Page 7 - Goldco Wealth Protection Guide 2023

P. 7

Why Buy Gold & Silver?

The more time goes by, the worse things get.

Since 2000 alone, the dollar has lost approximately 50% of its value. Looking forward?

By 2042 -- assuming the Federal Reserve holds close to its “target inflation rate” of 2% annually -- you can expect the value of your money to decline by another 48.6% thanks to intentional monetary inflation.

So, while you might think of a dollar bill as real money, the fact of the matter is that the Fed can indeed create money out of thin air -- whenever more of them are needed by the government.

This is sometimes referred to as “increasing the money supply” or “Quantitative easing”, and it’s considered to be good for business.

And yet...what’s “good for business” is not necessarily good for YOU.

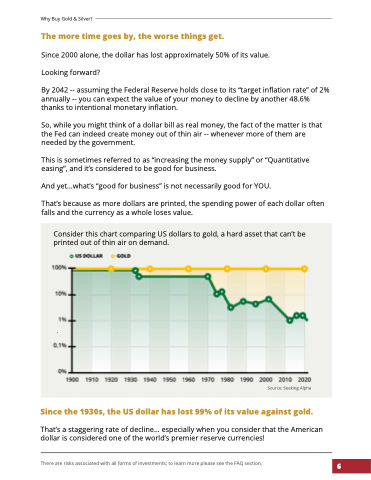

That’s because as more dollars are printed, the spending power of each dollar often falls and the currency as a whole loses value.

Since the 1930s, the US dollar has lost 99% of its value against gold.

That’s a staggering rate of decline... especially when you consider that the American dollar is considered one of the world’s premier reserve currencies!

Consider this chart comparing US dollars to gold, a hard asset that can’t be printed out of thin air on demand.

.

Source: Seeking Alpha

There are risks associated with all forms of investments; to learn more please see the FAQ section.

6