Many people want to benefit from the possible protection that precious metals offer. But making the decision about which precious metal to purchase can be a daunting one.

Some people may prefer to buy gold, which has seen centuries of use as a hedge against inflation and financial crisis. Others may prefer to buy silver, which can have a greater potential for upside growth.

Still other people may want to buy both gold and silver but are unsure of how much of their portfolio they should allocate to each metal. That’s where the gold silver ratio can play a role in helping you determine whether to purchase gold, silver, or both metals.

Gold to Silver Ratio: An Overview

The gold silver ratio is just a numerical expression of the number of ounces of silver that have the same value as one ounce of gold, or the price ratio of gold to silver. Many precious metals buyers will keep track not just of the gold price or the silver price, but also of the ratio between those two prices.

For instance, if the gold price is $3,000 per ounce and the silver price is $30 per ounce, the gold silver ratio is 100 to 1. But if the silver price rises to $40 per ounce while gold remains unchanged, the gold silver ratio is now 75 to 1.

The gold silver ratio fluctuates over time and doesn’t always move in a narrow band. At times, an ounce of gold is worth more ounces of silver, other times it’s worth less.

But whenever either gold or silver is considered undervalued versus the other metal, some people see that as an indicator that they can add to their holdings of one metal versus the other.

A Brief History of the Gold to Silver Ratio

The gold silver ratio has varied over time and across geographic areas. But for much of its history, as gold and silver were used as monetary metals, the two were traded in legally fixed ratios.

By the 18th and 19th century, the gold silver ratio in most areas of the world was somewhere between 15 to 1 and 16 to 1.

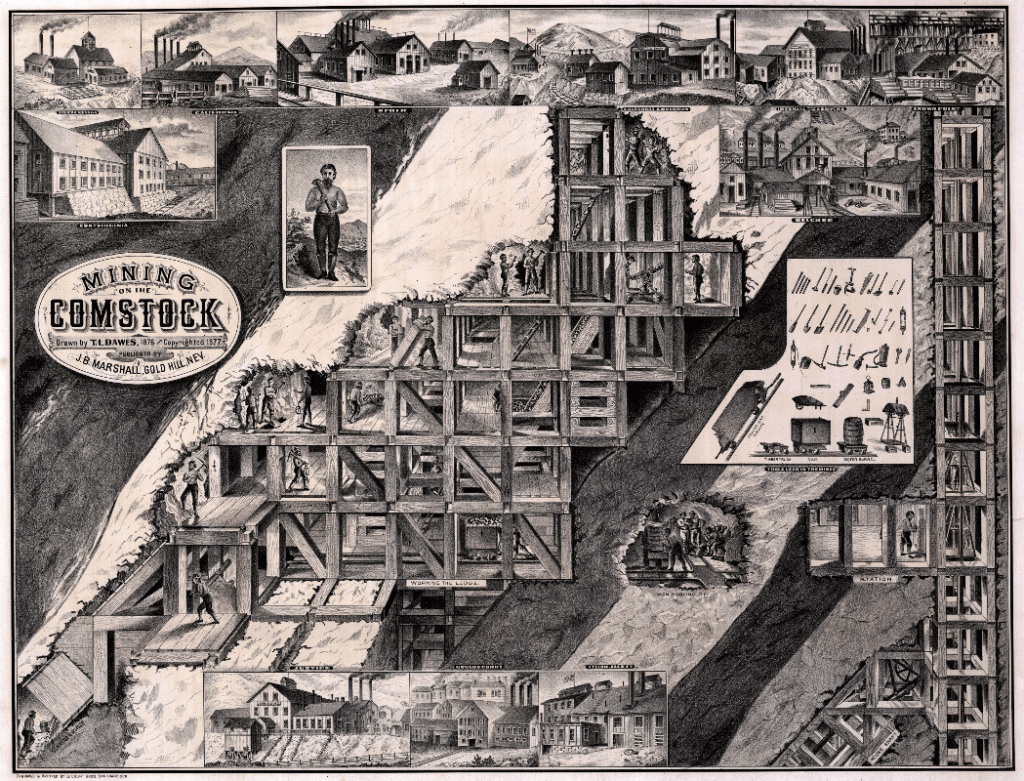

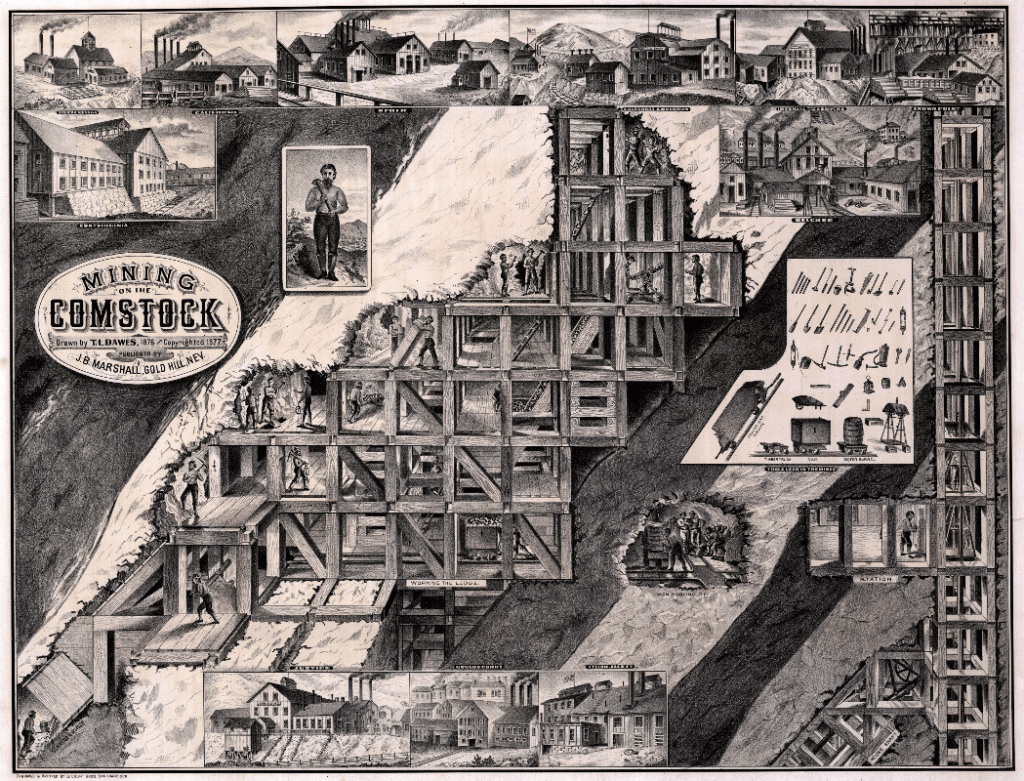

As more and more silver was mined, particularly in the aftermath of the discovery of the Comstock Lode, the first major silver discovery in US history, the gold to silver ratio began to climb as silver supply increased while the silver price decreased.

As more countries moved away from silver standards or bimetallism and onto the gold standard, silver coinage began to be demonetized, and its market value further decreased.

In recent decades, the gold to silver ratio has varied anywhere from around 30 to 1 to over 110 to 1.Comstock Lode Currently, the gold silver ratio is around 89 to 1.

How to Use the Gold to Silver Ratio

Some people will target a certain ratio based on what they believe the true value of gold or silver to be. So, if they believe that the long-term sustainable market gold silver ratio is 70 to 1, then a current ratio of 89 to 1 means that they think silver is undervalued, and gold is overvalued. Those people might then seek to purchase more silver or convert some of their gold holdings into silver.

Conversely, if the silver price were to spike such that the gold silver ratio were to fall to 55 to 1, people targeting a 70 to 1 ratio would see that silver is now overvalued (or gold is undervalued), and might seek to purchase gold, or move some of their silver holdings into gold.

The Pros

One of the benefits of using the gold silver ratio to decide whether to purchase gold or silver is that it’s a pretty simple ratio to use. If the gold to silver ratio is relatively stable for a long period of time, and you’re looking to buy precious metals, then using the ratio to determine which assets you acquire can make your choice easier.

With people being able to purchase both gold and silver through a precious metals IRA, you can roll over existing retirement assets from 401(k), 403(b), TSP, and similar retirement accounts into a gold IRA or silver IRA relatively easily.

That allows you to enjoy the same tax benefits of IRAs while also benefiting from the potential protection of precious metals.

The Cons

One drawback to using the gold silver ratio is that you can’t forecast long-term changes in the ratio, nor can you necessarily determine where the market gold to silver ratio might move. Supply and demand factors could push the ratio one way or another for a period of years, making this a strategy with lots of potential risk.

The gold silver ratio is perhaps most useful for larger or institutional traders, those who can easily switch their positions back and forth from gold to silver, rather than most individuals.

As an individual buying gold or silver, your transaction costs are likely going to be higher in percentage terms than traders at big firms that can make millions of dollars worth of purchases or sales at the click of a mouse button.

Learn More About Purchasing Gold

How much money you want to allocate to gold and silver and how much of each metal you want to buy is dependent on what your particular financial situation and goals may be. And that means that you may want to research how to buy gold, where to buy gold, and the best methods to take advantage of owning gold.

The precious metals specialists at Goldco have years of experience helping people just like you harness the power of gold and silver to help protect their retirement savings. With our knowledge of precious metals, factors that affect gold prices, and the ins and outs of the gold IRA rollover process, Goldco can help you get your start buying gold and silver.

Don’t wait any longer, contact Goldco today to learn more about putting gold and silver to work for you.

This article was originally published in December 2019 and was updated in August 2025.