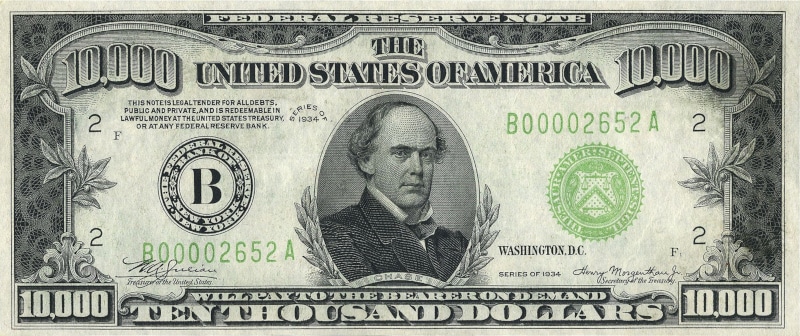

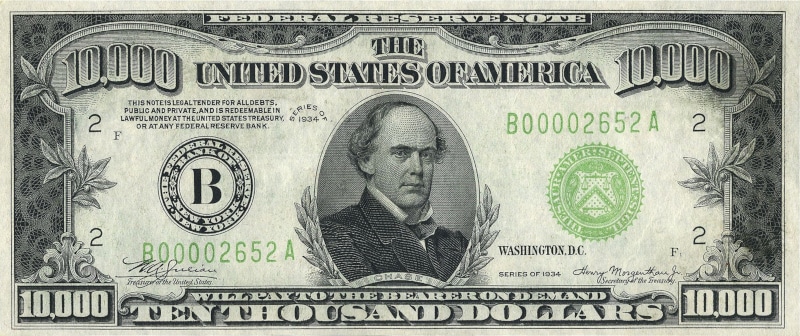

While cash is portable, carrying large amounts of it can make it impractical for large purchases. Carrying $10,000 means carrying a stack of 100 $100 bills, which would make for a big bulge in your pants.

When the Federal Reserve Act was first introduced in 1913, the US Treasury was required to print $10,000 notes in such quantities as were necessary to supply the Federal reserve banks. That statute is still on the books, but Treasury has long since ceased producing those bills, as the government is trying to cut down on tax evasion and money laundering.

But that $10,000 bill today has as much purchasing power as $312.55 did in 1913. So while it may seem like a lot, it’s actually not really.

With the way inflation is going, there may eventually be a time when $100 bills are used like $5 and $10 bills are today. And when that happens, the utility of cash could be greatly diminished.

Health Concerns:

You’ve probably heard stories of studies that find traces of cocaine on over 90% of bills in circulation, or of the germs that can catch a ride on cash. It became a real fear during COVID, when many people thought they might be able to catch COVID from handling cash.

While these fears may be slightly overblown, there’s still a bit of a stigma attached to dirty, used bills. And if the thought that the money in your wallet may have spent time in a strip club or been used to snort cocaine makes you feel ill, cash may not be for you.

Counterfeiting:

Counterfeiting remains a problem with cash, and it can be tough to tell real bills from fake ones. With counterfeiters using real banknote paper to make fakes, and with the quality of counterfeits rising, sometimes the counterfeit notes are higher quality than the real thing.

For the layman, there’s not really a foolproof way to determine real cash from counterfeits. We all just assume that the cash we use is real, and many of us try to avoid anything larger than a $20 bill for transactions.

But if you’re trying to accumulate large holdings of cash, the last thing you want to do is pick up a few counterfeits, because that calls the legitimacy of all of your cash into question.

Inflation:

Inflation is the real killer when it comes to holding cash. Because of inflation, the value of your cash holdings is decreasing every year.

Even at a relatively low inflation rate of 2%, cash will lose 80% of its value over the course of your lifetime. And at the current rate of inflation, it will lose 80% of its value in less than 50 years.

The higher inflation gets, the worse it is for cash holders. If inflation were to return to levels of 10% or higher, cash would lose 80% of its value in less than 17 years.

Advantages of Gold

Many people choose to own gold as a safe haven asset, whether it’s to protect against inflation, to protect against recession-related loss, or as a potential barter method in a post-crisis society in which currencies have collapsed.

While methods of buying gold such as purchasing gold through a gold IRA are gaining in popularity, that still requires your gold to be managed by a custodian and stored in a bullion depository. For many people, being able to hold physical gold coins or bars in your hands is worth it to ensure that you have your gold whenever you want it.

Here are some advantages to having gold in your safe.

- Inflation Hedge

- Wealth Protection

- Growth Potential

- Portfolio Diversification

- Portability

Inflation Hedge:

Gold has long enjoyed a reputation for being a hedge against inflation. While the US dollar has lost 87% of its purchasing power since President Nixon closed the gold window in 1971, the gold price has risen over 6,500% since then.

During the entirety of the 1970s stagflation, when inflation reached into double digits, gold’s annualized rate of growth was over 30% per year, and over 20% per year even after adjusting for inflation.

Wealth Protection:

Gold has been trusted to protect wealth for centuries. When currencies fail, companies go bankrupt, and governments collapse, gold is one of the first assets people run to for safety and security.

Growth Potential:

Not only is gold popular for wealth protection, it also has the potential to make great gains during tough times. While markets fell more than 50% from October 2007 to March 2009, gold gained more than 25%, before continuing on to set all-time highs in 2011.

Many people who are buying gold today are hoping that gold will repeat this same kind of performance during the next recession.

Portfolio Diversification:

Gold can help diversify your portfolio, as it alters the risk profile of your assets and can help offset losses elsewhere. How much of your portfolio you want to allot to gold may depend on your risk tolerance, aversion to losses, and overall financial goals.

Portability:

While cash is portable too, gold can offer increased portability of purchasing power in small units.

For instance, a ¼-ounce gold coin is about the size of a nickel, yet it is worth several hundred dollars. Folding an equivalent number of $100 bills would result in a much bigger footprint.

A roll of one-ounce gold coins is small enough to fit in your pocket, yet is worth enough to buy a very nice car. The same amount of $100 bills would be far bulkier.

Disadvantages of Gold

Like everything else, gold has some disadvantages too. Here are three of them.

- Storage and Theft

- Counterfeiting

- No Income Generation

Storage and Theft:

As a precious asset, gold will also need to be stored or protected against theft. And because gold coins offer relatively high value in a very small package, absconding with $50,000 or $100,000 of gold can be very easy to pull off.

If you’re making direct cash purchases of gold to store at home, you’ll want to make sure that you have a safe to store your gold in. And make extra sure that your safe remains out of sight of potential thieves.

If you choose to store your gold in a safe deposit box or in a bullion depository, that imposes an extra cost that can eat into any gains your gold makes. But that may be worth it to you to give you some extra peace of mind.

Counterfeiting:

Gold is subject to counterfeiting too, although it’s a lot more difficult to counterfeit gold than it is to counterfeit paper currency. Still, it’s something you have to watch out for.

Knowledgeable buyers can use calipers and scales to make sure that the gold coins they buy are legitimate, but why put yourself through the hassle? Working with trusted partners like Goldco, who work directly with mints to source gold coins, you can ensure that the gold you’re buying is 100% authentic.

No Income Generation:

Gold coins and bars are dependent on increases in the price of gold for their gains. That’s unlike some stocks and many types of funds that pay dividends.

These dividends, when reapplied, can add to additional growth in wealth. That’s something that gold can’t offer.

However, when gold is growing at faster rates than overall stock markets with dividends included, is that really an issue? After all, if your goal is just to maximize your wealth, and you think gold is the way to do that, the fact that gold doesn’t pay dividends may be a non-issue.

Is Gold or Cash The Right Choice for You?

If you’re looking for a safe haven to park your money during an upcoming recession, there’s a good chance that you’re going to be choosing from among assets that include cash and gold. The ultimate decision about whether or not to buy gold or remain in cash is something that you’ll have to decide on based on your particular financial situation.

Whether to choose gold or cash could come down to how long you’ve been in the markets, how much longer you have until retirement, or how much money you’re looking to protect.

With gold, there is the potential for great gains during a recession, but there are no guarantees. And there will likely be periods of time where your gold holdings could sustain losses.

With cash, you’re guaranteed not to make losses, at least in nominal terms. But your cash holdings will lose purchasing power every year to inflation.

Cash can be easy to get, as easy as pulling money out of your bank account. And while gold does take a little more effort to acquire, with the help of experienced partners like Goldco the gold buying process can be quite simple.

Goldco has helped thousands of Americans benefit from owning gold. And with over 6,000 5-star reviews and over $2.5 billion in precious metals placements, we have worked hard to make ourselves one of the biggest and most trusted gold companies in the country.

If you’re wondering whether to choose gold vs. cash, contact the experts at Goldco today to learn more about the many benefits of buying gold.